AkzoNobel Pakistan Ltd, a listed chemical company, announced last week that its foreign majority shareholder — ICI Omicron BV — intends to buy back 11.2 million shares comprising 24.19 per cent of the company’s paid-up capital from minority stakeholders and go for voluntary delisting.

In doing so, the company affirmed, the majority shareholder intends to obtain full ownership of the Pakistan subsidiary.

The company was created in April 2011 when ICI Pakistan Ltd split into two listed entities: AkzoNobel Pakistan (comprising the paints business) and ICI Pakistan comprising all other businesses of the pre-split entity.

Over the years, many large profitable subsidiaries of multinational companies have parted ways with public stakeholders. Some noteworthy examples are Philips, Gillette, Novartis Pakistan (formerly Ciba Geigy) and Novartis Pharma (formerly Sandoz). In February 2016, Amsterdam-based parent company sold its entire stake in Singer Pakistan.

The market is looking at a much higher bargain price in the case of AkzoNobel’s delisting

But perhaps the most spectacular share buyback and voluntary delisting took place in April 2013. Unilever Pakistan, one of the biggest fast-moving consumer goods companies (FMCG), left the public domain as the UK-based parent entity bought back shares held by the public at Rs15,000 each. This was the biggest share repurchase transaction in the country’s history.

A blue-chip company opting to exit is never good news for the stock market. Securities and Exchange Commission of Pakistan (SECP) Policy Board Chairman Khalid Mirza calls it a signal from the company about its “lack of faith in the market,” which should be a cause for concern.

He affirmed that in many markets companies have developed a penchant for turning private from public, although it is more often for business reasons. A company’s decision to seek delisting, Mr Mirza says, can be for a number of motives. It can go for delisting for business reasons or having no faith in the market. The company may believe that it is not getting the value it deserves for being listed and is unable to raise capital from the market.

The SECP Policy Board chairman stressed that the stock market is doomed to failure unless there are multiple exchanges to ensure competition, noting that monopolies ought to be broken.

Hundreds of private flourishing companies that make lots of money in cellular, food, FMCG, technology, textile, pharmaceutical and oil and gas exploration sectors are loath to go public. There is nothing that the regulator can do about it.

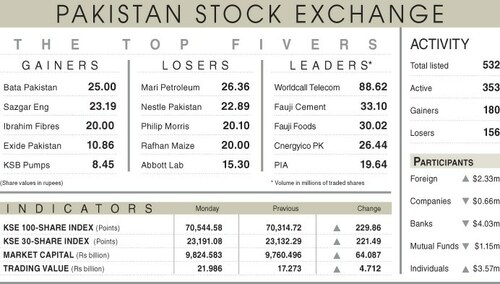

A chief regulator had amused the market a few years back by proclaiming that he could coerce large private corporations into compulsory listing. The number of 558 listed companies, down from 638 in 2012, should be worrisome since the number of initial public offerings (IPOs) drastically went down from the annual average of 25 in the 1990s to just one last year.

The minimum purchase price per share for AkzoNobel has been determined at Rs194.47 while the stock was trading around Rs250 a day before the buyback announcement.

It has to be conceded that regulators have done well in most buybacks to broker good prices for minority holdings. It is perhaps for this reason that the delisting announcement by AkzoNobel was followed by upper circuits for two consecutive days. The market is possibly looking at a much higher bargain price. On Nov 28, 2019 when the company made the compulsory announcement of the buyback, the price of the share stood at Rs167.

Sani-e-Mehmood Khan, former general manager of the Pakistan Stock Exchange (PSX), says that cash-rich sponsors buy-back company shares, although it has to be ascertained whether the cash is that of the stakeholders or coming out of the sponsors’ pockets.

He points out that since the economy is in a forced contraction mode, listed companies are finding it hard to make money. It is for this reason that instead of distributing excess cash among shareholders in payouts, listed companies have started to buy-back their shares using the money that actually belongs to shareholders.

The frontline and apex regulators must ensure that all stakeholders have a role in the determination of the buyback price. Even Unilever Pakistan wanted to delist at a price that was at least 30pc lower than the one that was finally determined after a months-long strenuous debate.

Besides blue-chips, scores of companies — mainly lame ducks in the textile sector — have been delisted by the exchange. Many others opted for voluntary delisting in the last two decades. Such parting of ways with shareholders is fair and must be encouraged as these companies were unable to remunerate shareholders for their investment.

Concurrently, companies in default also get routinely delisted. They vanish overnight without paying a paisa to small shareholders in exchange for their holdings. Such delistings must be looked down upon as a bailout and, therefore, considered unacceptable.

Published in Dawn, The Business and Finance Weekly, February 3rd, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.