KARACHI: The Karachi Electric Supply Company Limited (KESC) public issue of Term Finance Certificates (TFCs) have been subscribed in the sum of Rs500 million, making a quarter of the total amount of Rs2 billion on offer, inclusive of Green shoe option of Rs1 billion. The paper had been picked up by investors in about a week from the opening of subscription on May 25 to June 1, which market experts thought was a reasonably warm response. The TFCs are available for public subscription up to August 24.

The KESC TFCs mark the public offering of Pakistan’s first-ever utility sector retail bond issue. The TFCs Rated, Listed and Secured have been offered in three tenors: 1 year at 13pc, 3 year at 14.75pc and 5 year at 15.5pc.

Minimum investment amount has been fixed at Rs10,000, which the utility said was to allow broad-based participation in the venture.

Analysts quoting company sources said the papers have been secured against receivables from specific 250 corporate customers.

The average collection from those customers was Rs900 million per quarter.

Investments received against the TFCs would be utilised for financing KESC’s permanent working capital requirements.

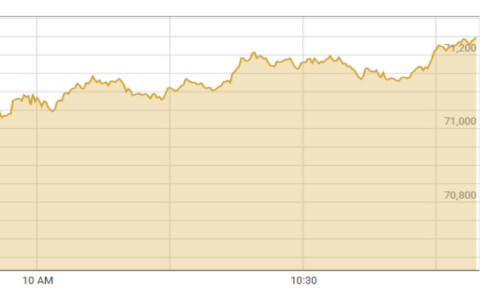

On Monday, the bankers to the issue announced at the stock exchange, the subscription figures up to June 1.

The bifurcation of amounts sold in TFC 1/TFC 2/TFC 3 from May 25, 2012-- the opening of subscription period-- to June 1, 2012 stood as follows: In respect of TFC 1, the company had sought Rs300 million, against which 83 applications were received in the sum of Rs269 million, covering 90 per cent of the offer. TFC 2 received 35 applications for total sum of Rs45 million or 4 per cent of the offer of the heaviest amount of Rs1.2 billion and the TFC 3 that are for sale in the sum of Rs500 million, received Rs185 million, representing 37 per cent of the issue.

Capital market analysts said that the trend seems to indicate investors’ interest in one, three and two year tenor, in that order.

Dear visitor, the comments section is undergoing an overhaul and will return soon.