Is Thar Coal a solution to Pakistan's long-term energy woes?

Pakistan's coal trap

By: Omar S. Cheema

For those listening, the distressed calls for help from those living in the 12 villages of Gorano have been disturbing: an under-construction reservoir meant for temporarily storing mine effluent from the coal pits of Thar is putting their homes and livelihoods at stake.

Many fear that the waste deposit is the tip of an environmental fallout that will not only destroy their arable land but also the larger ecology of the Thar desert.

Most recently, the villagers stormed out of the Hyderabad Literature Festival, another public forum where they tried to voice their plight. Reportedly, they were no match for the slick corporate machine of Sindh Engro Mining Company, the joint venture managing the Thar mining operation.

The Gorano villagers haven’t given up railing against Engro — a big, well-established corporation — and the Sindh government. The controversy hasn’t been completely drowned out either, though it’s clearly a lopsided contest with only one likely outcome.

Is this just another case of a mega development project for the larger good, being stymied by natives? The Sindh government may sincerely believe that the project is a great idea, a panacea for the nation’s relentless energy woes.

Such a conviction however rests upon a very tenuous set of assumptions about coal energy: whether it has a major role to play in 21st century electricity portfolios, there are no competitive alternatives available on the same tract of land, it’s the quickest and most economical large-scale electricity project that can be delivered with the allocated resources, it’s necessary to keep the lights on, that it may even result in electricity exports, and hence it’s worth all the multi-billion dollar investment and development fatigue.

In short, it depends on the view of coal as being a critical energy source for the future. The truth is that’s far from the case.

Thar Coal has been touted as the panacea to the country’s long-term energy woes. But aside from its environmental repercussions, it doesn’t even make economic sense, argues an energy expert

By drawing our attention to the gestalt of the project, even at this late hour, the villagers of Gorano have done the whole nation a favour. After all, the villagers aren’t going to be the only victims of its environmental and economic consequences.

The lure of a dirty Watt

A society and economy lacking sufficient provision of energy, in particular electricity, is like a human without oxygen. And there is no denying that Pakistan suffers from a chronic gap between electricity supply and demand.

It’s not just a matter of nominal installed electric power capacity, but how electricity is made available in terms of affordable, sustainable pricing and alignment to the demand pattern of consumption.

In Pakistan, a vicious cycle persists between the lack of affordable electricity and struggling socio-economic development.

So it should certainly be a topmost national priority to decisively solve this problem, not merely with stopgap measures but systematically for the long run.

Coal became the global workhorse of large-scale electricity in the 19th and 20th centuries.

The discovery of oil and gas between the two world wars, the superiority of energy density in these fossil fuel cousins was a significant setback to the global coal market, not to mention the market entrance of radioactive uranium later on.

The 1973 oil shock to the United States, the world’s single largest national economy, spurred a fresh momentum for coal. At that time, the US did not know how much natural gas it had or its extraction technology.

Copycat economies, especially those with ample coal reserves of their own, followed the US’s example. The worldwide electricity share of coal grew from 30.3 per cent in 1974 to a peak of 41.3pc in 2007, but has been faltering since.

During the coal boom, the many ill-effects of coal electricity, from environmental destruction to greenhouse gas emissions to a lethal impact on human health became increasingly obvious, extensively researched and documented.

Despite a growing toll on planet care and human life, coal was considered a necessary evil for cheap electricity and competitive industrialisation.

Around the turn of the 21st century, it dawned on the more affluent and technologically advanced countries that coal was more of a historical burden than future necessity. The lure of the dirty watt began to rapidly fade.

Pakistan's late romance

Pakistan was unable to mine coal in its heyday. The opportunity of coal from the Thar desert became a hot topic about a decade ago, ironically when the smarter economies started its retirement planning from their energy portfolios.

The perception built around the Thar coal reserves was the discovery of a momentous national solution, even though the reserves consist of lignite, a lowly ranked form of coal in energy content.

Engro pounced on the opportunity, first forming the Engro Powergen Thar Limited (EPTL), then teaming up in a joint venture with the Sindh government for the mining — a clever move to lock in the political and bureaucratic establishment with its corporate financial plans.

According to a publicly available information pack, EPTL initially planned two stages of coal power scaling up from 600 megawatt (MW) to 1.2 gigawatt (GW), the numbers would change a few times over the years.

The selected mining area, called Thar Block-II, is said to have exploitable lignite reserves of 1.57 billion tonnes with the potential to generate five gigawatts power for 50 years. The leased mining area is spread over 95.5km2.

Apparently, the project planning was initiated several years ago, around 2010. The promotion material boasts, “Given the large energy deficit and the lack of any sustainable indigenous resources in the country, the Thar coal project presents a tremendous growth opportunity.”

According to a news report (Dawn, July 2017), the National Electric Power Regulatory Authority (Nepra) set an offtake tariff, the all-inclusive buying price (also called the Levelised Cost of Electricity or LCOE in energy industry jargon) for the project’s 30-year electricity output at 7.33 US cents/kWh. The overall project deployment cost is estimated at an average of $1.2 million/MW.

A more recent news update (Dawn, Dec 30, 2017) reports that 660 MW of Thar coal power supply to the national grid is expected by December 2018. The total project investment comes to $1.945 billion, of which $845 million is for the mining.

The remaining $1.1 billion divided by 660 MW comes to $1.6 million/MW for the coal power plant commissioning. Another $2.5 billion investment is earmarked for complementary works in the area, bringing the total bill to $4.5 billion. The project is included in the China-Pakistan Economic Corridor programme — another seal of approval. The project managers optimistically mention the prospect of electricity exports to India.

While EPTL and the Sindh government have invested considerable time and financial resources in the protracted Thar project planning, mining and other works to date, a project of this magnitude deserves intense scrutiny at every stage, a check of how it compares to alternative courses of action at each juncture.

Whatever financial spending has happened to date is a “sunk cost”, money that has already been spent and cannot be recovered, whether for good or bad. What matters most is deciding the best path forward, based on what we now know.

To assess the value of coal power, one must understand the nature of the beast. Coal follows the thermal route to electricity generation. There are two basic defining characteristics of thermal power plants: technical and commercial.

A thermal power plant initially transforms the chosen fuel ingredient into heat energy that is subsequently turned into electricity by a steam turbine. It is an indirect conversion process that requires copious amounts of freshwater to create steam from the heat energy as an intermediate step.

The other important characteristic is that the plant requires a recurrent supply of the fuel, with an associated variable (operational) cost of production, for electricity generation.

The variable cost is driven by volatile financials of the fuel supply — no one really knows how to predict or control fuel prices over the long run, no matter what one might claim.

Plenty of cheaper energy, here and now

Is there really a “lack of any sustainable indigenous resources in the country” to meet our “large energy deficit”?

The 21st century ushered in an alternative system of large-scale electricity generation, challenging the status quo of thermal power plants.

This new category is called renewable energy or renewables for short. Abundant natural assets in Pakistan, the renewables of solar photovoltaics (PV) and wind are local resources ideally suited to meet our large energy deficit, without being a major drain on scarce water resources, polluting the air, causing environmental damage or social displacement.

Solar PV is the direct conversion of light into electricity by semiconductor materials, with silicon being the most commonly used semiconductor for the purpose (over 90pc of the market). Silicon is the second-most abundant element in the Earth’s crust (and the universe for that matter).

Wind plants take kinetic energy in atmospheric velocities to drive a mechanical system for electricity generation. The main materials used in wind turbines are glass or carbon fibre-reinforced plastics.

Neither solar PV nor wind energy face a potential materials shortage for the foreseeable future.

These renewables do not need any recurrent supply of fuel. The variable cost of fuel supply is zero, for the entire planned duration of the power plant.

The power production process does not need the intermediate steps of creating heat energy and then converting it into electricity with the use of freshwater and a steam turbine. The water withdrawal and consumption requirements for operating these renewables, small amounts for routine cleaning, is therefore relatively trivial.

How much solar electricity can be produced from the 95.5 km2 allocated mining area for Thar Block-II? The land usage requirement for ground-mounted solar PV, using standard fixed-tilt arrays, is 1 MW-peak per 12,138 m2.

The solar MW-peak capacity needs a capacity factor adjustment for the local operating conditions. Adjusting the 1 MW-peak by a capacity factor of 20 percent, we come to 1 MW per 0.06 km2 (5 x 12,138 m2 = 60,690 m2) i.e. 1,574 MW for 95.5 km2 (95.5 km2 divided by 60,690 m2). The solar power capacity of the mining area alone is well over twice the 660 MW coal power plant.

The block of land can be used again and again for solar PV. The bankable lifetime of a solar PV plant is 25-30 years. However, the solar PV plant can be easily replaced by another after the 25 to 30-year period, with a lower installation cost and electricity output price for each successive installation.

How much solar electricity can be produced from the 95.5 km2 allocated mining area for Thar Block-II? [About] 1,574 MW for 95.5 km2 (95.5 km2 divided by 60,690 m2). The solar power capacity of the mining area alone is well over twice the 660 MW coal power plant.

How would the solar electricity buying price (the project LCOE) compare to that of the 7.33 US cents/kWh set by Nepra for the EPTL coal project?

The electricity buying price for the latest 100 MW-peak extension of the Quaid-e-Azam Solar Park near Bahawalpur, being undertaken by Zorlu Enerji, has been reportedly agreed at 6 US cents/kWh for 25 years — that’s 18 percent cheaper than the Thar coal tariff!

The daily insolation at Thar is about the same as Bahawalpur, an average of nearly 6 kWh/m2 per day (about twice the level of Germany, a global leader in solar per capita).

A greater project size possible on the 95.5 km2 of land enables a lower procurement cost, an economies of scale effect, so an even lower tariff than Bahawalpur is possible.

Alternatively, the Thar solar project developer can pocket a higher profit than Zorlu Enerji at the same tariff of 6 US cents/kWh.

It should be clear from the above, that solely on the basis of the achievable project financials, renewables are a preferable option to coal for the designated Thar land.

It’s better for the potential financiers and owners of a large-scale electricity project on the land, the people of Thar, the electricity infrastructure of Sindh and Pakistan, our national economy, the welfare of our shared planet.

Water not coal

The absurdity of coal mining and thermal power plants in areas with acute water stress should be self-evident. Mining operations require around 250 litres of freshwater per tonne of coal.

The daily diet of coal for a thermal power plant is about 12 tonnes per MW. A typical 500 MW coal power plant then needs another 1,300 million litres of freshwater a day for the electricity generation process, varies by the exact heating and condensing technology. That’s close to three litres of freshwater per day for every inhabitant of Sindh.

Solar electricity can be used to desalinate brackish water deposits into drinking water for the local population. Community-based solar powered desalination projects have been demonstrated to deliver drinking water at a cost of as low as one US cent per litre. Rather than being a drain on dwindling freshwater reserves, a solar project would have the opposite effect.

The global energy transition

The last decade has seen an irreversible sea change in new electricity planning. Solar PV and wind are inevitably increasing their share of the global electricity portfolio for the two previously mentioned reasons: no fuel and less taxing on scarce freshwater.

Another key driver of change is the emergence of Natural Gas (NG) as the preferred choice for thermal power plants. As with renewables, one fundamental reason is a reduction in lifecycle generation cost to financially outperform coal.

Another is that well designed NG plants have fewer toxic emissions than other fossil fuels. The most important advantage is how NG and renewables complement each other in the overall electricity portfolio.

The electricity output of renewables is higher up the pecking order in consumption priority than a thermal power plant — it’s called the Merit Order Effect (renewables have a higher demand merit) — as there is no additional operational cost of paying for the fuel.

A zero marginal cost of solar or wind energy supply always wins over fuel expenses. However, solar and wind are variable sources of electricity that can, at times, produce excess electricity than planned (or vice versa).

So if you want a thermal power plant in the portfolio mix, it’s best to have one that can be easily ramped down and up. Coal and nuclear do not fit the bill — technically cumbersome and costly to shut down and restart. NG, on the other hand, is well suited to flexible power generation.

Let’s scan how various economies are adapting in the global energy transition. The US, China and India offer instructive examples of heavily coal-reliant countries, with far greater supply-chains, well-developed reserves of the fuel than Pakistan.

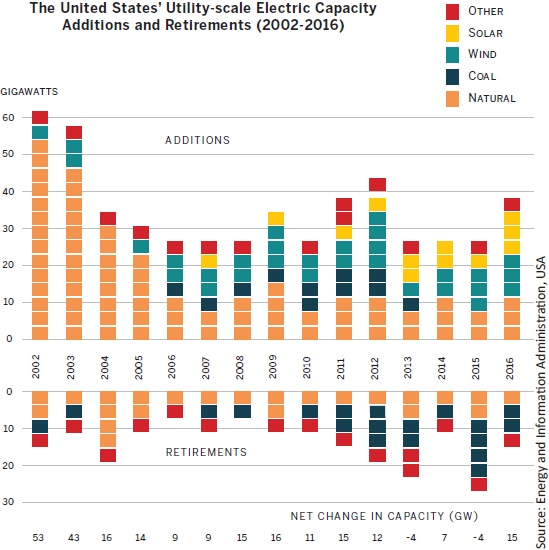

The US Energy Information and Administration meticulously compiles data on new capacity additions each year. The trio of solar, wind and gas have dominated the new millennium in the US, with solar and wind sharply accelerating in 2015-2016.

Coal (and nuclear) power plants are on their way out, stagnating till their expiry date or already being decommissioned (an excruciating, costly process in itself). The Trump administration has tried to revive coal’s fortunes for political reasons, but to no avail.

All sorts of concessions aren’t rolling back the years for coal, because of the sheer force of competitive economics. It’s now more economical to invest in a new renewables plant than prop up a coal dinosaur.

This month, the US Federal Commission rejected the push to subsidise coal and nuclear for future electricity needs, prompting media headlines like “Trump’s Coal Bailout Is Dead”.

China’s progressive transition to renewables is even more dramatic. About a year ago, the Chinese National Energy Administration abruptly cancelled all 103 of its new coal power plant licences totalling 1.2 GW capacity.

China learnt the hard way that a strategy of green coal power based on supercritical and ultra-supercritical technology had spawned “white elephants” in a “provincial pipe dream”.

Utilisation rates for coal power were plummeting. Independent US research into the Chinese experience came to the conclusion that it’s not a good idea to follow the same failing strategy (though obviously the Trump administration wasn’t paying attention). Renewables and gas were better options, it concluded.

Aside from worsening air pollution, despite the use of superior coal technology, and the consequent social backlash, the economics didn’t work out for China.

Parochial politics, chasing short-sighted gratification for their own constituencies, drove the Chinese coal rush further into the mire. The disappointing outcome is captured in the above graph (see China’s Coal-fired Power Capacity Bubble).

On the other hand, China’s experience with solar PV and wind has been as escalating lovefest, not only domestically but in international investment.

In 2016, China installed 68 GW of renewables nationwide out of a global total of 165 GW (surpassing its 2020 cumulative target well in advance). Investments in overseas projects crossed $44 billion last year.

China is eagerly consolidating its global leadership in renewables, as a consumer, manufacturer and investor.

The future of coal in India is also in jeopardy. Hazardous air pollution, of great peril to the political establishment, has necessitated tighter emissions controls for new coal power plants, spiking the total deployment costs.

Renewables, both solar and wind, have soundly beaten coal to become the cheapest electricity source in India.

Two-thirds of India’s coal power is now more expensive than renewables. Replacing these coal power plants with renewables would save Indian consumers up to $8 billion annually.

Recent research indicates that further investment in coal will result in India missing its Paris Agreement emissions targets and/or cause a proliferation of stranded assets.

A stranded asset means a power plant that has to be operationally abandoned before the completion of its planned financial lifetime. In contrast, there is little risk of a stranded asset in renewables because the variable operational cost is zero.

Unsurprisingly, the Indian government is beating a strategic retreat from coal, abandoning a pipeline of 50 GW. Coal India, the world’s largest coal company that owns 82pc of India’s coal, has been forced into closing down 37 mines. Further closures are on the cards to deliver the desired coal-free future.

The writing on the wall is crystal clear. Numerous other examples from Chile to Britain to Australia present similar facts, show trends in the same direction.

Future electricity portfolios will be dominated by solar, wind and NG. Forward-looking economies do not want to become trapped in the past with coal. It would be quite foolhardy on the part of Pakistan to go against the tide of the global energy transition, wasting its meagre financial resources on coal.

Pakistan, like China and India, is a signatory to the Paris climate agreement and cannot afford to ruin its international standing by undermining its commitments. Pakistan does not have better coal technology than that of the Chinese (world leaders in the field, ahead of the US).

The fragile economy of Pakistan cannot afford to repeat the mistake of the Chinese coal capacity bubble. Coal is increasingly incompatible with a global energy transition that has gone past the tipping point. The multi-billion dollar debt being poured into the Thar sands is investment in a dead horse.

The baseload argument

While the more savvy energy planners are busy migrating to 21st century electricity portfolios, we seem intent on financing a power supply chain that will become obsolete before the investment fully pays off. Although renewables have become cheaper, are cleaner, and save on the scarce, precious resource of freshwater, a trite argument used by die-hard coal advocates is that it’s necessary to provide baseload power.

A few years ago, the CEO of UK’s National Grid famously remarked in an interview, “The concept of baseload is already outdated”, going on to explain that “the idea of a large baseload generator that runs pretty much all of the time ... just doesn’t have as good a fit to the market conditions we expect to see.”

Baseload power means the provision of a minimum threshold of power for a sustained period of time. Coal power plants are no longer needed for it. The diversification of electricity supply to renewables and NG has enabled a more robust paradigm of flexible power generation.

The minimum threshold is securely and economically taken care of, not to mention the unexpected deviations in demand. The old baseload contracts that coal needed for economic profitability are now defunct, incongruous with modern electricity planning.

An illustration of how the future electricity needs for hot climates like Pakistan, the so-called duck curve of aggregated demand variation in such conditions, can be best served by renewables and NG without the need for any coal:

The whole point behind sprawling, capital intensive, transmission and distribution networks is taking advantage of diversified electricity sources. Flexible power generation has been likened to a musical orchestra, the conductor needs to know what instrument to play at different times to satisfy the tune of demand.

Solar and wind generation are complementary in terms of their daily and seasonal variation. NG chimes in well, coal doesn’t. Energy storage is also an essential part of the band.

When a large coal power plant trips, as it will do, a backup energy storage unit of equal power output capacity is needed to quickly compensate for the outage.

With distributed renewables, any single outage of a solar PV or wind system will not require the same level of backup. The geographical distribution of electricity supply, the more renewables the better, reduces such backup costs.

The backup requirement also kicks in during the downtime of power plants, for periodical maintenance operations. The typical guaranteed plant availability of solar PV and wind is over 98-99 percent, while it is around 70-80 percent for coal.

The operational maintenance of solar PV and wind plants is much simpler than that for coal power, so their scheduled and unexpected downtime is much less.

Energy storage comes in several varieties. Large-scale centralised energy storage can consist of pumped hydro — the Makran coast offers possible locations — or compressed air energy storage, perhaps feasible in the abandoned salt mines of Khewra.

Decentralised energy storage in the form of MW-scale batteries is making rapid advances in cost and ease of installation. MW-scale batteries are ideal for storing the cheap electricity of solar and wind, shifting the supply to different times of the day. This advancing technology front boosts the case for renewables, accelerates the inevitable obsolescence of coal.

In countries such as Pakistan, where the transmission and distribution networks are weak and plagued by energy theft, an attractive alternative is the bottom-up electricity infrastructure development of micro-grids. These micro-grids can deliver reliable power at various levels e.g. an industrial zone, rural village or metropolitan area. Coal power is not suitable for micro-grids because, unlike renewables, it is not modular and incrementally scalable. Micro-grid projects rely primarily on renewables and NG from local renewable sources (methane from waste). These micro-grids can be set up far more quickly than thermal power plants, and offer an ideal quick fix solution to local load-shedding.

National security or folly

It’s unlikely that the Thar coal power output will be in demand for exports to India. The area on the other side of the border is prioritised for India’s national solar strategy, and we know the cost of this solar electricity is cheaper than the output price of the proposed Thar coal project. We also know that India is phasing out its own reliance on coal power, as it’s incompatible with a forward-looking electricity portfolio based mainly on renewables.

Sustainable electricity at affordable prices for the long run without technical or financial risks, mitigating climate change, optimal use of our land, water management, clean air, and avoiding social discontent that can be politically exploited, are all issues of major national security importance. The Thar coal endeavour needlessly creates vulnerabilities in every aspect.

Energy independence is better secured by renewables than resorting to the Thar coal reserves. There is no need for a trade-off between cheap, reliable electricity supply and preserving our natural environment. The situation might have been different when the Thar coal project was originally envisaged, but we can surely do better now, learning from the experiences of others and understanding the latest options available with an eye on future developments.

The Thar coal is best left buried as it is. A few may fleetingly benefit from this silly, blighted scheme but it’s not worth sacrificing the well-being of the many and national security for it, and it is not worth proving how myopic and self-destructive a nation we have become, easily led astray. It would be a grave mistake, a staggering act of national masochism, to fall into this coal trap.

The writer is a renewable energy and technology commercialisation expert based in London. He can be contacted at Viewpoint@Vivantive.com

Published in Dawn, EOS, February 4th, 2018

‘Energy supply needs to be a mix’

By: Ahmed Yusuf

Since when has Engro been working on this project and how much has Engro invested on the project to date?

About eight years now. By the time the project is completed next year, Engro would have equity of $125 million dollars.

How much has the Sindh government spent to date?

In Phase I, the Sindh government spent about $105m.

When will the first 660 MW coal power plant be fully operational?

The 660 MW coal power plant is being built by two companies: Sindh Engro Coal Mining Company and Engro Powergen Thar Limited.

The government of Sindh is only part of the former, it is not part of the power company. In power, Engro’s share is 60 per cent and then there are other parties involved. There are eight stakeholders in total, including the government. The commercial operation date has been set for June 3, 2019.

A number of other launch dates have been doing the rounds, can you provide some clarity on the matter?

When we define commercial operation date, we mean that everything has been completed and all kinks have been worked out. The last six months of the project is when we start this process, sometimes the power plant is shut off, at other times there can be some new issues.

The last six months of the project is when we keep learning and improving the systems in place. When we talk about a June 3, 2019 launch date, we are talking about a project completion date. But we will produce our first electron, God willing, this year in December.

For the operation of the 660 MW coal power plant, what are the annual water consumption requirements of the CFB boilers [CFB: Circulating Fluidised Bed]?

Our requirement is 17 cusecs per day (about 481 litres). We avoid making annual calculations because the power plant operations are dependent on many factors. Power plants are typically operational about 85pc of the times, at other times they need to be switched off for maintenance purposes etc. So, if you really need a number, it will be 17 multiplied by 365 multiplied by 0.85, which gives us about 5,275 cusecs.

But normally, when we assess a power plant, we look at daily consumption not yearly. We will be drawing about 25 cusecs per day [from the mines]. This is saline water and needs to be screened. About four cusecs will be lost but eventually we are left with 17 cusecs of usable water.

And of course there is the LBOD; the two are backups for each other. We’ll be using one and saving the other, as per our requirement.

Where will the water be withdrawn from for the purpose above?

There are two sources of water for the power plant. The first is the LBOD [Left Bank Outfall Drain] and the second is underground water that is available in the system. When we mine coal, we have to extract underground water to completely dry the mine. We will be using this water as well for our power plant operations.

Has your company carried out any assessment about how much depletion this will cause the aquifers?

Thar has three aquifers. The first is at a depth of 70 metres but it is what we call a “discontinuous aquifer.” At some places there is good water, while at others, there is bad water or no water. The other two are both “continuous aquifers” and water is saline.

These aquifers are at a depth of 120 metres and 180 metres. We are currently at the second aquifer. When you draw water from the aquifer, it will either be used in the power plant or returned to the soil. In the case of the former, water needs to be treated for use. If this water is not utilised in the power plant, it is dumped into a pond which is lined. If the water has not been used, you can return it to the soil.

The pond that we are currently using is not lined, because power plant operations haven’t started as yet.

How much wastewater will be generated from the coal mining and how do you plan to treat and dispose of it?

If we are using LBOD, then about four or five cusecs will be lost per day from the 17 we plan to draw. We will be following the guidelines set in the National Environmental Quality Standards (NEQS). We will treat the wastewater then dump it into a lined pond and then evaporate it.

The regulations for the wastewater dumping are a big issue because there can be massive hidden costs that are eventually slapped on the taxpayer. How do we ensure that no burden is transferred on to the taxpayer?

There are two processes in place, one put in by Engro and the other by the Sindh government. Apart from NEQS standards, Engro has a system in place for all its plants where we follow World Bank and International Finance Corporation (IFC) rules.

Whatever the requirements are for liquid or gaseous emissions, we always take these national and international standards into account. At Engro, we have a track record of never having breached any environmental rules nor will we ever go down that route.

Even today, we have to submit a three-monthly report to the Sindh Environmental Protection Agency office in Karachi. A third-party has been involved by the government to check various operations, emissions, underground water and so on.

They send their independent report to the government. If we are found in violation of any rule, then we won’t be handed permission to mine.

There is also the associated matter of banks approval that is needed. You need no-objection certificates (NOCs) at the time of construction and another one at the time of commissioning.

Banks need an environmental no-objection certificate (NOC) from the government upon completion of a project, else they will not accept the project to have been completed. If permission isn’t granted, then we won’t be able to access our dividend in the project.

This project is worth two billion rupees, and there are a number of conditionalities imposed on us by banks and insurance companies. It is an international project and check and balances exist at every level. All these need to be satisfied before we can proceed, and we have been meeting all requirements.

How much coal ash will be annually generated from the 660 MW plant and where will it be deposited?

When you use coal, typically about 10-12 percent coal ash is generated. We are using about 3.8 million tonnes coal, so about 380,000 tonnes. For mine mouth power plants [a plant that is built close to a coal mine], usually coal ash is deposited in the same mine from where coal is extracted. Typically clay beds are built in the deep mine.

These clay beds are impervious so that the coal ash deposited there doesn’t mix with the underground water. If they aren’t impervious, then the coal ash begins to impact the aquifers.

In cities, whenever coal is imported from elsewhere, they don’t have a place for safe disposal so they tend to make ash ponds for the purpose. We will make ash ponds but on a temporary basis. As soon as we hit bottom of the mine, we’ll deposit the ash there and cover it up with mud. This is the international standard of disposing of coal ash.

If you skip across the border to the Indian side of Thar, it is fascinating to see that despite similar topographies, they are relying heavily on solar. Do you feel the focus and reliance on coal is misplaced?

I think that this isn’t entirely true. Whenever and wherever progress has been made, it has been because of coal. In India, too, more than 50pc of the power production is based on coal. The same is the case with China. If you look at global statistics, 42pc of the world is still being run on coal-based energy.

When it comes to Pakistan’s reliance on coal, it is only 4 to 5pc. Coal is still the cheapest baseload option to generate electricity and it is indigenous. It is more expensive than renewable, of course, but that is a function of how banks invest in coal. Under the terms drawn for coal projects, banks usually lend money over a 10-year period. For renewable, this changes to 20-25 years.

What would be your response to detractors of the coal power project, who argue that this investment should instead be made on alternate energy?

Alternate should definitely be an option, but we need to realise that the best way forward is to have a healthy mix of energy sources. So, you can have coal, oil, gas, hydel, solar and wind. In today’s world, you cannot have reliance on a single source of energy.

Where we are today, we need a stable and cheap supply of base load energy. Even at Engro, we are working on alternate forms of energy. But you have to realise that we need about an 80pc stable base load.

But hasn’t the baseload argument been contradicted?

Baseload means that we have round-the-clock energy 365 days a year. And baseload is typically drawn from fossil fuel or nuclear power. When it comes to other forms of energy, the issue is one of storage.

The great tragedy is that because storage systems are imperfect, we cannot rely on renewable energy for baseload. That said, I want to reiterate that a healthy mix of energy sources is the optimal solution. We hope that technology would have advanced enough in the next 20-25 years to create better storage systems, but till then, we will have to rely on traditional baseload.

Do you feel that coal-based energy will be cheap?

Our project will produce 4,000 MW energy when we complete building power plants — we should reach that point around the year 2024. Once that is done, electricity will be produced at about five cents, which is the cheapest in the country.

Our plan to this effect has been submitted, all guarantees are in place, which is why the banks have approved this two billion rupee project.

But haven’t you signed agreements to sell energy at seven cents for 25 years?

A sliding scale tariff has been approved and the price of energy will decrease over time. Mines have different levels, so the more levels that are exploited, the more coal we will have and the greater will be the price reduction.

What are some of the challenges that you foresee?

Most challenges have been overcome, but there are some challenges in commissioning. One of our biggest challenges is to ensure that Thar’s people benefit from the coal that is extracted. We have already launched the Thar Foundation, which puts in focus on health and education of the locals.

About 70-75 percent of our hires are from Thar. By the end of the year, we will have 5,000 kids who are being imparted education through school built by the Thar Foundation and The Citizens Foundation.

As for potable water, we have already set up five reverse osmosis plants and we have asked the government to hand over the rest to us too. We have experience and we can efficiently run them.

The writer is a member of staff. He tweets @ASYusuf

Published in Dawn, EOS, February 4th, 2018

Dear visitor, the comments section is undergoing an overhaul and will return soon.