The local currency market witnessed dull trading activity last week.

The rupee to dollar exchange rate remained mostly firm amid minor changes. There was insignificant demand while sufficient liquidity was available in the market.

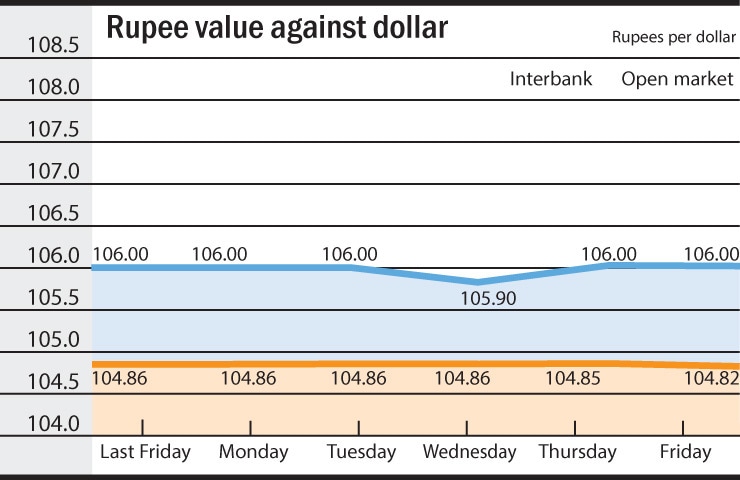

On the interbank market, the rupee/dollar parity showed a firm trend. No change was witnessed in the exchange rate due to the lack of dollar demand amid easy external inflows.

The rupee to dollar exchange rate remained mostly firm amid minor changes

Commencing the week unchanged, the rupee held its previous weekend level.

However, the rupee in the fourth trading session inched up by one-paisa against the dollar, reacting positively over the Supreme Court’s ruling over the Panamagate issue.

The rupee further extended its overnight firmness against the dollar, posting three-paisa gain on the buying counter and another two-paisa gain on the selling counter in the last trading session and hitting close to an eight-week high at Rs104.82 and Rs104.84 towards the weekend.

In the open market, the rupee/dollar parity moved both ways amid minor changes last week. The parity commenced the week on a firm note, trading flat at Rs106.00 and Rs106.20.

However, the rupee staged a rebound in the second trading session because of improved influx of remittances amid dull demand from corporate sector and importers.

The dollar managed to recover overnight losses in the fourth trading session.

The rupee did not show any change against the dollar in the last trading session and closed the week flat, trading at Rs106.00 and Rs106.20 for the second day in a row.

While remaining stagnant against the dollar in three sessions during the week in review, the rupee gained ten-paisa in one session and lost by the same amount in the following session.

The dollar thus did not show any change against the rupee in the open market on week on week basis.

Against euro, the rupee turned negative last week. Assuming a downtrend, the rupee in the week’s opening session posted 30paisa loss before ending the first trading session at Rs112.30 and Rs113.80.

The rupee downtrend persisted for the fourth day in a row. It suffered 30paisa loss on the buying counter and another 40paisa decline on the selling counter in the fourth trading session that pushed euro to Rs113.30 and Rs114.90 its highest levels in almost three weeks.

In the last trading session, the rupee turned positive as it managed to gain 50paisa and closed the week at Rs112.80 and Rs114.30 against the euro.

On week on week basis, however, the euro managed to gain 80paisa against the rupee last week.

The euro hit the week’s highest level at Rs113.30 and Rs114.90 and lowest level at Rs112.30 and Rs113.80 against the rupee.

Published in Dawn, Business & Finance weekly, April 24th, 2017