KARACHI: After only a day of gains, which technical analysts referred to as a ‘dead cat bounce’, the stock market returned to the negative trajectory with the KSE-100 index hammered down by 320.53 points (0.93 per cent) to close at 33,971.12.

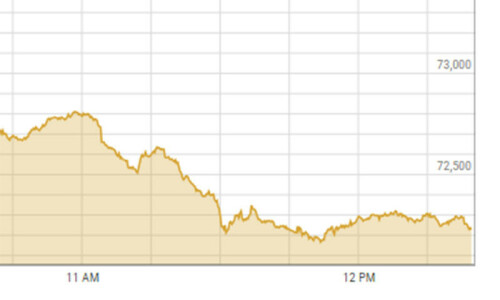

Although the market opened in the green to extend yesterday’s gains, the optimism proved short-lived as the index began to tumble and hit intra-day low by 717 points.

Some index heavyweights bounced back a little in the last hour of trading which helped market trim overall losses. The major reason for the Thursday’s fall was panic selling by investors due to sudden fall of the rupee against the dollar in both the interbank and the open market, attributed to government’s compliance with International Monetary Fund conditions.

It resulted in across the board selling by investors who sought the greenback while mutual funds switched to money market funds to cover their capital protected funds. By the end of session, State Bank of Pakistan released the notification of Monetary Policy announcement on May 20 — earlier than scheduled, which failed to impress investors.

Exploration and production sector gained on the back of anticipation of potential discovery in Kekra-1. For the third consecutive day, independent power producers extended their gains on several factors including the hopes of resolution of circular debt.

Selling pressure was witnessed in the cement sector were big players: D.G. Khan, Cherat Cement, Maple Leaf and Pioneer Cement, all hit their lower circuits. Banking, fertiliser and pharmaceuticals were also major losers.

Traded volumes declined 2pc over the previous day to 109 million shares, while traded value fell by 16pc to $26.5m. Stocks that contributed significantly to the volumes included K-Electric, Pakistan Int. Bulk Terminal Ltd, Unity Foods Ltd, TRG Pakistan and Pakistan Stock Exchange formed 35pc of the total volumes.

Major scrips contributing to the index downside included Habib Bank Ltd down 2.0pc, Lucky Cement 2.5pc, Pakistan State Oil 3.7pc, Engro Fertiliser 2.1pc and MCB Bank Ltd 1.4pc.

Published in Dawn, May 17th, 2019