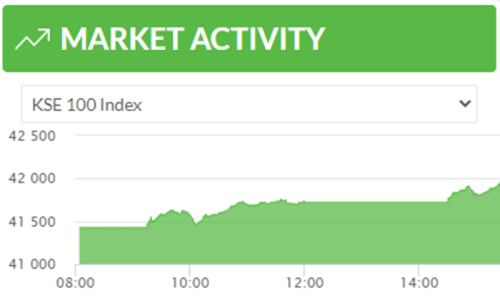

The Pakistan Stock Exchange (PSX) continued its positive momentum on Wednesday, gaining nearly 400 points.

According to the PSX website, the benchmark KSE-100 index closed at 42,494.85 points, up 398.61 points or 0.95 per cent.

It saw an intraday high of 42,776.47 points around 10:40am.

Head of Research at Intermarket Securities, Raza Jafri, attributed the stock market's rise to expected investment from the United Arab Emirates and the country moving closer to the resumption of the International Monetary Fund (IMF) programme.

Jafri said the economy was stabilising as Pakistan moves closer to the IMF programme's resumption. "This is turning attention to corporate profits and the cheap valuations on offer.

"[The] expected investment from UAE is also generating investor interest, particularly in energy stocks," Jafri said.

Last week, the UAE's state news agency WAM had reported that the kingdom intended to invest $1 billion in Pakistani companies across various sectors.

The UAE is keen to continue cooperation with Pakistan "in various fields, which include gas, energy infrastructure, renewable energy, health care," the agency added.

Meanwhile, Salman Naqvi, head of research at Aba Ali Habib Securities, said the market was reacting positively to a number of factors, including the IMF's assurance, the UAE investment and the dollar's depreciation.

"The market has been strengthening during the last few sessions because the IMF has assured that Pakistan will receive the tranches and the import bill has been reduced to a big extent due to which the trade deficit and the current account deficit have decreased.

"Besides this, the yield of Pakistan Investment Bonds has strengthened. It makes it clear that Pakistan has exited the default category," he said.

Naqvi noted that the dollar had fallen by seven per cent in the interbank market since July 29 and it might depreciate further once the IMF tranches and $4bn inflows from friendly countries were received.

"Its impact will have a very positive impact on our economy," he added.

Chief Executive of First National Equities Limited, Ali Malik, said there were three reasons for the index's rise — release of the long-awaited IMF tranche, the rupee's appreciation and declining prices of oil in the international market.