KARACHI: The current account deficit shrank 38.6 per cent on a month-on-month basis to $623 million in April, data released by the State Bank of Pakistan (SBP) showed on Friday.

The widening current account deficit has been one of the biggest economic problems throughout this fiscal year. Despite a monthly dip recorded in April, the cumulative gap for the first 10 months of 2021-22 amounted to $13.78 billion. It was more than 25 times higher than the deficit of just $543m recorded in the same period of the last fiscal year.

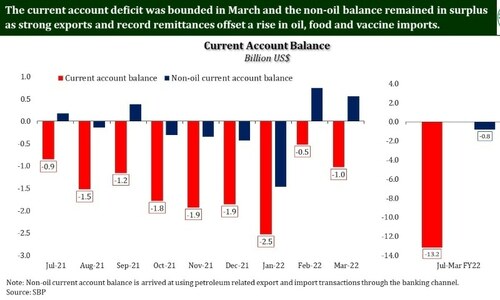

The updated data shows that the current account deficit in 2020-21 was $2.82bn versus $4.45bn in the preceding year. The gap started increasing with the onset of 2021-22 and recorded the highest monthly deficit in January at $2.53bn.

The worsening of the current account balance is mainly on account of an unprecedented increase in imports, which reached $69bn in July-April. Rising imports outpaced the increase in exports, which reached $32.6bn during the same period.

The trade imbalance contributed the largest share to the widening of the current account deficit during the 10-month period.

The new government has just imposed a ban on the import of 32 items in a bid to reduce the outflow of dollars. The surging import bill was also due to higher oil prices in the international market. As a result, the oil bill for Pakistan has more than doubled in the current fiscal year.

Experts said the import bill could be reduced to some extent through the recent import restrictions. However, already booked items would keep arriving in Pakistan even after the end of the current fiscal year. The ban may not have an impact on the current account deficit for 2021-22.

Earlier, analysts estimated that the current account deficit for 2021-22 could be between $15bn and $16bn.

The annual gap was around $20bn when the recently ousted PTI government took charge in 2018. The poor state of the current account balance forced the Imran Khan government to seek help from friendly countries and donor agencies. Meanwhile, it also borrowed funds from the market at commercial rates.

The current account is likely to remain in deficit until the government successfully concludes negotiations with the International Monetary Fund for a $1bn loan tranche. It will also nudge other sources towards extending loans to Pakistan.

At present, the country is unable to issue bonds in the international market due to its external account weaknesses, which are reflected in the massive devaluation of the rupee against the dollar. The local currency has depreciated by over 20pc during the current fiscal year.

Published in Dawn, May 21st, 2022