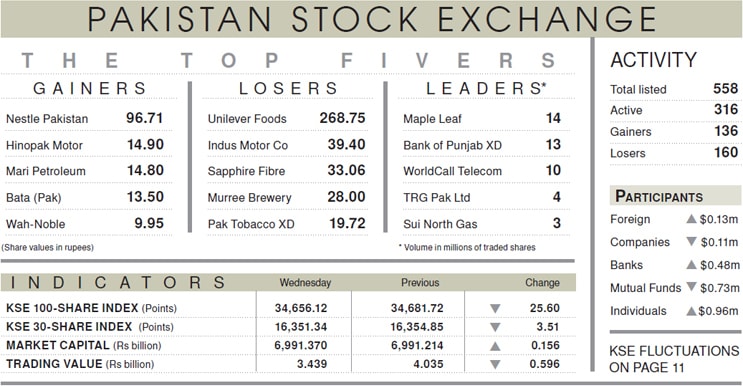

KARACHI: The stock market depicted insipid conditions on Wednesday as the KSE-100 index failed to find a direction and closed about flat with a tiny loss of 25.60 points (0.07 per cent) at 34,656.12.

The market took off to a firm start after two days of heavy beating, but the index failed to sustain the gains and succumbed to selling pressure. The fact that the treasury and opposition agreed to carry out a debate in the National Assembly over 2019-20 budget lowered political temperatures a bit but quickly flared up after the leader of opposition rejected the budget, terming it as IMF-influenced and demanded major changes.

It took investors on a rollercoaster ride as the index raced up to intraday high by 132 points and slid down to intraday low by 159 points before closing almost unchanged. Market watchers said that some hurdles were required to be crossed including MSCI’s annual country classification review (due on June 25); the passing of FY20 budget; IMF board’s approval of bailout (due on July 3); and the activation of market support fund of $20 billion which could provide a trigger on which a relief rally might be built.

Sector-wise banks were impacted by the Federal Board of Revenue measure to rope in tax evaders by sifting 4 million bank accounts. Habib Bank, decreasing by 0.7pc, and United Bank 0.4pc closing in the red while MCB gained 1.2pc. Cement generally closed positive with Lucky, Fauji and Maple Leaf as gainers. Fertilisers were major laggards while oil and gas exploration and production remained strong due to increase in international crude prices.

Among scrips, major gainers included Oil and Gas Development Company, increasing by 1.7pc, MCB 1.2pc and Sui Northern Gas 2.2pc. On the flip side, Fauji Fertiliser, down 1.4pc, Habib 0.7pc and National Bank 3.3pc were the losers.

Published in Dawn, June 20th, 2019