SINGAPORE, Feb 14: Asia’s frontier markets Pakistan and Vietnam, offer investors some of the best potential returns in the region, said Spencer White, Merrill Lynch’s chief Asia equity strategist on Tuesday.

Both Pakistan and Vietnam have been among the fastest growing economies in Asia in recent years, as policy and market reforms, as well as the privatization of state assets, picked up in pace, White said.

“There is appetite for a revisit to some of the emerging frontier Asian economies and markets which really have been in the shadows since the Asian financial crisis,” he said.

With the pace of earnings growth likely to slow in the region’s larger markets, including Australia, Hong Kong and India this year, investors should underweight those markets relative to the MSCI benchmark, White said.

They should consider putting at least three per cent of their Asian portfolios into each of Pakistan and Vietnam, where returns on equity are expected to be 28.1 per cent and 29.8 per cent, respectively this year, he said.

In addition, the yield for Pakistan stocks is around 5 per cent, among the highest in Asia.

Despite the attractive returns, few foreign investors have invested in Pakistan and Vietnam stocks.

Portfolio inflows into Pakistani stocks were estimated to be around $450 million in 2005, compared with an annual average of $150 million in the previous three years, White said on the sidelines of a Pakistan equity investment conference organized by Merrill Lynch.

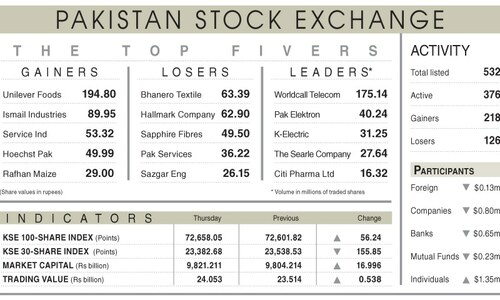

White, a former fund manager who joined Merrill in 1999, said that in Pakistan he would recommend stocks such as Pakistan Oilfields, National Bank of Pakistan, Nishat Mills, telecoms group WorldCall Communications and Kot Addu Power Company for their earnings growth.

Pakistan’s Karachi Stock Exchange 100-index has risen 17.2 per cent this year, after a 53.7 per cent rise last year, making it Asia’s second-best performer after South Korea

White said those investors who did not invest in Pakistan last year have missed the best part of a recent rally. The $53 billion market is now 60 per cent more expensive than it was six months ago.

“It’s still cheaper than lots of other markets. It was an awful lot cheaper last July, but I think it’s still cheap enough with a lot of interesting opportunities,” White said, adding that Pakistan trades at 11.4 times 2006 forecast earnings, compared to 15.8 times in India, and 12.7 times in Asia ex-Japan.

Karachi’s average daily trading volume of about $800 million makes it more liquid than its Southeast Asia peers, he said.

“Pakistan would on a daily basis trade an amount equivalent to Thailand, Indonesia, the Philippines and Malaysia combined.”—Reuters

Dear visitor, the comments section is undergoing an overhaul and will return soon.