KARACHI: The World Bank is preparing a housing finance plan to help Pakistan meet its growing demand for residential units.

In this connection, a World Bank delegation, including representatives of Pakistan Mortgage Refinance Company (PMRC), met National Bank of Pakistan (NBP) President Saeed Ahmad on Wednesday.

“The World Bank will provide funds for housing projects that will reach banks through PMRC,” Mr Ahmad told Dawn.

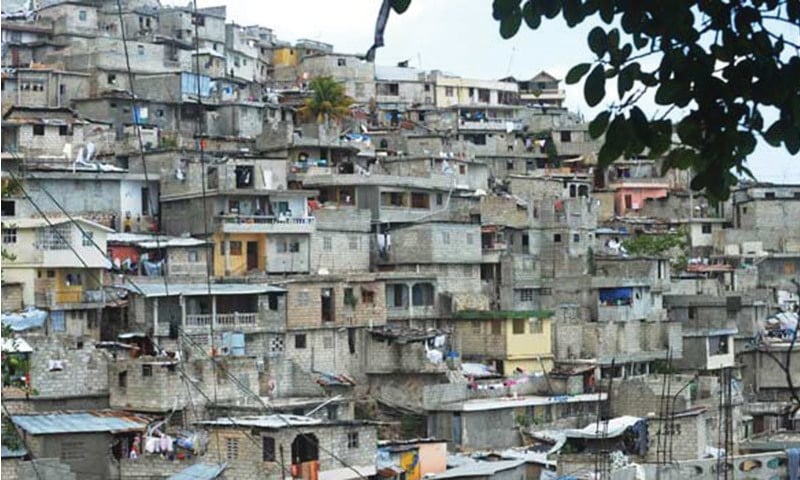

He said housing finance has vast development potential, adding that the country needs low-income housing projects.

“If the government provides free-of-cost land, a small house comprising one room with attached bath, kitchen and veranda can be built at Rs1.1-1.2 million,” he said, adding that the Punjab government has shown willingness to provide land without charges for the low-income housing segment.

Banks shy away from housing finance because of long-term engagement of funds

The World Bank will provide Pakistan with support to expand conventional mortgage lending, increase housing finance for the low-income segment, build capacity and ensure technical assistance for housing policy.

In addition, PRMC was also in talks with banks to provide them with support for on-lending, which means lending borrowed money to a third party.

Mr Ahmad said the World Bank can provide funds at a cost of 0.5-1 per cent, which will help private banks increase their lending for the housing sector. Banks are reluctant to grow housing finance because of many reasons, including long-term engagement of funds, poor recovery and weak foreclosure laws.

He said this is an opportunity for the financial sector to expand its housing portfolio on a secured and profitable basis.

PMRC along with the World Bank is planning to sign a memorandum of understanding with NBP as well as other commercial banks for the development and promotion of housing finance.

World Bank official Korotoumou Ouattara said the project will increase lending to low-income households. PMRC CEO N. Kokularupan Narayanasamy explained the role of the company in establishing and promoting a fixed-rate mortgage market, reducing the maturity mismatch risk for banks and developing the local capital market through regular issues of conventional and Islamic debt instruments.

Mr Narayanasamy said PMRC’s current discussions with banks include the use of these instruments as well as working with developers to overcome challenges of housing titles or ownership.

Mr Ahmad said the country faced a shortage of 7m housing units a few years back, a number that could now have exceeded 10m.

Published in Dawn, September 28th, 2017