KARACHI: Amid an economic slowdown in the second quarter of the current fiscal year and a substantial hike in electricity tariffs, the stock market snapped its four-day winning streak on Friday. As a result, the benchmark index faltered from an all-time high level hit a day earlier.

Ahsan Mehanti of Arif Habib Corporation said the National Electric Power Regulatory Authority’s (Nepra) approval of a Rs2.75 per unit hike in the uniform electricity tariff for the April-June quarter and a sharp slowdown in GDP growth to 1pc in 2QFY24 compared to 2.2pc in the same quarter last year depressed market sentiments, triggering profit-taking by institutional investors.

The power regulator, however, has raised serious concerns as the power companies were also seeking an additional Rs4.99 per unit in fuel cost adjustment (FCA) for electricity consumed in February. The net increase would be Rs7.63 per unit for extra fuel cost, which would make it impossible for the industry to absorb such shocks on a continuous basis.

Topline Securities Ltd said a range-bound session was observed as the index traded between its intraday high of 166 points and intraday low of 320 points.

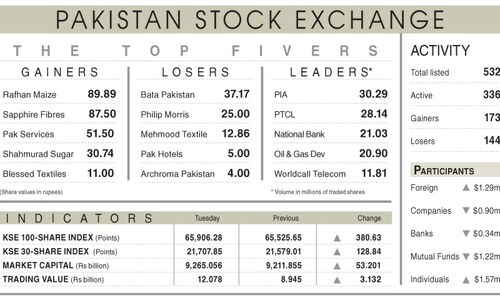

As a result, the KSE-100 index closed at 67,005.11 points after losing 137.02.34 points or 0.20 per cent from the preceding session.

The overall trading volume squeezed 25.66pc to 313.03 million shares. The traded value also plunged by 38.73pc to Rs9.89bn on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pakistan International Airlines Corporation (39.19m shares), Pakistan Telecommunication Company Ltd (32.21m shares), Cnergiyco PK Ltd (18.94m shares), K-Electric (15.43m shares) and Agritech Ltd (14.21m shares).

The shares registering the most significant increases in their share prices in absolute terms were Hoechst Pak (Rs70.00), Pakistan Tobacco Company Ltd (Rs42.95), Shahmurad Sugar Mills Ltd (Rs35.63), Hallmark Company Ltd (Rs34.85), and Lucky Core Industries Ltd (Rs11.00).

The companies registering the biggest decreases in their share prices in absolute terms were JDW Sugar Mills Ltd (Rs15.50), Mehmood Textile Mills Ltd (Rs10.97), Khyber Tobacco Company Ltd (Rs10.94), Pakistan Hotels Developers Ltd (Rs9.95), and Gillette Pakistan Ltd (Rs8.04).

Despite the FTSE Russell retaining Pakistan’s secondary emerging market status for six more months, foreign investors remained net sellers as they offloaded shares worth $0.23m.

Published in Dawn, March 30th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.