ISTANBUL: Whichever way Turks vote on Sunday, the lira is tipped to keep sliding.

This year’s second-worst performing major currency will lose 4 per cent more against an equally weighted basket of euros and dollars in the coming year, according to Credit Suisse Group, which ranks among the three most accurate lira forecasters for the past four quarters by Bloomberg.

Oyak Securities, the Istanbul-based brokerage that correctly predicted the benchmark repo rate before the last four central-bank meetings, sees a 5pc slide against the dollar in 2015.

Ahead of the tightest election in more than a decade, destined to determine whether Turkey moves toward a presidential system of government, the focus for investors is the country’s drift into decelerating economic growth and rising inflation. Amid pressure from President Recep Tayyip Erdogan to stimulate the economy, the central bank has held interest rates at a two- year low even as prices rose faster than its target for a fourth year.

“The market needs a proactive hiking cycle that is ahead of the curve, but that is highly unlikely to be signalled,” said Bhaveer Shah, an analyst at Credit Suisse in London.

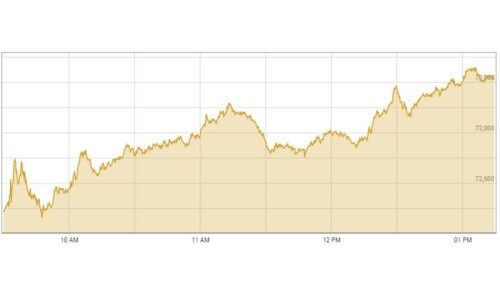

The lira weakened 0.3pc to 2.8410 against the euro- dollar basket at 11:15am in Istanbul after snapping an eight-day losing streak yesterday. Credit Suisse sees the currency weakening to 2.95 against the measure in the next 12 months, while Oyak Yatirim see the lira at 2.8 versus the dollar by year-end.

Bond yields trimmed the steepest increase in emerging markets this year, falling two basis points to 9.89pc.

Even though some surveys have indicated the ruling AK Party could be set to secure a majority in this weekend’s election, final polls before a 10-day blackout signalled the party may win no more than 41pc of the vote.

That could usher in a coalition unable to control economic policy, while a super-majority would mean the risk of handing Erdogan more power.

Turkish consumer-price inflation accelerated to 8.09pc in May, the highest level this year, led by price gains in transportation and housing. Meanwhile, core inflation climbed to 7.48pc — faster than analysts predicted — as basic food prices gained due to the lira’s depreciation.

Central bank Governor Erdem Basci at the end of April raised his year-end inflation forecast to 6.8pc from 5.5pc, citing the weaker currency and higher-than-expected oil prices.

By arrangement with Washington Post-Bloomberg News Service

Published in Dawn, June 7th, 2015

On a mobile phone? Get the Dawn Mobile App: Apple Store | Google Play

Dear visitor, the comments section is undergoing an overhaul and will return soon.