Q. How is the deficit larger than the gap between revenues and expenditures?

A large amount of the revenues collected by the federal government are transferred to the provinces under an arrangement known as the National Finance Commission Award. This year that amount is Rs3,254.5 billion. Since this is not technically an expense — only a transfer — it is not booked as an expenditure under public finance conventions. So it does not show up on the expenditure side of the budget. After making this transfer, the federal government expects that the provinces will run a surplus of Rs423bn because they lack the capacity to utilise all the money that will be transferred to them. So the budget deficit will be calculated thus:

Read: Budget 2020: Govt predicts 2.4pc growth, Rs7 trillion in expenditures

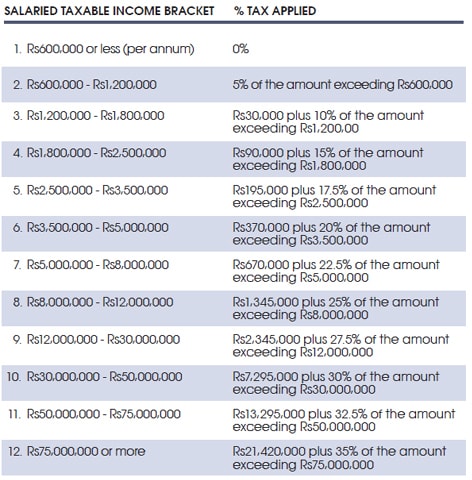

Q2. Have income tax rates gone up?

Yes, and not only that, but the slabs have been reworked altogether. Last year the government created six tax slabs and massively cut tax rates for all. This year they have reverted to 11 tax slabs with higher rates for everyone. Take a look in the table below to see how you are impacted.

Use this income tax calculator to see your take-home salary

Published in Dawn, June 12th, 2019