KARACHI: The Pakistan International Airlines (PIA) chief executive officer has been touting the financial gains made by the national carrier all year, but the stock exchange still awaits financial statements from last year, and this year’s financial data has not even been sent to the auditors yet.

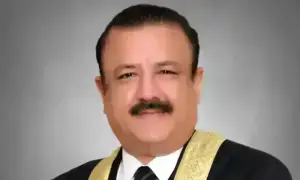

In the meantime, CEO Air Marshall Arshad Mahmood Malik told a gathering at the Korangi Association of Trade and Industry in Karachi that the airline had increased its revenues by 41 per cent in the last six months, and is ready to induct more aircraft by the end of the year.

Earlier in April, he had claimed that PIA has “achieved breakeven at the operational level”, meaning its revenues almost matched its operating costs, minus financing costs.

Nevertheless, the management has been unable to release any financial statements for the airline beyond the year 2017. “The auditors are finalising the results for 2018” Mashood Tajwar, the spokesperson of the airline, tells Dawn when asked about the status of the financial statements that the company is yet to file. “They should be ready before the end of the year.”

Airline filed results for the year 2017 only one month ago, nothing since

For 2019, the delay will be longer since the company will be reappointing its auditors, he says. At the moment, two firms audit PIA’s financial statements: Grant Thornton Pakistan and BDO Pakistan. Reports emerged in January, attributed to sources within PIA, saying that the airline’s auditors had refused to sign the company’s financial statements for the first half and third quarter of 2017 due to some missing records.

The airline management at that time uploaded the unsigned statements on their website nonetheless. The auditors at the time were Ernst & Young Ford Rhodes and KPMG Taseer Hadi and Co, two of the country’s top auditors.

The last financial statements that PIA reported are for the year 2017, and they were published on the stock exchange on Aug 25, almost two years after the year that they describe.

“The reason for the delay is a software glitch,” Tajwar tells Dawn. He says two new accounting softwares were acquired by the airline in 2016, and their installation has taken some time, and then more time has been taken up to make staff proficient in the use of these softwares. “By middle of 2018 our team became proficient in the use of this software, so compilation of the numbers has taken some time.”

In the meantime, the PSX placed the company on its defaulters list in October 2018 for failing to hold an Annual General Meeting for its 2017 results. The announcement prohibited the trading of airline’s shares till the meeting was held.

That meeting was finally held on Aug 24, when the financial results from 2017 were approved and reported to the stock exchange.

In April, the PSX repeated the warning, saying that further delay in release of audited financial results will mean another suspension for delay in reporting results for financial year 2018.

“[T]he deadline for holding the AGM for the year ended Dec 31, 2018 is expiring today,” the stock exchange said on April, adding this meeting “was required to be held within 120 days from the date of closure of financial year i.e. up to April 30, 2019”.

The national carrier ran a loss of Rs47.76 billion in 2017, as per its latest financial statements released in August. It had accumulated losses of Rs344.14bn in that year, up from Rs296.3bn in the preceding year. The company’s revenues were reported at Rs104.2bn, and its finance cost at Rs15.74bn.

The company had negative equity of Rs284bn in 2017.

Published in Dawn, September 25th, 2019