KARACHI: The benchmark index of the Pakistan Stock Exchange (PSX) shifted to the green territory in the outgoing week as investors rushed to the bourse in anticipation of the disbursement of a $1 billion loan tranche by the International Monetary Fund (IMF).

According to Arif Habib Ltd, the bullish momentum gained strength owing to investors’ optimism about the forthcoming corporate results. Besides, the shares market welcomed the arrival of the $1bn sukuk proceeds in the outgoing week.

International oil prices, which are hovering at their seven-year high, kept the buyers’ interest alive in the exploration and production sector throughout the week. However, bears broke the three-day positive streak of equities on the second-last day of the week owing to general profit-taking, the brokerage added.

As a result, the benchmark index closed at 45,910 points, gaining 832 points or 1.85 per cent from a week ago.

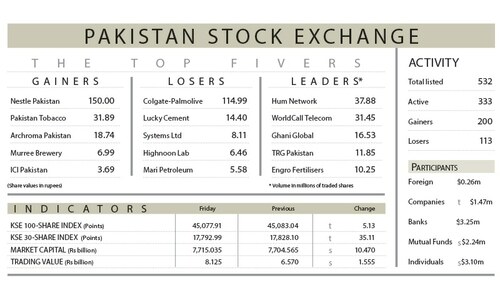

Sector-wise, positive contributions came from commercial banking (189 points), fertiliser (132 points), oil and gas exploration (127 points), oil and gas marketing (92 points) and textile (69 points).

Sectors that contributed negatively were technology and communication (26 points), power generation and distribution (five points) and automobile assembling (four points).

Scrip-wise, positive contributors were Habib Bank Ltd (60 points), Fauji Fertiliser Company Ltd (52 points), Bank AL Habib Ltd (51 points), Oil and Gas Development Company Ltd (51 points) and Pakistan State Oil Company Ltd (50 points).

Negative contributors were TRG Pakistan (18 points), Systems Ltd (17 points) and The Hub Power Company Ltd (12 points).

Foreign selling continued in the outgoing week, with net sales totalling $4.42 million versus $4m in the preceding week. Major selling was witnessed in technology ($2m) and commercial banking ($1.7m).

On the local front, buying was reported by “other organisations” ($3.9m) and mutual funds ($3m). The average daily volume clocked in at 289m shares, up 54pc week-on-week, while the average value traded settled at $55m, up 43pc from a week ago.

According to AKD Securities Ltd, investors’ confidence is likely to translate into the positive performance of the index given the resumption of the IMF loan programme. Noting that the government is planning to raise further money through a Eurobond auction, the brokerage said the currency will likely gain further ground against the dollar.

“Moreover, the result season is in full swing where we expect corporate profitability to remain buoyant amid a commodity bull run, robust exports growth and depreciation. With valuations at very attractive levels, the market may be set to post a sustainable bull run,” it added.

Published in Dawn, February 6th, 2022