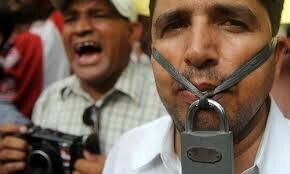

ISLAMABAD: The Auditor General of Pakistan (AGP) has unearthed variations of Rs201.39 billion in the figures of tax receipts, and referred to these as ‘evasion’ in the audit report on the accounts of the Federal Board of Revenue (FBR) for 2017-18.

The AGP has recommended various measures for the recovery of evaded taxes from the FBR along with fixing of responsibility. Those found responsible be proceeded against under the relevant disciplinary rules, the AGP added.

The observation includes cases of non/short assessment of taxes, grant of incorrect exemptions, non-levy of minimum tax, non-levy of default surcharge, non-recovery of adjudged revenue, inadmissible adjustment of input tax, incorrect sanction of refunds.

The report will soon be placed before the Public Accounts Committee which is led by Mian Shahbaz Sharif.

The audit report unearthed a loss of Rs22.203bn due to non-realisation of sales tax on subsidy from government on sale of electricity; another loss of Rs8.45bn was noted due to non/short realization of sales tax due to difference/concealment of sales declared in income tax returns/sales tax returns.

The report observed a loss of Rs14.7bn due to non-charging/ non realization of sales tax; another loss Rs10.48bn due to inadmissible sales tax adjustments/exemptions and a loss of Rs9.88bn was recorded due to non recovery of adjudged dues.

The inadmissible adjustment of input tax lead to a revenue loss of Rs7.4bn due to non-charging of sales tax, another Rs1.2bn loss due to non-registration of taxpayers. The non-realisation of federal excise duty also led to a loss of Rs7.66bn.

Under the income tax, a revenue loss of Rs2.4bn was recorded owing to non-imposition minimum tax on the income, besides a Rs13.29bn loss in revenue due to concealment of income or assets.

The short levy of super tax also led a revenue loss of Rs11.79bn and another loss of Rs6.74bn was recorded due to non-apportionment of expenses between final and normal tax regimes. Similarly, the inadmissible claim of Rs10.79bn in respect of expense/allowances was recorded causing loss to the government exchequer.

The short or incorrect assessment of income tax to the tune of Rs11.19bn was recorded in the audit period, another revenue loss of Rs9.31bn was recorded due to application of incorrect rate of tax, and Rs4.8bn was recorded as non-recovery of government dues and another Rs4.07bn revenue loss due to payment of unlawful payment of refunds.

The audit report observed a loss of Rs16.78bn due to misclassification/under valuation of imported goods and inadmissible exemption of SROs and another Rs6.67bn due to blockage of government revenue.

Published in Dawn, September 18th, 2019