KARACHI: Stocks remained volatile throughout the session on Wednesday as the market searched for a direction. The KSE-100 index opened in the red after a steep fall a day earlier.

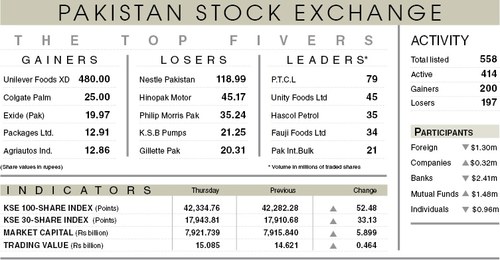

It dipped to intraday low by 73 points but managed to find a foothold and make to an intraday high by 194 points before dropping back to close almost flattish with a slight gain of 47.35 points (0.11 per cent) at 41,876.26.

The index received support from the release of current account data by SBP which showed surplus of $295m in August for the second consecutive month, which elated investor confidence for the economy appeared to have staved off major damaged by the pandemic. The market priced in the status quo on monetary policy which kept the interest rate unchanged at 7pc, but could not shake off the concerns over the rollover week.

Foreign investors sold shares of $0.17 million. The volume increased by a significant 32pc to 583m share while traded value declined 1pc to $77.5m, signifying the dominance of second and third-tier stocks. Leaders included Silk Bank, Unity Foods, JS Capital, PTCL and Hascol Petroleum, which formed 54pc of total turnover.

From the exploration and production sector, Pakistan Petroleum, Pakistan Oilfields and Oil and Gas Development Company declined as the crude prices continued to slip in the international market. Banking saw renewed buying activity, especially in Habib and Bank of Punjab.

Among oil marketing companies, Shell and Hascol performed well. Cement stocks were mixed with Fauji, Maple Leaf and DG. Khan closing in the green while Lucky, Cherat, Attock and Power in the red.

In food, post credit of Unity’s right shares in investor accounts, the stock price of stock dipped but recovered by day end. Automobile assemblers continued to be pummeled. Steel and refinery sector declined where Amreli, lower by 4.9pc, Aisha 2.8pc, International 1.6pc, Mughal 1.4pc, International Industries 1.4pc, National Refinery 0.1pc, Attock 0.6pc and Byco 2.8pc were the major losers.

Published in Dawn, September 24th, 2020

Dear visitor, the comments section is undergoing an overhaul and will return soon.