KARACHI: The benchmark index of the Pakistan Stock Exchange (PSX) reached a significant milestone in the outgoing week as it crossed the psychological barrier of 66,000 points.

Arif Habib Ltd said the sentiment remained robust since board meeting of the International Monetary Fund (IMF) is now scheduled for Jan 11. Additionally, Pakistan and Saudi Arabia agreed upon investment modalities during the outgoing week — a move that’ll pave the way for the signing of a free trade agreement with the Gulf Cooperation Council.

Moreover, petroleum sales witnessed a nine per cent moth-on-month jump in November. Urea and DAP offtake showcased a healthy month-on-month growth of 33pc and 26pc, respectively. Cement despatches decreased 2pc year-on-year and 8pc month-on-month in November.

Meanwhile, foreign exchange reserves of the State Bank of Pakistan (SBP) plummeted $237 million to $7bn. The rupee closed at 283.87 against the dollar after appreciating Rs1.09 or 0.38pc from a week ago.

Overall, the stock market’s benchmark index closed at 66,224 points, up 4,532 points or 7.3pc week-on-week, which is the highest ever weekly pointwise return.

Moreover, the stock market became the world’s best-performing market on a weekly basis.

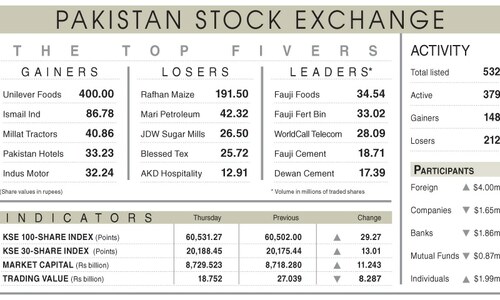

Sector-wise, positive contributions came from commercial banking (1,704 points), oil and gas exploration (997 points), fertiliser (387 points), oil and gas marketing (333 points) and power generation (166 points).

Sectors that contributed negatively were automobile assembling (19 points) and cement (11 points).

Scrip-wise, positive contributors were Pakistan Petroleum Ltd (388 points), Habib Bank Ltd (320 points), Oil and Gas Development Company Ltd (294 points), Mari Petroleum Company Ltd (282 points) and Bank AL Habib Ltd (271 points).

Meanwhile, negative contributions came from Lucky Cement Ltd (70 points), Millat Tractors Ltd (26 points), Systems Ltd (seven points), Ibrahim Fibres Ltd (seven points) and Fatima Fertiliser Company Ltd (five points).

Foreign buying clocked in at $11.2m versus a net purchase of $17.5m a week ago. Major buying was witnessed in banks ($4.3m) and all other sectors ($2.4m). On the local front, selling was reported by banks ($13m) followed by individuals ($3.7m).

The average daily volume arrived at 1bn shares, up 64pc week-on-week. The average daily value traded settled at $118m, up 48pc from a week ago.

AKD Securities Ltd said it maintains an optimistic outlook on the market. “Our positive stance is supported by the Special Investment Facilitation Council’s efforts to enhance current investment avenues, improving macro indicators and diminishing uncertainty surrounding the upcoming elections,” it said.

Published in Dawn, December 10th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.