DULL trading persisted in the local currency market for the third consecutive week.

The rupee traded slightly depressed against the dollar on the interbank market as a result of fresh surge in dollar demand.

In the open market, however, the rupee remained firm against the dollar. The parity traded flat for the third successive week due to easy dollar supply.

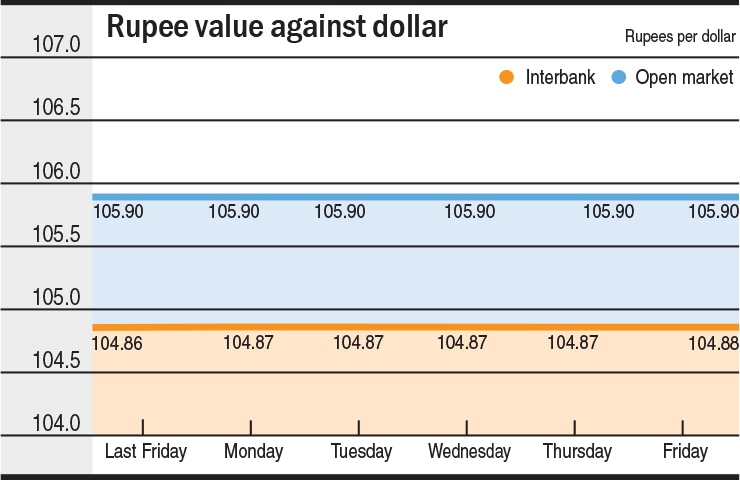

On the interbank market, the rupee traded at Rs104.86 and Rs104.87, unchanged from the prior week’s close

On the interbank market last week, the rupee commenced the week on a stable note against the dollar in the first trading session and traded at Rs104.86 and Rs104.87, unchanged from the prior week’s close.

In the second session, however, the parity showed minor fluctuation as the dollar managed to gain slight strength against the rupee on fresh surge in dollar demand by importers and corporate sector.

The rupee shed one paisa against the dollar during the session, pushing the dollar to Rs104.87 and Rs104.88.

In the third session, the parity did not show any change amid flat dollar demand from the importers due to lacklustre trading activity. The rupee remained range-bound, trading flat at Rs104.87 and Rs104.88.

In the fourth session, the parity traded flat at Rs104.87 and Rs104.88.

In the last session, the parity remained unchanged as the rupee closed flat at Rs104.87 and Rs104.88.

During the week, the dollar on the interbank market managed to appreciate by one paisa against the rupee on a WoW basis. Against the dollar, the rupee posted loss in one session but remained unchanged in four sessions.

In the open market, the rupee stayed firm against the dollar due to adequate foreign inflows. The rupee did not move any side against the dollar for the third consecutive week. The parity commenced the week at Rs105.90 and Rs106.10, unchanged from the previous week’s close.

In the last session, the parity remained unchanged and the rupee closed the week flat against the dollar at Rs105.90 and Rs106.10 for the fifth straight day on the back of low demand.

Against euro, the rupee commenced by posting a 30 paisas loss in the first session that lifted euro to the week’s highest levels at Rs118.60 and Rs119.60. In the second session, the rupee, however, managed a partial recovery, posting a 10 paisas gain at Rs118.50 and Rs119.50.

In the third session, the rupee gained 25 paisas on the buying counter.

The euro downslide continued for the third day as the rupee in the fourth session picked up 25 paisas on the buying counter and another 50 paisas on the selling counter, dragging the euro to fresh lows at Rs118 and Rs119 in June.

During the week, rupee gained 30 paisas against the euro on a WoW basis as the rupee managed to gain 60 paisas in four sessions while losing 30 paisas in one session.

Published in Dawn, The Business and Finance Weekly, June 19th, 2017