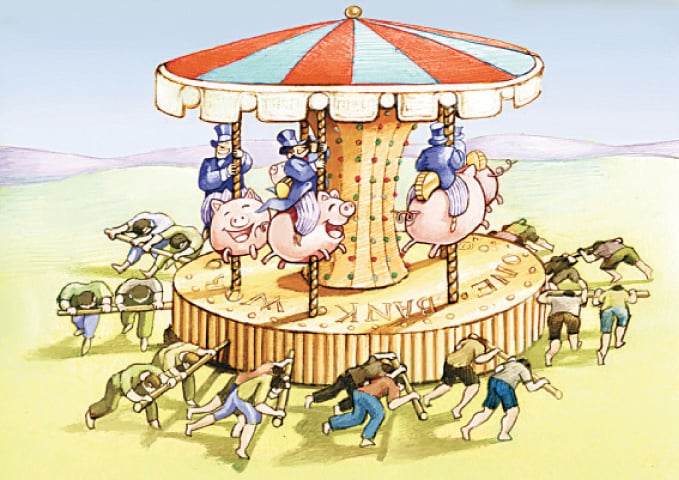

Deep pockets had the 2021-22 budget their way. They secured incentives, tax breaks and subsidies in the name of trickle-down effect.

The purported spinners of the trickle-down list in the budget included manufacturing, oil refining, pharmaceutical, financial, steel, leather, auto and cellular phone segments.

The vulnerable and the poor got the benefit of the purported Riyasat-e-Madina’s compassion and the bottom-up support direly needed after the devastations caused by the two years of real negative economic growth amidst an unprecedented pandemic.

The lower middle and middle classes remained at the receiving end: revenue generation to finance both trickle-down and bottom-up support measures will be through higher taxation on petroleum products, crude oil, gas and electricity to name a few. Some exceptions here were nominal increases in salaries and pensions of government employees.

Many proposed policy measures are highly inflationary, such as taxes on crude oil, LNG imports and food items

In broader terms, the budget appears to be the PTI government’s prelude to the next general election because of its focus on politically motivated schemes that will unleash a spending spree and the efforts to appease the industrialists and corporate brokers that have remained financiers of past elections.

But in a balancing act to raise revenues and at the same time keep the International Monetary Fund (IMF) on its side, the government has proposed certain measures that are highly inflationary in nature and can ultimately antagonise general voters.

The budget documents suggest that the government has said adieu to fiscal discipline and set aside around Rs350 million for each treasury member by proposing Rs68 billion under the Sustainable Development Goals Achievement Plan (SAP) — a term coined years ago to camouflage the funding for the politically motivated projects after a ruling by the Supreme Court of Pakistan banned discretionary spending. The practice is still ongoing but under a name that was meant for ending global poverty and hunger.

Strangely, such allocations have been made on the instructions of Prime Minister Imran Khan who vehemently criticised similar but significantly smaller doles during the PPP and PML-N governments. He had been terming it a political bribe to lawmakers at the public expense. The quality of utilisation of such funds has always remained questionable and mostly goes to waste.

Similarly, huge funding is also allocated to various ministries to finance projects being recommended by politicians and members of the cabinet and provincial assemblies. These allocations are largely made under the finance and inter-provincial coordination divisions.

As a result, the Public Sector Development Programme (PSDP) has been increased to Rs900bn, which is Rs200bn more than originally conceived for 2021-22 in March this year and 40pc higher than the current year’s revised spending of Rs630bn. Consequently, the size of the budget is Rs8.48tr — higher by Rs1.4tr or 19pc from the one that former finance minister Dr Hafeez Shaikh and the IMF agreed to. This indicates the government has adopted a fiscal expansionary policy in the second half of its term.

Surprisingly though, nearly 47pc of this will be financed by adding more loans to an already high and unsustainable debt level. The federal budget deficit is estimated at Rs3.99tr — up Rs553bn or 16pc from 2020-21. In terms of GDP, the federal budget deficit will be equal to 7.4pc — slightly higher than the current year’s level. Despite the IMF programme, the federal deficit is set higher for the next fiscal year.

The real challenge for the government is the implementation of the budget. Its success hinges upon the FBR’s ability to achieve the Rs5.83tr collection target. The FBR’s failure will mean reversing the first step that the government has taken towards addressing the core issue of high indebtedness. There will then be little funding available for political projects. The IMF had initially asked Islamabad to set the tax target at Rs5.96tr that was subsequently revised down by Rs134bn to Rs5.83tr.

Many proposed policy measures are highly inflationary like taxes on crude oil, LNG imports and food items and a higher sales tax rate for locally produced dairy and edible items, which are in addition to withholding taxes on certain levels of electricity consumption. The budget imposes a 17pc sales tax on the import of crude oil to generate Rs38bn. Its inflationary impact will flow into every important consumable and daily-use item, including sugar that will now be taxed at a retail stage and its price will go up by about Rs7 per kilogram.

This will make the next fiscal year’s 8pc inflation target challenging given the fact that other taxation measures like a Rs30 per liter petroleum levy will also increase the cost of transportation, farming and electricity. The government’s desire to remain relevant in the constituency politics and also continuing with the IMF programme may eventually cost it dearly as the middle section — between the big business and Ehsaas-supported poor — feels the pinch of a higher cost of living and shrinking purchasing power amid falling real incomes.

The finance minister believes the incentives for the industry, agriculture and big businesses will have a trickle-down impact on the middle class through job creation and better income levels in two to three years while some relief can reach both lower and middle classes through quota allocations in essential items via reforms in the Utility Stores network. “I do not have the chaddar to give more to everybody. We have exhausted our (fiscal) space.”

In the next few days and weeks, the challenge for the finance minister will be to strike a balance between the IMF’s demands and various lobbies. The performance in the first quarter may determine the revival of the IMF programme again in the September review. Until then, the programme may remain in the doldrums.

Published in Dawn, The Business and Finance Weekly, June 14th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.