Pakistan’s foreign exchange reserves held by the central bank rose to $4.3 billion in the week ending on March 3, the State Bank of Pakistan (SBP) said on Thursday.

“During the week ended on March 3, SBP’s reserves increased by $487 million to $4.3bn due to receipt of $500m as GoP commercial loan from China,” it added.

The SBP said total liquid foreign reserves held by the country stood at $9.75bn.

Arif Habib Limited calculated that the reserves had increased by $1.4bn since February 3, adding that they were sufficient to cover almost a month of imports.

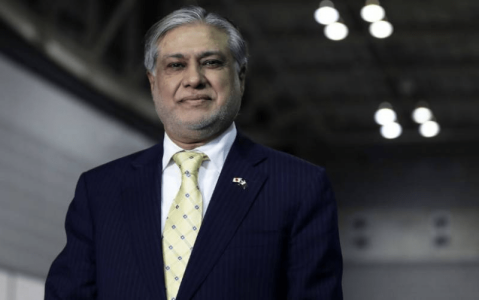

Last week, the Industrial and Commercial Bank of China Ltd had approved a rollover of a $1.3 billion loan for Pakistan, which Finance Minister Ishaq Dar had said would help shore up depleting foreign exchange reserves.

According to the minister, the facility would be disbursed in three instalments, adding that the first one of $500m had been received by the central bank.

Cash-strapped Pakistan is in a race against time to implement measures to reach an agreement with the International Monetary Fund (IMF). The agreement with the IMF on the completion of the ninth review of a $7bn loan programme — which has been delayed since late last year over a policy framework — would not only lead to a disbursement of $1.2bn but also unlock inflows from friendly countries.

The prerequisites by the lender are aimed at ensuring Pakistan shrinks its fiscal deficit ahead of its annual budget around June.

Pakistan has already taken most of the other prior actions, which included hikes in fuel and energy tariffs, the withdrawal of subsidies in export and power sectors, and generating more revenues through new taxation in a supplementary budget.

As a last step, the international lender has required Pakistan to guarantee that its balance of payments deficit is fully financed for the remaining period of an IMF programme.

The US State Department has also urged Pakistan to “continue working” with the IMF, especially on reforms that will improve the country’s business environment, highlighting that it would help Pakistan attract “high-quality investment”.

Addressing a seminar earlier today, Dar vowed that he and his team were “absolutely committed” to completing the IMF programme, once again stressing that Pakistan was close to signing the staff-level agreement.

“We have been in the process of the 9th review which has taken longer than it should have […] we seem to be very close to signing the staff-level agreement, hopefully in the next two days,” Dar added.

Dear visitor, the comments section is undergoing an overhaul and will return soon.