Crude oil and politics are an explosive combination!

A couple of months are too long a period in the crude world. Things change rapidly.

In September, while Washington was busy tightening the screws on Tehran, the possibility of three digit ‘crude price’ was the talk of the town.

Today the scenario has reversed altogether. Markets are oversupplied and under considerable pressure. As global markets closed for the weekend last Friday, both the benchmarks, Brent and WTI, posted a sixth straight weekly loss.

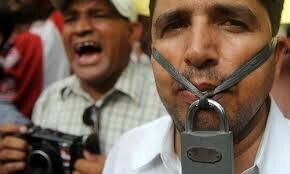

Interestingly, all this is happening while chasm is growing between Washington and Riyadh on a number of issues — crude included.

And despite Jared Kushner’s and Trump administration’s initial efforts to provide cover to Saudi Crown Prince Mohammad bin Salman in Khashoggi murder case, Washington is now increasingly under pressure to distance itself from Saudi Arabia.

That would have ramifications — all around.

All these are beginning to influence the relationship between Riyadh and Washington, impacting the global oil markets in a big way. Reports now say Saudi Arabia and the US are on a collision path — as far as oil markets were concerned. Saudis are increasingly worried about US position on Iran.

The ‘generous’ waivers given to countries to continue importing crude from Iran is infuriating Riyadh.

As a consequence, instead of driving exports from Riyadh’s arch rival down to zero, as was initially targeted, crude continues to flow out of Iran.

“The Saudis are very angry at Trump (for providing these waivers). They don’t trust him anymore and feel very strongly about a cut,” Reuters quoted a senior source briefing on Saudi energy policies.

“The Saudis feel they were completely snookered by Trump. They did everything to raise supplies (this summer), assuming Washington would push for very harsh Iranian sanctions,” another source briefed on Saudi oil thinking, told Reuters.

“The waivers were totally unexpected, especially after calls (on Opec) to raise output. A few people are upset,” emphasised a senior Gulf oil source familiar with the discussions among the Organisation of Oil Exporting Countries (Opec) and its allies on the output issue.

Angered and frustrated by the US move, Saudi Arabia is now considering cutting output. It is in discussion with Opec and its allies to cut global output by about 1.4 million barrels per day (bpd) or 1.5 per cent of global supply.

Riyadh’s concern is to avoid the kind of oversupply that led to a price collapse in 2014 to below $30. Last Sunday, Saudi Oil Minister Khalid Al-Falih announced that Riyadh planned to cut crude exports by 500,000bpd next month.

President Trump has blasted the move, twittering “Hopefully, Saudi Arabia and Opec will not be cutting oil production. Oil prices should be much lower based on supply!”

Riyadh seems to have a real crude diplomatic task in hand. By going ahead with its proposed output cut move, it may have to confront an angry President Trump — its closest ally. But in order to achieve its goal, Riyadh also needs full support of Russia. That also doesn’t seem forthcoming.

Speaking in Singapore last week, President Putin underlined: “The situation as it is now, (the price) at around $70, suits us completely.” However, he also promised to “cooperate” with Saudi Arabia’s call to cut output in an effort to bolster prices.

Earlier last week, Russia’s Energy Minister Alexander Novak too underlined that there was no need to take any action to halt the decline of oil prices.

Speaking to reporters on the sideline of the conference in Singapore, Novak said that long-term oil prices should be taken into consideration when any decision is taken by oil-producing countries.

A senior Russian government source told Reuters that production in Russia shouldn’t be reduced, as Moscow has been growing its output and will continue to do so in the future.

Russian oil companies are also unlikely to be on board in any output cut deal between Russia and Saudi Arabia. Vagit Alekperov, CEO of Russia’s second-biggest oil producer Lukoil, said last week that he doesn’t see any need of cuts in 2019.

For Riyadh to achieve its objectives of a ‘balanced’ market by cutting output, doesn’t seem plausible, in the given circumstances.

And for a weakened MBS to pick up another ‘crude’ fight at this juncture is neither advisable nor sustainable. This needs to be put off for the time being — at least.

Published in Dawn, November 18th, 2018