KARACHI: The Securities and Exchange Commission of Pakistan (SECP) has ordered an investigation into the leakage of trading information of Pakistan Stock Exchange (PSX), a press release issued by the apex regulator on Tuesday stated.

“While taking a serious notice of various complaints received, the SECP constituted a team with a mandate to immediately start the investigation proceeding to identify and curb the sources of such unlawful practices and take necessary corrective and punitive actions,” the SECP said.

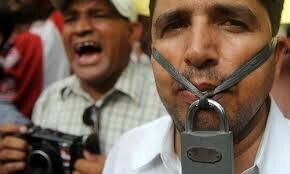

The hastily released press note is unlikely to send shivers up the spine of the perpetrators. The practice of leaking trading data is not new to the stock market. At the annual general meeting of first shareholders meeting on Oct 24, some senior members vehemently protested the ‘data leakage’ and demanded that it be plugged.

The majority stakeholders—the Consortium of Chinese investors who now manage the bourse — sat dumbfounded as the acting Managing Director tried to pacify the crowd and explain that steps were being taken to ensure secrecy and security of live market data.

Several years ago, two whistle-blowers accused senior staff of illegally accessing sensitive real time trading data and accessing emails. A reputed consultancy firm, Sidat Hyder Morshed Associates, were hired by the bourse to conduct forensic analysis of the extent of the problem.

Their report was never released and has since remained a well-guarded secret, but sources familiar with its contents say that the 2014 report of the consultants observed that some members of the bourse’ staff and the then managing director of the exchange had access to Individual Unique Identification Numbers (UNIC)—the account number allocated to each investor—and those staff could peep into their ‘buy and sell’ orders.

A senior broker on condition of anonymity confided that several such inquiries have been conducted over the years with the bourse footing a bill of Rs20m or more. But the malady persists. Most knowledgeable sources conceded that all in all it was a complex matter and it was indeed difficult to pinpoint the perpetrators. A market participant said that those in the knowledge of leaked sensitive trading information have been blatantly selling the code-named ‘calendar’ which stipulates the ‘buy-sell’ orders of big investors for a price. It enables the buyers to benefit from information and get away with ‘front running’ and ‘insider trading’.

The SECP further stated that in order to achieve the objective (of preventing trading data leakage), the Commission will engage the services of professionals/experts as deemed necessary and ensure fair and early disposal of this investigation.

Published in Dawn, November 22nd, 2017

Dear visitor, the comments section is undergoing an overhaul and will return soon.