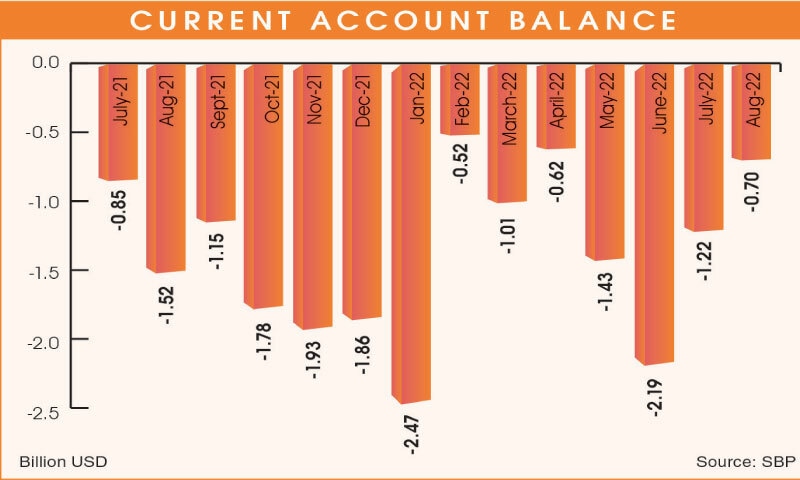

KARACHI: The current account deficit decreased by $512 million on a monthly basis to $703m in August, which shows a decline of 42 per cent.

However, the deficit declined by 19pc in July-August to $1.9 billion from $2.3bn in the same period of last year.

According to the latest data issued by the State Bank of Pakistan (SBP), the deficit declined by 54pc on a year-on-year basis in August.

The country witnessed a massive current account deficit of $17.3bn in 2021-22, which caused the worst impact on the economy as a whole and the exchange rate in particular.

The 11pc increase in exports helped the country reduce its current account deficit in the first two months of 2022-23.

The move to reduce the import bill has also helped curtail the current account deficit. However, its cost was much higher because low imports led to a slowdown in economic activity.

Pakistan is now expected to achieve a growth rate of about 3pc in 2022-23. However, the impact of floods has yet to be calculated. The estimated losses are in the range of $15bn to $30bn.

While the import of oil may cost the country the same as it did the previous year, the import of grains and other food items will be more expensive. Exporters have demanded that they be allowed the import of raw materials like cotton whose crops were washed away by the floods in Sindh.

The SBP recently announced that there is no restriction on the import of raw materials even though importers insist that the opening of the letters of credit is far from easy. Low foreign exchange reserves of the SBP make it difficult for the government to allow imports on a large scale — something that produced a current account deficit of $17.3bn in the preceding fiscal year.

In view of the inadequate foreign exchange reserves, the government has been compelled to borrow dollars. The government has received $1.2bn from the International Monetary Fund. China has already provided $2.3bn while Saudi Arabia recently rolled over $3bn deposits.

In July-August, imports recorded a decline of $240m to $11.98bn. However, exports posted an increase of $519m to over $5bn.

Pakistan still needs a huge amount of dollars to meet the $32bn requirement for the current fiscal year. The SBP’s former acting governor previously assured the nation that arrangements had been made for $36bn in 2022-23.

Published in Dawn, September 23rd, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.