ISLAMABAD: Pakistan will likely turn to Islamic banks to borrow another Rs200 billion ($1.45bn) to try and ease the financial crunch in its power sector, a senior finance ministry official said on Friday.

The government is trying to clear power sector government payment arrears amid warnings by power producers that they could go out of business if they are not paid.

Pakistan’s power sector arrears or “circular debt” currently stands at more than Rs1.4 trillion ($10.1bn).

Pakistan took out Rs200bn rupees sukuk last month and another one is planned in coming months, officials say. Local media reported six Islamic banks were involved in the first issuance, with Meezan Bank Ltd leading the syndicate.

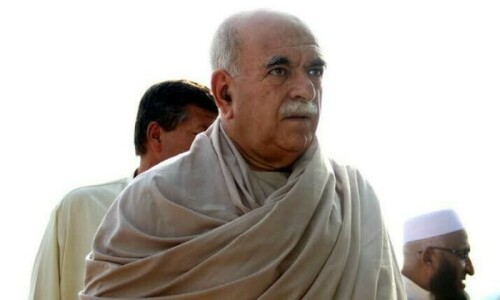

“Yes, the government may consider borrowing in addition to the Rs200bn in process and is likely to follow the sukuk route further ... as there is ample liquidity in the Islamic banking area,” Khaqan Hassan Najeeb, adviser and spokesperson to the finance ministry.

Electricity woes have been weighing on Pakistan’s economic outlook and plans for clearing circular debt are a key part of its ongoing bailout negotiations with the International Monetary Fund (IMF).

Najeeb added that the government wants to reduce circular debt flow, or build up, to negligible levels in next financial year ending June 2020.

Pakistan, which has had 12 bailouts since late 1980s, is trying to avert a balance of payments crisis amid dwindling foreign currency reserves and a yawning current account deficit. On top of an IMF bailout, Islamabad is sourcing loans from friendly nations, mostly in the Middle East, and trying to attract foreign investment, including through the privatisation of some state assets.

The government has also launched a bond for Pakistani diaspora and is due to an issue a yuan-denominated Panda Bond, for which it has issued a request for proposal (RFP).

But negotiations have been slow and delayed, with several Pakistani officials voicing concerns that conditions being put forward as part of an IMF programme would cripple economic growth. Najeeb did not put a date on how long it would take before any final deal is struck, but added: “We continue to productively engage with IMF on regular basis through video conferencing, emails and sharing of data.”

He said the government and Finance Minister Asad Umar are determined for the next bailout to be the last IMF rescue package for Pakistan.

Published in Dawn, February 23rd, 2019

Dear visitor, the comments section is undergoing an overhaul and will return soon.