2021 in review: Business stories that captured the waves

2021 was the third full year of the PTI government's tenure and given the devastating economic impact of the coronavirus pandemic, the government spokespersons have argued that Pakistan's economic trajectory is similar to, and in some cases better than, its regional peers.

But several analysts and opposition parties have disagreed with that assessment, with many asserting that performance could have been much better on various fronts.

As for the common man, rising inflation, surging fuel price, gas scarcity and a rupee in freefall has meant that the year has been much more than a struggle.

Here, Dawn.com takes you through 10 business and economy stories that made the headlines and impacted the masses this year.

IMF negotiations — will they or won't they

If there was one business news story which not only remained in the limelight throughout the year but also impacted many others on this list, it would be the government's continuing negotiations with the International Monetary Fund (IMF).

State Bank of Pakistan Governor Dr Reza Baqir said at the start of the year that Pakistan was in talks with the IMF to put a three-year $6 billion bailout programme, agreed to in 2019, back on track. A staff-level agreement over reforms that would lead to the release of around $500 million in funds was reached in February with the IMF agreeing to release the funds in March after approving four pending reviews of the country’s economic progress.

The approval followed some tough decisions taken in Islamabad to stabilise the economy. The measures included a steep rise in electricity bills, imposition of Rs140bn taxes and a move to grant unprecedented autonomy to the central bank.

However, come June, IMF spokesman Gerry Rice said the lender was holding open, constructive discussions with Pakistan as part of a sixth review of the financing programme. He declined to say if disbursements under that programme had been halted but said further discussions were needed about Pakistan's fiscal spending plans, structural reforms, particularly in the tax and energy sectors, and social spending.

Talks with the IMF for the sixth review of the financial package started in earnest in October but progressed with unusual uncertainty and lack of clarity with the finance ministry remaining silent on the status of talks. Positive news started to trickle in starting from November and a staff-level agreement on policies and reforms, needed to complete the sixth review, was announced on Nov 22.

However, the news was not positively received in all quarters with the opposition assailing the lack of details provided over the agreements and vowed to oppose a planned mini-budget — to implement fiscal adjustments and expenditure cuts worth about Rs600bn as part of an understanding with the IMF — by the government.

Read more: Why is the IMF so unpopular?

FATF talks — so close yet still so far away

Pakistan's reviews with the Financial Action Task Force (FATF) occupied news spaces and financial discussions across the country for a significant chunk of the year.

In the year's first review in February, FATF President Dr Marcus Pleyer said, "Pakistan remains under increased monitoring", adding that while Islamabad had made “significant progress”, there remained some “serious deficiencies” in mechanisms to plug terrorism financing. He said three from the 27 points remained to be completed and noted Pakistan's progress in fulfilling the conditions.

The next time around, after June's plenary meeting, only one item from the 27 points action plan remained unfulfilled and against expectations, Pakistan was still kept on the grey list. To most analysts' surprise, Pakistan was also also told to address all items on a parallel action plan handed out by the watchdog's regional partner – the Asia Pacific Group (APG) – in 2019.

The latest review took place in October and Pakistan was yet again kept on the grey list with Pleyer saying it had to complete two concurrent action plans with a total of 34 items. "It has now addressed or largely addressed 30 of the items," he had said.

He said completing the 30 items showed the government's "clear commitment" so there was no question of Pakistan being blacklisted.

In a bright spot, Energy Minister Hammad Azhar had responded positively to the development, terming it as "good news". He had said that Pakistan's technical stance would be "vindicated soon".

The next review of Pakistan is set for February 2022.

Read more: US notes Islamabad’s efforts to meet FATF demands

Saudi support package — rekindling old flames

Not all was doom and gloom on Pakistan's economic front for 2021. Prime Minister Imran Khan's warm approach to fostering relations with Saudi Arabia yielded dividends during his trip to the kingdom in October when it agreed to revive its financial support to Pakistan, including about $3bn in safe deposits and $1.2bn worth of oil supplies on deferred payments.

The premier later said in an interview with Saudi Arabia’s Al-Riyadh newspaper that he was "extremely grateful" to the kingdom. "The budgetary support will help the balance of payment of Pakistan in the backdrop of rising commodity prices globally," he had said.

In November, the prime minister and his cabinet approved a pair of summaries in this regard and soon after the State Bank of Pakistan (SBP) signed an agreement with the Saudi Fund for Development to receive $3bn. A press release had said the amount would help support Pakistan’s foreign currency reserves and contribute towards resolving the adverse effects of the Covid-19 pandemic.

Read more: Saudi conditions

On Dec 4, Adviser to the Prime Minister on Finance and Revenue Shaukat Tarin announced that the SBP had received the deposit and thanked the kingdom and its crown prince for the "kind gesture".

Pakistan joins Amazon's empire

Pakistan took a major stride into the world of e-commerce with a welcome announcement from Adviser to the Prime Minister on Commerce and Investment Abdul Razak Dawood in May that the country would soon be added to Amazon's sellers' list.

"We have finally made it. We have been engaged with Amazon since last year and now it’s happening. It is a great opportunity for our youth, small and medium enterprises and women entrepreneurs.

"An important milestone of the e-commerce policy has been achieved through teamwork by many people across the globe," he had said.

The prime minister had also welcomed the development. In a tweet, he had said: “A great development as Amazon has finally approved that our sellers can export their goods through their system. Amazon starting operations in Pak will open opportunities for our youth as it will enable a new breed of young men & women entrepreneurs to join the export market.”

The deal was made official on May 21 when Dawood announced that Pakistan had been added to the e-commerce giant's sellers' list.

"It is a big accomplishment for our e-commerce and will open up vast opportunities for a new breed of young men and women entrepreneurs. We congratulate everyone involved," he had tweeted.

A message from Amazon International Seller Services Vice President Eric Broussard said the company was "eager to work with Pakistan's dynamic business community, including small and medium-sized sellers and help connect them with customers around the globe".

Situationer: To Amazon, with cautious optimism

The major difference after being added to the sellers' list is that Pakistani companies can create IDs using their Pakistani details, including Pakistani banks. Moreover, SMEs, youth and women entrepreneurs have great opportunities to connect with the global market.

Private sector logistics companies also have an opportunity to scale up businesses and develop international partnerships. Pakistan Post is also working on automation and preparing itself for parcel deliveries.

Read more: South Punjab set to get its first Amazon facility

The year of the startups

Pakistani startups have been on a roll in 2021 and have attracted unprecedented investment from major venture capitalists across the globe.

Startup investments in the first half of 2021 amounted to $128m, which is the highest recorded in any six-month period. According to investment advisory firm AlphaBetaCore, the start-up funding in January-June period exceeded the amount raised for the last three years combined.

Read: Pakistani startups on a roll as they rake in $120 million in first half of 2021

Azhar Mashwani, Punjab chief minister's focal person for digital media, pointed out in August that investment in Pakistani startups had increased from $170m between 2015 and 2020 to $193m in 2021 alone.

Planning Minister Asad Umar said close to the year's end that the funding raised by startups in 2021 alone exceeded the amount raised in the entire five-year duration of the PML-N government. He heralded the booming startup revolution in Pakistan as an example of "real innovation and entrepreneurship emerging instead of crony capitalism".

One of the more prominent examples is Airlift, a Lahore-based online shopping delivery service, raising $85m in Series B financing in August, the largest single private funding round in Pakistan’s history. The financing was about twice the size of the largest private company IPO in the country’s history and the highest in the Middle East and North Africa region.

The development was warmly welcomed by Prime Minister Imran Khan who said Pakistan had "huge potential" and was open for business, adding that the PTI government was "fully committed" to creating further opportunities.

Bazaar, a year-old B2B marketplace from Pakistan, raised $30m in Series A financing in August co-led by Silicon Valley-based Defy Partner and Singapore-based Wavemaker Partners. According to a press statement, the round took Bazaar’s total funding to $38m, “making it one of the best funded startups in the country”.

The planning minister congratulated Bazaar on the achievement. He said: "Time for the Pakistani tech sector has arrived."

Remittances at all-time high

For a cash-strapped economy such as Pakistan's which is dependent on imports, remittances offer a much needed salve to ease pressure on the country's foreign exchange reserves. This held even truer in 2021 when they offered crucial support to the PTI government combatting the scourge of the coronavirus.

Remittances remained above the $2bn mark in December 2020 for the seventh month in a row. In the first half of 2020-21, inflows totalled $14.2bn. The amount was about 25 per cent higher than $11.37bn received in July-Dec 2019.

They continued this positive trend till hitting an all-time high of $2.8bn in April, 56pc higher than a year ago. Cumulatively, during the July-April FY21, workers’ remittances rose to an unprecedented level of $24.2bn, up by 29pc, compared to the same period last year. These also surpassed the full FY20 level by over $1bn, creating a new record, the SBP said.

Reacting to the development, the premier had said that he "always believed overseas Pakistanis to be [the country's] biggest asset". "Remitting $24.2bn in first 10 months of FY21, you have broken the record level achieved in the entire FY20. Thank you for your faith in Naya Pakistan," he had tweeted.

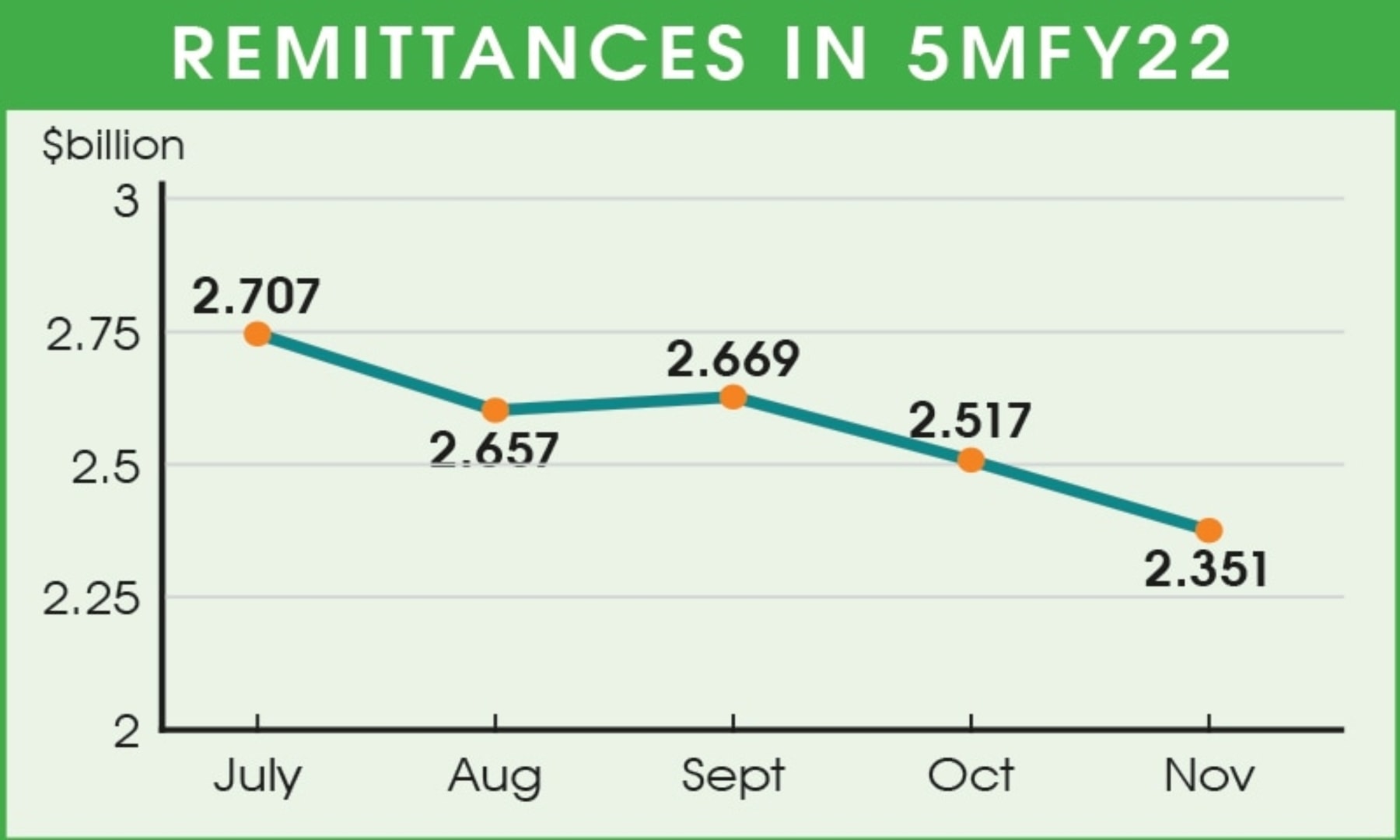

The central bank reported in October that overseas Pakistanis sent the highest-ever $8bn remittances during the first quarter of the current fiscal year, registering a growth of 12.5pc over the same period last year.

“The proactive policy measures by the government and SBP to incentivise the use of formal channels, curtailed crossborder travel in the face of Covid19, altruistic transfers to Pakistan amid the pandemic, and orderly foreign exchange market conditions have positively contributed towards the sustained improvement in remittance inflows since last year,” the SBP had said in a statement.

By December, remittances fell 6.6pc on a month-on-month basis in November but grew by almost 10pc in the first five months of the current fiscal year.

However, a World Bank report said remittances are likely to remain flat at the present high levels in 2022 as the one-off effect of government incentives to attract them fades.

Read more: Record remittances

Rising current account deficit

The government may have touted a current account surplus by 2020's end but by January, the current account was in a deficit for a second month with $229m due to surging imports.

It declined in the subsequent months to $50m in February, $33m in March and increased to $200m in April before rapidly shooting up to a deficit of $650m in May. That left a meagre $153m surplus in the first 11 months of the outgoing fiscal year (11MFY21).

The current account deficit (CAD) for June was $1.644bn, the highest monthly deficit in FY21, and ended the fiscal year with a large CAD of $1.8bn despite showing a surplus till the end of first 11 months (July-May) period of the year mainly driven by higher imports in the last month.

It ballooned to about $1.5bn in August before surging to 4.7pc of the GDP with $1.6bn in October — much higher than the 2-3pc range predicted by the SBP in July.

According to data issued by the SBP on Dec 20, the current account recorded a deficit of $7bn in the first five months (July to November) of the current fiscal year, mainly on account of increasing imports.

At $1.91bn, November saw the highest monthly current account deficit since July 2018 when it reached $2.1bn. This was the year when the country faced a record $20bn current account deficit. Besides, the five-month figure of $7bn, this year stands in total contrast to a current account surplus of $1.64bn during the same period a year ago.

The five-month deficit has already reached 5.3pc of the GDP, leaving no chance of a decline amid a rising import bill.

Analysts believe the current account deficit may hit $15bn by the end of this fiscal year.

The government is striving to maintain the foreign exchange reserves at an adequate level to mitigate the impact of a ballooning CAD. Despite borrowed foreign exchange, the reserves have been declining during the current fiscal year, adversely affecting the exchange rate and resulting in the rupee’s depreciation.

Rupee at all-time low

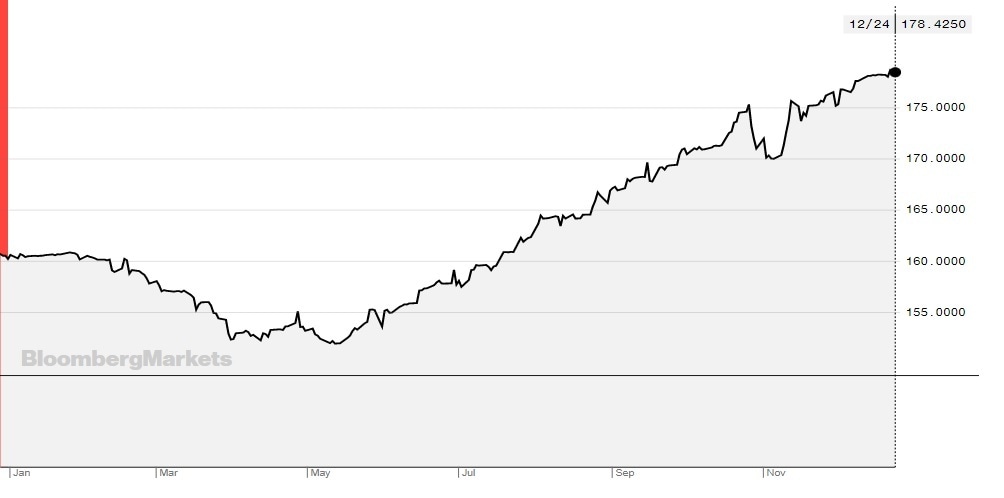

The year 2021 saw the dollar reaching record highs against the rupee even though it started out on a positive note. The rupee was seeing a rally against the dollar and reached a 22-month high in March, trading at levels last seen in June 2019. It gained Rs5 or 3.27pc against the dollar in March alone.

However, since May, the dollar has been on a the rise. On August 2, the rupee had hit a nine-month low against the dollar at Rs163.67. The reported deficit of the current account and surging oil prices were bearing down on the local currency.

The rupee continued this sustained depreciation, broken up by sporadic gains, until the dollar reached Rs177.5 in intraday trade on Dec 8 for a new all-time high. On Dec 24, the dollar was trading at Rs178.4, which translates into a rise of 11.1 per cent since the start of the year (YTD), when it was trading at Rs160.6 (on January 1).

Interestingly, Fitch Ratings had revised down its forecasts for the Pakistani rupee in September for both this year and the next due to a variety of factors including an increased flow of US dollars into Afghanistan, projecting an average rate of Rs180 versus a previous forecast of Rs165 in 2022.

The continuing rupee depreciation also elicited a rather interesting response from the SBP governor who said it was actually advantageous for families of overseas Pakistanis who received remittances. His comments generated a volley of criticism from the opposition questioning his explanation of the situation.

Inflation on the upswing

Inflation has proven to be the beast most difficult for the government to wrangle, even if at the outset of the year it seemed to be under some control. The inflation rate eased to 5.65pc in January from 8pc the previous month, according to the Pakistan Bureau of Statistics.

However, the inflation rate began to increase soon after, 8.7pc in February then 9.1pc in March until it saw a double-digit increase in April to 11.1pc. This was mainly driven by double-digit growth in food inflation in both urban and rural areas.

The rate then remained somewhat steady until November when it edged up to 11.5pc — the highest increase noted in the past 20 months influenced by a record hike in fuel prices last month.

The massive rupee depreciation fuelled import-led inflation. At the same time, prices of fresh vegetables, fruits and meat have also posted a persistent increase in major urban and rural centres. The average inflation during the July-November period rose to 9.32pc on a yearly basis.

Read more: The real pain of inflation

The increase saw criticism from the opposition with the Pakistan Democratic Movement announcing an "anti-inflation march" in Islamabad on March 23, 2022, to protest against the government's failures.

In another damning development, a nationwide perceptions survey by Transparency International showed that more than 90pc of Pakistanis believed that inflation and price hikes were the highest in the PTI government's tenure compared to previous governments.

Read more: Crushed by inflation

Fuel price and gas crisis

There is perhaps no other financial topic that elicited more public anger and commotion in 2021 than that of persistent increases in fuel prices.

The year started off with an increase of Rs3.2 per litre in the price of petrol on Jan 15. That itself was the third time in four weeks that fuel prices had been increased.

Similar increases followed and a Rs5.4 increase on July 15 took the petrol price to Rs118.09 per litre. A bomb was soon dropped on Oct 16 when the government raised petrol price by Rs10.49 per litre due to higher oil prices in the international markets.

The increase set off widespread and intense criticism from the opposition and the public even as government ministers defended the hike.

PML-N Vice President Maryam Nawaz called it a "calamity" that had fallen on the people like a "lightning bolt" while party president Shehbaz Sharif said it would "push people to the brink of starvation".

The PPP, meanwhile, announced a protest against the ongoing wave of inflation in the country.

However, more was soon to follow as the petrol price was again hiked on Nov 4 by up to Rs8.14, taking it to Rs145.82 per litre, to ensure the revival of the IMF programme.

At one point, Prime Minister Imran Khan himself attempted to diffuse the uproar. "In India today, there is uproar as well [over petrol prices] and the petrol price per litre is Rs150 while it is Rs200 in Bangladesh. [On the other hand] it is the lowest in Pakistan at Rs146," the premier said, while addressing a public gathering in Attock in November.

If the petroleum crisis wasn't enough, the country was also grappling with an issue of gas supply in 2021. Following reports that two state-owned foreign suppliers had declined to supply their two committed vessels for delivery in February, Pakistani authorities were reported to have salvaged at least one of the vessels through high-level diplomatic efforts but confirmed that the vessel committed for February's second half would not be available.

The Sui Southern Gas Company Ltd also warned of "acute shortage" of gas from different fields.

Read more: Gas supply shortage

The crisis deepened across the country in June as two state-owned companies announced complete closure of gas supply till July 5 to industries and CNG stations following a decline in gas availability, low pressure in the system and dry docking of the LNG terminal.

In November, the Cabinet Committee on Energy decided that gas supply would be curtailed to the CNG sector.

In a memorable moment for the year, the energy crisis saw Energy Minister Hammad Azhar and journalist Shahzeb Khanzada going head to head over the power sector's woes. PML-N leader Miftah Ismail also jumped into the fray and reminded the minister that his job was to end gas loadshedding and ensure uninterrupted supply rather than win arguments against anchorpersons.

Read more: Hammad Azhar vs Shahzeb Khanzada: Whose side is Twitter on?

Compiled by Syed Talal Ahsan

Header image by Mushba Said