KARACHI: The US dollar climbed to an all-time high on Tuesday after gaining Rs1.14 or 0.62 per cent against the rupee in the interbank market amid deepening political turmoil and a steep fall in foreign exchange reserves of the country.

Since the beginning of the political crisis which accelerated after tabling of a no-confidence motion against the PTI government in March, the rupee never demonstrated strength against the greenback. The traders said a widening trade deficit with falling foreign exchange reserves of the State Bank of Pakistan (SBP) is the main culprit for the rupee’s depreciation.

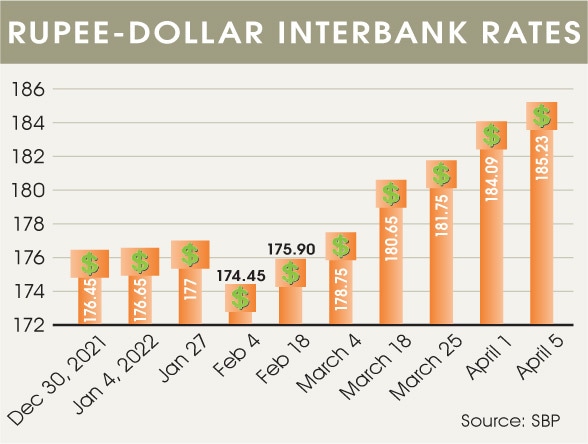

The dollar for the first time traded above Rs185 and closed at Rs185.23 in the interbank market from Rs184.09 the previous day.

Since January, the dollar gained 4.71pc against the rupee while it appreciated by 17.79pc since May 2021.

Industry leader says rupee devaluation adds about 20pc to production costs

“The political situation is critical but the economy is still on track. Hopefully, the current account deficit will not be more than $1bn in March,” said Samiullah Tariq, Head of Research at Pak-Kuwait Investment and Development Company.

He said the sharp depreciation of the rupee is mainly due to the current political instability, but the situation could be improved as soon as the crisis is settled down.

However, representatives of traders and industries were found extremely uneasy about the current political as well economic indicators which depreciated the local currency much faster than the market expectations. During the current fiscal FY22, the dollar appreciated by over 15pcagainst the rupee.

The 49pc growth in imports has inflated the economy mainly due to the devaluation of local currency and higher cost of commodities in the international market. Currency dealers in the interbank market said the SBP has been trying to influence the exchange rate but has failed. At the same time, the central bank’s foreign exchange reserves have fallen to $12bn since August 2021, recording a steep fall of over $8bn.

However, bankers said the SBP reserves (not reported by SBP) had further declined by $1bn to $11bn during the current week.

“The political developments are taking impacting the financial markets. Today dollar liquidity was much less than optimal and many importers were not able to process their imports. The road ahead for the rupee is likely to be complicated by rising inflation, higher twin deficits and faltering economic fundamentals,” said Komal Mansoor, head of research at Tresmark.

Traders and industrialists have started appealing to the SBP to stop the free fall of the rupee, which has triggered inflationary pressures in the economy badly hitting the manufacturing sector.

“Although the experts are attributing the rupee devaluation to political uncertainty the SBP has to play a role otherwise it will create a lot of problems for the economy which is faced with many challenges due to widening current and fiscal deficits,” said Karachi Chamber of Commerce and Industry (KCCI) President Muhammad Idrees.

Despite the fixed price of petrol and diesel, the cost of production is going higher due to the costly import of raw materials. The devaluation adds about 20pc directly to the cost while the indirect cost goes much higher with the manufacturing, transportation and other processes.

“Severe devaluation of rupee has raised the cost of doing business and fostered the inflation, therefore, it is crucial to review the current strategies being pursued by the regulator,” he reiterated.

“Due to lack of effective price control mechanism, an abnormal upsurge has been witnessed in the prices of almost all the commodities of household usage which have to be controlled to ease the already overburdened and miserable life of the inflation-stricken common man,” he stressed.

Published in Dawn, April 6th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.