With an asset base of a mammoth Rs1.77trn, Habib Bank Ltd is currently involved, at various stages, in potentially acquiring two financial institutions: a foreign bank’s operations in Pakistan and a microfinance bank.

Yet, it is the government’s decision to divest its 41.5pc shareholding (609.3m shares) in the country’s largest bank that has put HBL in the spotlight; this is being bid as the largest capital market transaction in the country’s history.

At Thursday’s closing price of Rs187.66 per share, the potential divestment could fetch the government over Rs114bn (around $1.1bn).

‘People used to think that the OGDC transaction would be a piece of cake. But look how that ended. So the government would be keeping its fingers crossed; this is a big transaction’

According to recent media reports, the government has already started courting foreign institutional investors by launching overseas road shows. According to the transaction structure approved by the Privatisation Commission in February, initially 250m of the bank’s shares are to be sold through the book-building process.

But the transaction managers would also have the ‘green shoe’ option to sell the other 359.3m shares if the book-building attracts significant investor interest. As per multiple reports, the book-building portion is expected to be completed this month.

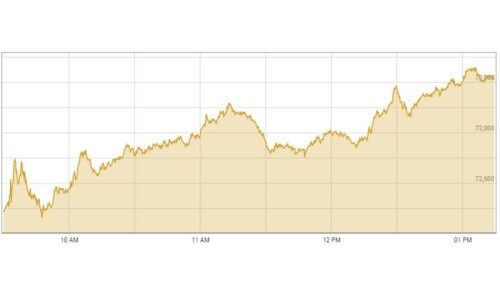

Meanwhile, there were initial fears that the government would have to put the HBL transaction on the back burner after the recent stock market rout, just like it did with the one involving OGDC. HBL’s stock had dived from a high of Rs220.02 a share in January to Rs169.4 early last week; in fact, bank stocks, in general, had dropped from their recent peaks.

“The road shows started late last month. So let’s see what happens. People used to think that the OGDC transaction would be a piece of cake; after all, it was one of the most profitable listed companies in the country. But look how that ended. So the government would be keeping its fingers crossed; needless to say, this is a big transaction,” maintained one cautious market watcher.

Barclays: HBL had first expressed interest in potentially acquiring Barclays Pakistan late last year, when it announced that it would conduct due diligence on the bank. Then last month, it said it had reached an agreement with the foreign bank to absorb the latter’s operations.

According to an industry source, regulatory approval would take a couple of months, and the subsequent merger of the foreign bank’s seven branches and related physical and digital infrastructure would probably take about six months from then on. “The whole thing is likely to be wrapped up before the end of the year.”

Barclays had almost Rs50bn in assets and Rs7.5bn in equity by June 2014, against accumulated losses of Rs3.3bn.

“Barclays was never really able to establish its foothold in the industry. Besides, it has been withdrawing from various markets in the region over the past few years, and Pakistan is one such market. And lastly, there is also the belief that the bank’s relatively stringent business protocols, when compared with the traditional way that banking is done here, resulted in not a lot of clients warming up to it,” the source told this writer.

First MicroFinance Bank: On March 19, HBL sent a notice to the stock exchange, informing stakeholders that it has been granted permission by the central bank to conduct due diligence on the First MicroFinance Bank Ltd (FMFB).

And according to a ‘statement of material facts’ in its annual report, HBL specified that its ultimate parent — the Aga Khan Development Network — already has over 20pc shareholding in both the bank and the FMFB, ‘making the entities associated’.

But HBL currently has no shareholding in the microfinance institution. Furthermore, the statement specifies that the bank is willing to invest up to Rs2bn to get a majority shareholding in the FMFB.

By end-2014, the FMFB had the fifth-largest gross loan portfolio among microfinance lenders, at Rs5.1bn, according industry data compiled by the Pakistan Microfinance Network. It also had the second-highest market share (20.1pc) in the micro-savings category, valued at over Rs8.7bn.

“You see, many banks have just started to focus on small and medium enterprises, and so they are a bit rusty here. And the SBP has also been lately pushing banks to diversify into this area, and it is partly due to this ‘encouragement’ that they are doing so. So that might be one reason why HBL is looking at potentially acquiring a microfinance bank to diversify into this segment,” said one market watcher.

Financial performance: HBL’s unconsolidated after-tax profit recorded a growth of 42pc — among the highest in the industry — to reach Rs31.1bn in CY14. Its earnings-per-share worked out at Rs21.21, against the prior year’s Rs14.95. The bank announced a final dividend of Rs5.5 per share, bringing its total payout for the year to Rs12 per share. Like its peers, the bank derived much of its core income of Rs135.9bn from its Pakistan Investment Bond holdings, which exploded from Rs99.4bn at end-2013 to a huge Rs303.9bn. The bank’s net investments grew by 10.6pc to over Rs880bn. But that compared with a lesser 6pc rise in its net advances, which reached Rs559.4bn.

Published in Dawn, Economic & Business, April 6th, 2015

On a mobile phone? Get the Dawn Mobile App: Apple Store | Google Play