ISLAMABAD: Finance Minister Ishaq Dar will be presenting the PML-N government’s second budget in the National Assembly on Tuesday. The finance bill for the fiscal year 2014-15 includes fiscal adjustments of more than Rs300 billion (about 1 per cent of the gross domestic product), achieved by slashing subsidies and cutting back on tax exemptions.

A meeting of the federal cabinet, to be presided over by Prime Minister Nawaz Sharif, will be held in the afternoon to formally approve the budgetary measures before they are tabled in parliament.

A source close to the finance minister said the federal government’s total expenditure over the next year had been estimated at about Rs3.87 trillion, including a Public Sector Development Programme worth Rs525bn.

According to sources, the only relief measures the government has envisaged would be the 10-15 per cent increase in the salaries of the civil and military workforce as well as a 15-20pc increase in their pensions.

The budget will propose steps to expand the tax base by reducing tax exemptions, improving audit and incentives for documented sales and purchases. The government is looking to curtail subsidies by about Rs110bn to Rs225bn next year – as a rise in electricity tariff is expected to lead to an increase in revenue equivalent to about 0.4 per cent of the GDP, while a similar rise in gas tariff may yield an increase equivalent to 0.3pc of the GDP.

Salary, pension raises among few relief measures

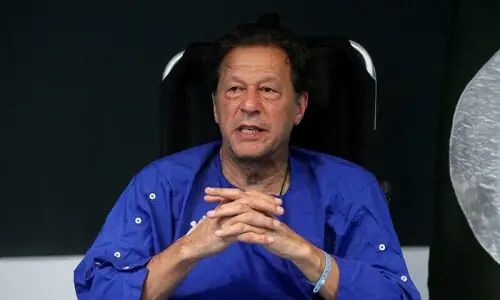

“Actual work (towards reviving the economy) would start now,” the finance minister said ahead of budget presentation. “We will take additional steps to ensure value addition in the textile sector to make the most of GSP-plus status from the European Union,” he said, adding that a 42pc increase was witnessed in raw cotton exports in FY2013-14.

Stressing that the government would never compromise on national security, Dar maintained that it would make sufficient allocations for defence in this budget.

He also said the government would continue with its agenda of reform to increase the economic growth rate by one per cent every year. Defence allocations stand at Rs700bn, up from Rs636bn in FY2013-14, which could be increased by an additional Rs20bn in case the military launches an operation in the tribal areas.

The estimates for next year’s tax revenue have been put at Rs3.94trn, of which the Federal Board of Revenue’s target is being set at Rs2.81trn. The provincial share in the national divisible pool has been estimated at Rs1.7trn and the overall tax to GDP ratio is projected to grow from 10.5pc this year to 11.3pc next year.

The federal government’s fiscal deficit has been estimated at about Rs1.63trn, almost the same level as FY2013-14. But the provinces have reportedly committed to providing a cash surplus of Rs225bn to limit the overall fiscal deficit to about Rs1.41trn or 4.8pc of the GDP – down from the revised deficit of 5.7pc in FY2013-14.

Total expenditure on mark-up payments for FY2014-15 has been projected at Rs1.35trn, up from the previous revised estimate of Rs1.2trn.

Pensions are estimated to consume about Rs220bn as compared to Rs186bn in FY2013-14, while the government’s wage bill would increase slightly from Rs270bn to about Rs290bn in FY2014-15.

Public debt will probably go up from Rs15.5trn to about Rs16.9trn. But because of increase in the size of the economy, the public debt-to-GDP ratio may come down to 60.2pc from 62.7pc in FY2013-14.

Published in Dawn, June 3rd, 2014