AMSTERDAM: Consumer goods giant Unilever, maker of Ben & Jerry’s ice cream, said Tuesday that sales slowed in the fourth quarter due to weakness in emerging markets and are expected to remain muted until later in 2014.

The company said “underlying” sales — that is, stripping out the impact of currency effects and new businesses — rose 4.1 per cent. While the figure was better than analysts had expected, it was entirely reliant on demand in emerging markets, which slowed.

Developed markets like the US and Europe are not improving quickly enough to benefit the company.

’’The growth that you see in the United States and some people get excited about is not enough to make a difference” to Unilever, Chief Executive Paul Polman said on a conference call with analysts.

He repeated the company’s goal of maintaining margins while growing faster than the markets it competes in, with brands such as Dove soaps, Vaseline, Axe deodorants, Omo laundry detergent, and many others.

For the full year 2013, sales fell 3pc to 49.8 billion euros ($67.5bn), mostly due to the strong euro, and net profit was up 9pc to 5.3bn euros. Unilever PLC managed to improve its operating margins to 15.1pc from 13.6pc. It did not release quarterly profit and loss figures.

The company said demand in emerging markets has been dampened by weaker currencies, and in developed economies it has seen little improvement — despite a rise in economic indicators. The US jobs market has been improving steadily and the European Union emerged from recession last year.

Underlying sales, the figure most closely watched by financial analysts, seeks to strip out the effect of currency movements and the buying and selling of businesses. The 4.1pc gain was slightly worse than the 4.3pc the company showed for the year 2013 taken as a whole. Actual sales fell by 6.4pc to 11.8bn euros, mostly due to the stronger euro.

In developed markets, underlying sales fell 1.7pc, half due to volume falls and half due to lower selling prices. In emerging markets, underlying sales grew 8.4pc, with volume growth of more than 5pc and price increases making up the balance.

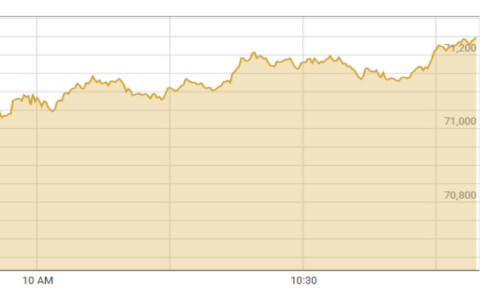

Shares, which have lagged those of competitors in recent months, rose 3.9pc to 29.95 euros in early Amsterdam trading.—AP

Dear visitor, the comments section is undergoing an overhaul and will return soon.