ISLAMABAD: The commerce ministry has proposed zero-rating for major exportable products in the next budget.

The major exportable items are textile and clothing, sports, surgical, leather goods and carpets.

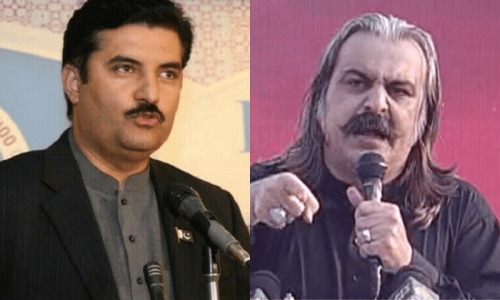

Speaking at a press conference on Tuesday, Commerce Minister Khurram Dastagir Khan said that his ministry was taking up the issue of pending refunds with the relevant stakeholders. The proposal of zero-rating would mean no tax, no refund.

Asked about the decline in exports, the minister blamed energy crisis, terrorism and global factors for the downward slide in export proceeds.

The finance ministry has withheld Export Development Fund (EDF) to the tune of Rs25 billion. This year, the minister said, the amount will reach Rs30bn.

The minister further stated that the finance ministry had been asked to release the withheld amount which can be used for supporting the export of those sectors which were declining.

TIR Convention

The minister disclosed that Pakistan will sign the International Road Trans-ports (TIR) Conven-tion in the next few weeks as Prime Minister Nawaz Sharif had given approval to accede to the convention. More than 61 countries are signatory to the TIR convention.

The minister explained that under the TIR Convention, the Pakistani trucks would be able to travel to Afghanistan, Central Asia, Turkey and Europe with minimum interference.

Asked about the establishment of land port authority, the minister said that paper work and land acquisition has been done. In the first phase, three land port authorities would be established at Wagha, Torkham and Chaman borders. The minister said that the matter had been lingering on for the past 10 years.

He further said that after signing the Convention, Pakistani goods would be able to travel in Customs secure vehicles or containers and throughout the journey, duties and taxes at risk would be covered by an internationally valid guarantee.

He said that goods would be accompanied by an internationally-accepted Customs document (TIR Carnet), opened in the country of departure and serving as a Customs control document in the countries of departure, transit and destination.

The minister said the TIR Convention would not only help develop good relations with Afghanistan, but would also help resolve issues with Central Asian States.

He said that Afghanistan had been charging 110 per cent guarantee taxes on transit of goods to Tajikistan which was returned to Pakistani exporters after crossing the Afghan border.

The minister said that the next year’s budget would be focused on pro-growth. He said that this year, the second phase of tariff reforms would be introduced.

The minister said that the Generalised System of Preference (GSP-Plus) scheme is good for the country. However, the scheme has yet to benefit the industrial sector because exporters diverted their exports from other destinations to Europe instead of increasing their production.

Published in Dawn, May 27th, 2015

On a mobile phone? Get the Dawn Mobile App: Apple Store | Google Play