KARACHI: Stocks surged on Monday as press reports hinted at the government’s commitment to meeting the terms of the International Monetary Fund (IMF) for the revival of a $7 billion loan programme.

Arif Habib Ltd said the exploration and production sector was in the spotlight following the news that the government is trying to settle the outstanding gas sector’s circular debt at once. Trading volumes rose across the board as the benchmark of representative shares touched a high of 831.13 points in intraday trading.

On the corporate front, Kohinoor Textile Mills Ltd notified the exchange about the buyback of 30 million shares totalling 10.02 per cent of its outstanding shares and 33.4pc of free-float shareholding, according to Topline Securities.

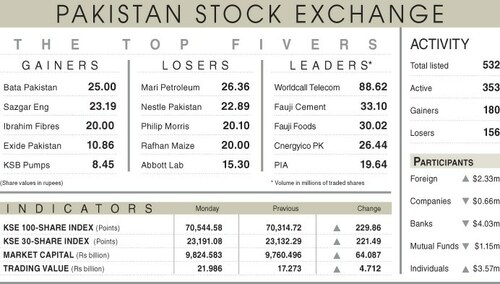

As a result, the KSE-100 index settled at 41,193.63 points, up 722.47 points or 1.79pc from the preceding session.

The overall trading volume increased 42.4pc to 176.7m shares. The traded value went up 44.4pc to $31.9m on a day-on-day basis.

Stocks contributing significantly to the traded volume included Pakistan Petroleum Ltd (21.8m shares), Sui Northern Gas Pipelines Ltd (13.4m shares), Oil and Gas Development Company Ltd (10.5m shares), K-Electric Ltd (8.9m shares) and Sui Southern Gas Company Ltd (7.7m shares).

Sectors contributing the most to the index performance were exploration and production (327.8 points), oil marketing (74 points), commercial banking (68.9 points), technology and communication (55.8 points) and cement (54.7 points).

Companies registering the biggest increases in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs299), Sapphire Textile Mills Ltd (Rs76.50), Mari Petroleum Company Ltd (Rs44.18), Pakistan Tobacco Company Ltd (Rs28.36) and Pakistan Oilfields Ltd (Rs25.77).

Companies that recorded the biggest declines in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs353.93), Nestle Pakistan Ltd (Rs64.01), JDW Sugar Mills Ltd (Rs17.75), Fazal Cloth Mills Ltd (Rs11.94) and Sunrays Textile Mills Ltd (Rs11.16).

Foreign investors were net sellers as they offloaded shares worth $0.09m.

Published in Dawn, February 7th, 2023

Dear visitor, the comments section is undergoing an overhaul and will return soon.