KARACHI: Share prices reversed their downward trend on Thursday owing to positive signals on the macroeconomic front.

Topline Securities said the benchmark of representative shares opened on a positive note and hit an intraday high of 424 points after the International Monetary Fund (IMF) stated that it remained engaged with Pakistan on the restoration of the stalled Extended Fund Facility programme.

Furthermore, a decline in international coal prices also generated investors’ interest in the cement sector.

But the confidence of investors took a hit as the rupee plunged against the dollar in the later part of the trading session, said Arif Habib Ltd. It led to the stock market witnessing lacklustre activity.

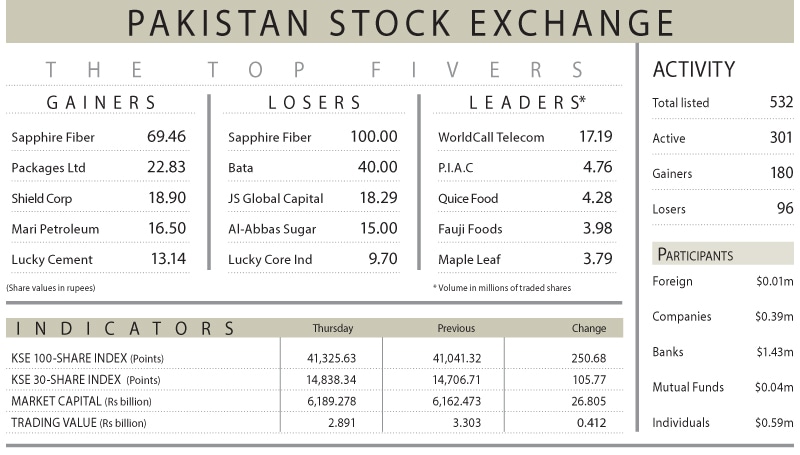

As a result, the KSE-100 index settled at 41,325.63 points, up 250.68 points or 0.61 per cent from the preceding session.

The overall trading volume decreased 2.4pc to 96.9 million shares. The traded value went down 15pc to $9.7m on a day-on-day basis.

Stocks contributing significantly to the traded volume included WorldCall Telecom Ltd (17.2m shares), Pakistan International Airlines Corporation Ltd (4.7m shares), Quice Food Industries Ltd (4.3m shares), Fauji Foods Ltd (4m shares) and Maple Leaf Cement Factory Ltd (3.8m shares).

Sectors contributing the most to the index performance were cement (54.3 points), exploration and production (49.2 points), commercial banking (41.6 points), fertiliser (31.8 points) and technology and communication (21.8 points).

Companies registering the biggest increases in their share prices in absolute terms were Sapphire Fibres Ltd (Rs69.46), Packages Ltd (Rs22.83), Shield Corporation Ltd (Rs18.90), Mari Petroleum Company Ltd (Rs16.50) and Lucky Cement Ltd (Rs13.14).

Companies that recorded the biggest declines in their share prices in absolute terms were Nestle Pakistan Ltd (Rs100), Bata Pakistan Ltd (Rs40), JS Global Capital Ltd (Rs18.29),

Published in Dawn, May 12th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.