KARACHI: Foreign direct investment (FDI) coming into the country plummeted by more than half to $430.1 million in the first five months (July to November) of the current fiscal year, the central bank data showed on Friday. The inflows were $884.9m during the same period a year ago.

The data for November showed a similar drop, as FDI plunged 48pc to $81.8m from $158.4m in the same month last year.

The falling inflows reflect foreigners don’t consider Pakistan an attractive destination for investment at present amid economic and political uncertainty prevailing in the country since the beginning of the year.

A fall in foreign direct investment inflows could be challenging for the country, which is already faced with low foreign exchange reserves.

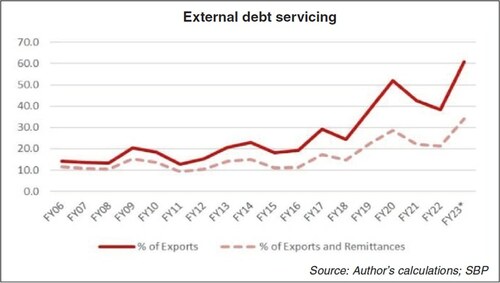

Continuous discussions in the media over the possibility of the country’s ability to pay back foreign loans have added fuel to the fire, making foreign investors wary.

November inflows fall 48pc to $82m

The worst signal is the poor foreign exchange reserves held by the State Bank of Pakistan, which has lost $11bn in the last 12 months and now has $6.7bn.

Details showed that the highest FDI inflows came from China during the July-November period, amounting to $102.5m compared to $124.9m in the same period of last year.

China is the biggest trading partner of Pakistan and also its biggest lender. However, poor economic health and a riskier external front of the economy have compelled China to be cautious as well over investing in Pakistan.

The United Arab Emirates was the second-biggest investor with $81.6m during the five months compared to the previous investment of $62m during the same period of last year.

Other significant investors were Switzerland and the Netherlands, with $58.7m and $44.3m, respectively.

The sector-wise position showed that the power sector attracted the highest foreign investment of $204m. Despite an overall 51pc decline in FDI, the power sector succeeded in improving its position, as it attracted $160m inflows a year ago.

Inflows in the financial business declined but still remained at a reasonable level. The sector attracted $141m compared to $205m last year.

Another important sector was oil and gas exploration, which attracted $40m against $93m in the year-ago period.

Published in Dawn, December 17th, 2022