THE rupee rose due to falling demand for dollar and euro amid sluggish trading activity due to political uncertainty. The dollar lost its lustre in overseas trade because of a bearish trend in the international equities market.

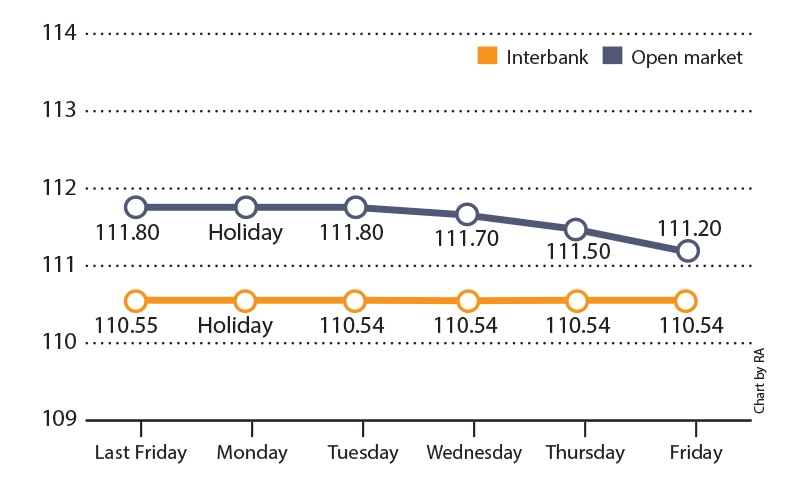

On the interbank market, the rupee/dollar parity showed was steady in a week reduced to four sessions due to a public holiday on Feb 5 on account of Kashmir Day. The market resumed operations on Feb 6.

Amid comfortable dollar supplies and depressed dollar demand, the rupee inched up by one paisa and traded at Rs110.54 and Rs110.55 on Monday, up from the previous week’s close at Rs110.55 and Rs110.56.

The local currency gained Rs4.80 against the euro

On Wednesday and Thursday, the parity was unchanged in the absence of market triggers. The dollar traded flat at Rs110.54 and Rs110.55 as the rupee remained stable.

The rupee ended firm against the dollar on Friday and closed the week flat at Rs110.54 and Rs110.55 amid dull trading activity. During the week, the dollar in the interbank market still managed to gain one paisa against the rupee.

In the open market, the rupee staged a rebound against the dollar. The rupee on Tuesday shed ten paisa that enabled the dollar to rise to Rs111.80 and Rs112.10 against the last closing at Rs111.70 and Rs112.00. However, the rupee turned positive against the dollar on Wednesday, after it posted a 10-paisa gain due to sufficient dollar inflows; with the dollar retracting to the prior week’s closing levels at Rs111.70 and Rs112.00.

The rupee further extended its overnight firmness and posted a 20-paisa gain against the dollar on Thursday. The dollar plunged close to Rs111.50 and Rs111.80. Maintaining its rising trend, the rupee posted a 30-paisa gain against the dollar on Friday. The dollar tumbled to Rs111.20 and Rs111.50 due to falling demand. On week-on-week basis, the dollar in the open market lost 50 paisa against the rupee. The differential between the interbank and open market rates narrowed from Rs2 to Rs1 in the past week.

Against euro, the rupee was seen in recovery last week. Extending previous weekend’s firmness, the rupee posted a 50-paisa gain against the euro on Tuesday and traded at Rs137.80 and Rs139.80 against the prior weekend’s level of Rs138.30 and Rs140.30.

On Wednesday, the euro continued its downslide as the rupee picked up 80 paisa on the buying counter and Rs1.55 on the selling counter, pushing euro further down at Rs137.00 and Rs138.25.

On Thursday, the rupee posted Rs1.50 gain on the buying counter and another 75-paisa gain on the selling counter, pushing euro to Rs135.50 and Rs137.50.

The rupee gained Rs4.80 against the euro on a weekly basis.

Published in Dawn, The Business and Finance Weekly, February 12th, 2018