HYDERABAD: The Hyderabad Chamber of Commerce and Industry (HCCI) on Monday expressed concern over the US dollar’s continued upward march and the Pakistani rupee’s depreciation, saying the State Bank of Pakistan (SBP) should come up with a clear policy on the dollar’s availability.

HCCI President Adeel Siddiqui feared that food insecurity could become a serious issue in the country if the dollar keeps rising because the country spends the second-highest amount of foreign exchange on the imports of edible oil after crude oil.

He said that Pakistan was already going through a severe energy crisis and crude oil, which has a major share in electricity production, was imported. He wondered whether such production was sustainable given the present economic condition and continued rupee devaluation. He said it was worrying industrialists.

Mr Siddiqui feared commercial banks were earning profit in the garb of the devaluation of the Pakistani rupee. He said that if SBP doesn’t have dollars, then Pakistan is all set to face the food security issue.

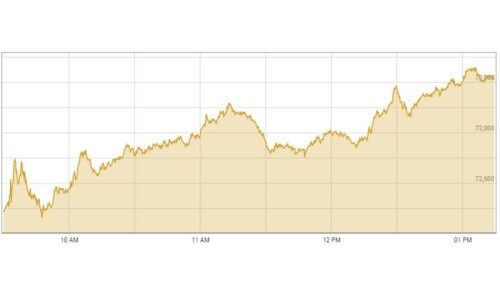

He observed banks were not quoting dollar rates by Monday morning and when the interbank rate was opened it was quoted at Rs213. But, he said, by noon it rose to Rs214. He said traders who had opened their letters of credit (LCs) would face serious issues if dollars were not readily available to make payments to their foreign counterparts for their deals.

He said the edible oil import bill would keep increasing resultantly. He said that the government was already importing grain for domestic consumption because Pakistan hadn’t come up with the required wheat production. He regretted that such a bleak economic picture had worried the common man.

He said that industries that were purchasing raw materials would be jeopardised and their survival would become difficult. He said that since the Pakistani rupee continues to record devaluation, everyone is fearing whether Pakistan is heading for default like Sri Lanka.

“The government should expedite its process of negotiations with the International Monetary Fund as soon as possible to stabilise the economy,” he said. Secondly, he advised, that the government should reach out to its time-tested friends to seek monetary assistance for fixing economic issues.

He stated that if the economy remained unstable, the SBP would raise interest rates as part of its monitoring policy, and people would begin to avoid investing in the industry in favour of keeping their capital in commercial banks.

Published in Dawn,June 21st, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.