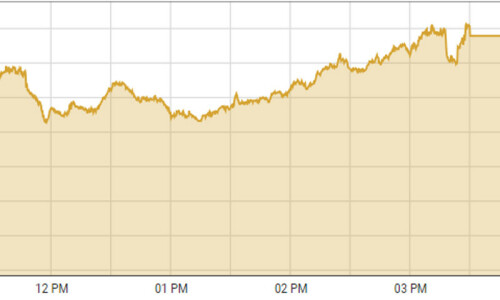

KARACHI: Following a tug of war between bulls and bears in the preceding two trading sessions, the bulls established their stronghold at the Pakistan Stock Exchange on Thursday by breaking the psychological barrier of 44,000 points — a feat that the PSX achieved after a gap of almost 56 weeks.

Topline Securities said stocks traded on the higher side after the opening bell and stayed in the green territory for most part of the day. The above-44,000-point level may unlock further upside if the stock market stays positive and closes on the higher side on Friday, it added.

The reason for optimism going forward is the meeting of the International Monetary Fund, scheduled for July 12, in which the Washington-based lender is expected to give formal approval to a $3 billion Stand-By Arrangement (SBA) signed with Islamabad last week.

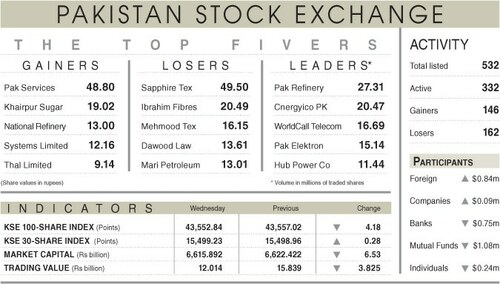

As a result, the KSE-100 index settled at 44,178.85 points, up 626 points or 1.44pc from the preceding session.

The overall trading volume decreased 15.2pc to 297.8 million shares. The traded value went up 3.4pc to Rs12.4bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (28.8m shares), Pak Elektron Ltd (16.1m shares), Pakistan Petroleum Ltd (14.1m shares), Bank Alfalah Ltd (12m shares) and Oil and Gas Development Company Ltd (11.5m shares).

Companies registering the biggest increases in their share prices in absolute terms were Mehmood Textile Mills Ltd (Rs43.15), Shield Corporation Ltd (Rs21.97), Abbott Laboratories Ltd (Rs19.96), Mari Petroleum Company Ltd (Rs17.05) and Millat Tractors Ltd (Rs16.19).

Companies that recorded the biggest declines in their share prices in absolute terms were Pakistan Services Ltd (Rs52.12), Bata Pakistan Ltd (Rs34), JDW Sugar Mills Ltd (Rs25.75), the Thal Industries Corporation Ltd (Rs8.85) and Dawood Lawrencepur Ltd (Rs6.34).

Foreign investors were net buyers as they purchased shares worth $0.85m.

Published in Dawn, July 7th, 2023