KARACHI: The stocks came under profit-taking on the first trading day of May after extensive gains during the previous month. The Pakistan Stock Exchange’s (PSX) benchmark 100-share index opened in the red and remained subdued for larger part of the session.

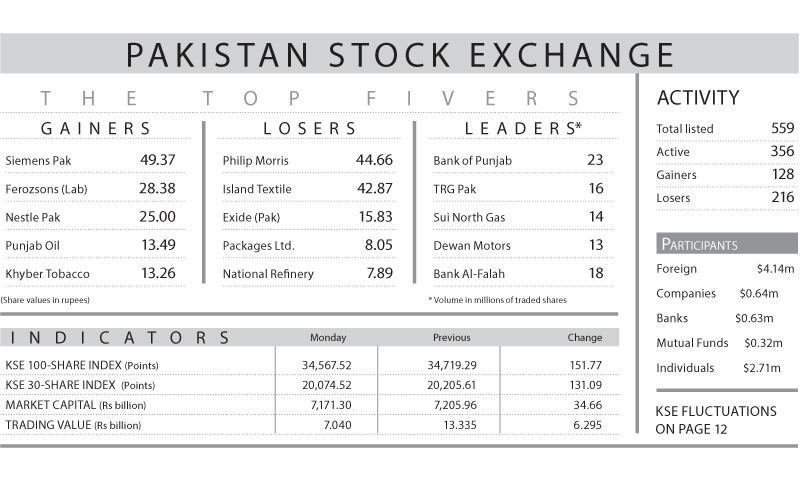

The index fell 151.77 points (0.44 per cent) on Monday to settle at 34,567.52. Stocks in oil and banking sectors succumbed to selling pressure.

The oil and gas sector remained under pressure amid global Brent crude oil prices coming down from their high over the weekend to trade around $46.80 a barrel. Major laggards of the sector included NRL (which fell 2.30pc), ATRL (2.07pc) and OGDC (1.89pc).

A rise in April inflation to 4.2pc further dampened investors’ interest as the figure was generally thought to be higher than expected. Volumes declined 27pc to 185 million shares while value decreased 47pc to Rs7bn.

Trading was led by second- and third-tier scrips. Foreign investors bought shares worth net $4.14m on Monday, which was a healthy departure from constant selling.

MCB Bank (MCB) declined 1.5pc while United Bank (UBL) dropped 0.5pc and FABL shed 2.76pc. Despite gas tariff reduction, the fertiliser sector failed to perform and remained under pressure, closing major scrips in the red zone. FFBL (which fell 2.58pc) was the top laggard whereas FATIMA (which rose 0.42pc) was the sole stock in the sector to close in positive territory.

Cements also came under selling pressure after reports of cement despatches clocking in at 3.5m tonnes (down 3pc month-on-month) during April. Selling in consumer staples like NESTLE, JDWS, NATF and EFOODS also added to the downward pressure.

Major support towards the index came from FML (4.99pc), TRG (3.25pc), KAPCO (1.13pc) and FEROZ (3.5pc).

Published in Dawn, May 3rd , 2016

Dear visitor, the comments section is undergoing an overhaul and will return soon.