Owing to sufficient liquidity in the market and sluggish demand, the rupee showed a steady trend against the dollar amid minor changes in the open market as well as in interbank dealings.

The central bank’s decision to provide funds for import payments also restricted any major fall in rupee value.

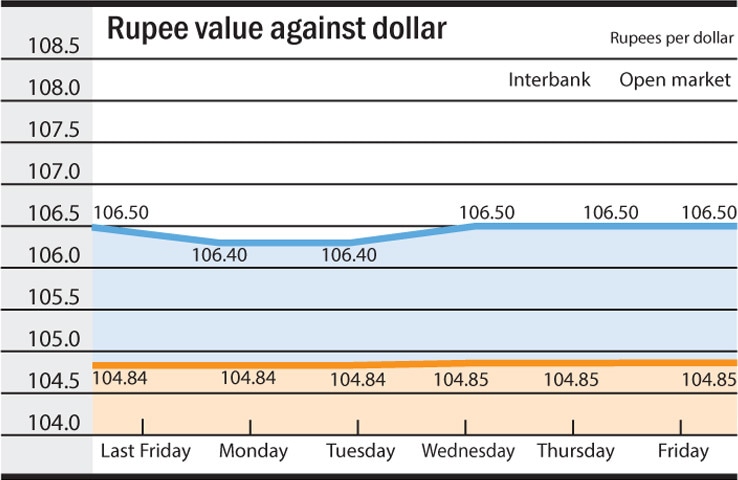

On the interbank market, the rupee traded range-bound against the dollar last week due to lack of buying interest by importers.

In the open market, the rupee last week continued to show a steady trend against the dollar, moving in a narrow band

Commercial banks continued to provide dollars to meet foreign payment requirements which prevented the rupee from falling against the dollar.

Commencing the week on stable note, the parity traded flat at Rs104.84 and Rs104.85 for the first two trading sessions due to slowdown in dollar demand and dull trading activity.

In the last trading session, the rupee remained stable against the dollar in a lacklustre activity amid absence of trading interest by market participants.

At the close of the week, the rupee/dollar parity did not show any change and traded flat at Rs104.85 and Rs104.86 for the third day in a row.

In the open market, the rupee last week continued to show a steady trend, moving in a narrow band.

Due to sufficient liquidity to cover dollar demand from importers and the corporate sector, the rupee commenced the week on a positive note.

The rupee / dollar parity traded unchanged for the third straight day in the last trading session as traders remained on the sidelines and the rupee closed the week flat against the dollar at Rs106.50 and Rs106.70.

Against euro, the rupee continued to move both ways in narrow ranges last week.

Commencing the week in negative zone, the rupee in the first trading session posted ten-paisa loss, changing hands versus euro at Rs113.10 and Rs114.60.

In the fifth trading session, the rupee downslide versus euro persisted and closed the week in minus as the euro further posted ten-paisa gain, hitting a fresh peak against the rupee at Rs114.00 and Rs115.50.

In international trade, the dollar strengthened against major rivals in early sessions but then weakened against most of them during the week after the US Federal Reserve delivered its first rate increase of 2017 and signalled two more rate increases by the end of the year; disappointing many traders who were expecting a more hawkish stance over the pace of the tightening cycle.

The dollar fell to a five-week low later in the week after the US Federal Reserve quashed hopes for a further bull run in the currency by keeping a gradual pace to its monetary policy. The dollar, however, largely stabilised towards the close of the week on an optimistic economic view from the Federal Reserve.

Published in Dawn, Business & Finance weekly, March 20th, 2017

Dear visitor, the comments section is undergoing an overhaul and will return soon.