In the local currency market, volatility in dollar trade was initially observed on the interbank market due to mounting fresh demand in the early sessions of the week.

However, measures undertaken by the SBP to check dollar outflows and restrict a sharp decline in rupee against the dollar by making dollar supplies easily available to cover demand proved helpful.

But in the open market, the dollar remained firm against the rupee where the greenback ended the first week of 2017 above Rs108 and the gap between the interbank and open market dollar rates rose by more than Rs3.50.

Resurgent greenback against major currencies overseas kept forex market sentiment shaky.

A resurgent greenback against major currencies overseas kept forex market sentiments shaky

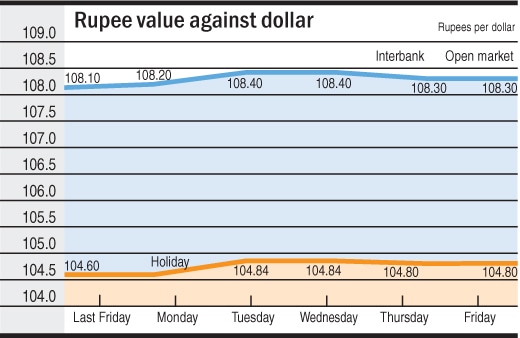

On the interbank market, where the rupee/dollar parity sustained its stability last week, trading was reduced on account of bank holiday on Jan 2.

The forex market turned volatile on increased dollar buying from importers and corporate sector. Consequently, the rupee turned negative against the dollar, shedding 24paisa on the buying counter and 22paisa on the selling counter.

The rupee closed the week against the dollar at Rs104.80 and Rs104.82.

During the week in review, the dollar posted 20paisa gain against the rupee on the buying counter and 17paisa gain on the selling counter on the interbank market amid minor changes on week on week basis.

The dollar remained firm in the open market, where the rupee/dollar parity continued to trade above Rs108 amid minor changes last week.

The week commenced on the negative note. The extended holidays exerted slight pressure on dollar demand in the open market.

Due to the fresh rise in dollar demand, the dollar rebounded against the rupee. It edged up against the rupee and climbed to Rs108.20 and Rs108.40 from the last closing of Rs108.10 and Rs108.30.

The parity closed the week unchanged, trading flat at Rs108.30 and Rs108.50 in the last trading session.

During the week, however, the dollar in the open market appreciated by 20paisa against the rupee on week on week basis.

Against euro, the rupee last week sustained its stability amid escalation in narrow ranges.

Commencing the week in plus the rupee posted 30paisa gain in the first trading session that pushed euro down to Rs112.70 and Rs114.20 from the previous week close of Rs113.00 and Rs114.50 after the single currency jumped two full cents to as high as $1.07 in overseas trade.

The week ended on a negative note as the rupee turned minus against the euro in the last trading session after losing Rs1.05 on the buying counter and Rs1.55 on the selling counter, the biggest one-day drop in almost three weeks.

Consequently, the euro regained strength over the rupee and surged to its highest level in almost four weeks at Rs113.75 and Rs115.25.

During the week, the euro lost 55paisa on the counter and Rs1.05 on the selling counter in three sessions and at the same time gained Rs1.30 on the buying counter and Rs1.75 on the selling counter in two sessions.

Overall, the rupee lost 75paisa against the euro on week on week basis.

On the buying counter, the euro touched its highest level at Rs113.75 on Jan 6 and the lowest level at Rs112.50 on Jan 3 while on the selling counter the euro was at its highest level at Rs115.25 on Jan 6 and the lowest level at Rs113.70 on Jan 5.

Published in Dawn, Business & Finance weekly, January 9th, 2017