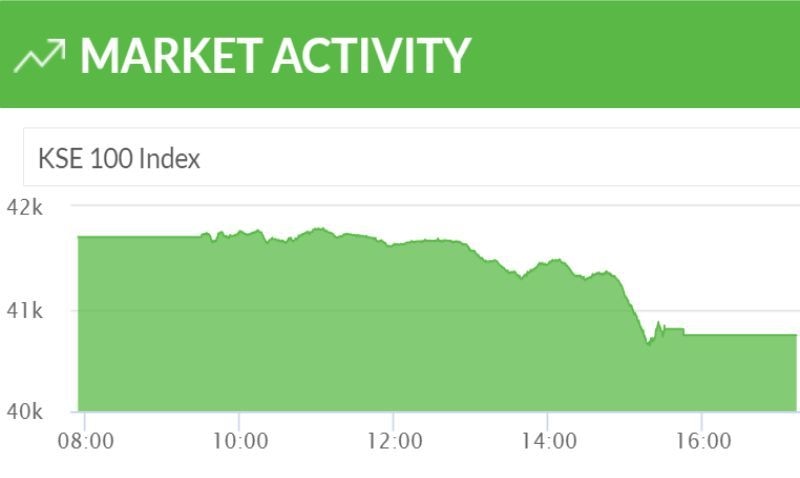

The stock market went into turmoil on Monday on the sudden flare-up in political temperature with the arrest of Leader of the Opposition Shehbaz Sharif after his bail was rejected in a money-laundering case. The KSE-100 Index plummeted 960 points (2.30 per cent) and closed below the 41,000 level at 40,741.

The market opened slightly in the negative and oscillated between the red and green until after mid-day when all hell broke loose with the Index going into a free fall. Small Investors who were still unaware of the developments thought it wise to jump out of stocks first and ask questions later.

By the end of the day, as much as Rs164 billion were hacked off the aggregate value of the market with 351 stocks settling in the negative against only 57 in the positive.

Commenting on the decline, Ali Asghar Poonawala, a senior financial analyst at AKD Securities, said political murmurs could be mostly seen impeding market moves to a higher level throughout the last week following the opposition's multi-party conference, but "today's headline [of Shehbaz's arrest] fed into a heightened risk sentiment".

Earnings were another key dampener, he noted, adding that headway on major policy moves initiated recently, such as circular debt resolution, talks with independent power producers (IPPs) and energy sector reforms, had failed to materialise as yet.

Muhammad Faizan Munshy, Head of Foreign Sales at Next Capital Limited, said most of the points lost were due to Shehbaz's arrest. "The rest was just normal profit-taking," he added.

Major market participants tried to calm the market which saw the index bounce back a little from the intra-day low of 1,056 points.

The data released by the National Clearing Company of Pakistan Limited in the evening did not show heavy exodus of foreign portfolio investment as the foreign sell-off remained at the daily average of $1.26 million.

Insurance companies, banks and other organisations with surplus cash considered it just the right time to buy when the blood was on the street. Mutual Funds were the major sellers of equity worth $5.35m.

Analysts at Arif Habib Limited said another reason for the stock decline was the previous week’s rollover session’s trickle-down impact on the first trading session, primarily due to low settlement ratios.

Volumes decreased from 435m shares to 407.2m shares (-6pc DoD). Traded value also declined by 7pc to reach $86.1m. O&GMCs, refinery, banks and cement sectors saw heavy selling pressure.

HBL (-3.6%), UBL (-2.5%), BAHL (-4.1%), MEBL (-1.8%), MCB (-1.4%) among banks and KOHC (-7.5%), MLCF (-6.7%), PIOC (-6.1%), DGKC (-4.9%) and CHCC (-4.0%) dented the Index.