THE tax revenue collection for 2012-13 might have been further off the budgetary target if the refunds for taxpayers had not dropped.

The Federal Board of Revenue (FBR) paid Rs84 billion in refund to taxpayers in 2012-13, against Rs146 billion in the previous year, resulting in a decline of Rs62 billion, or 42.46 per cent.

Withholding of refunds is one of the traditional tools of the FBR, which it uses when it is desperate to meet revenue targets.

It is also not known how much advance taxes the FBR collected from big taxpayers in order to avoid further revenue shortfall.

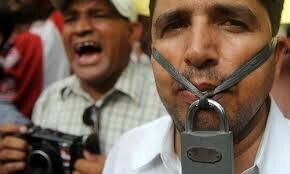

This FBR poor performance is mainly attributable to governance issues within the tax machinery. A key reason for this is the constant tussle between officials of the income tax and the customs groups.

The appointment of Mr Ali Arshad Hakeem as FBR chairman sparked severe opposition from the Inland Revenue Service (IRS) group, led by senior income tax officers. Hakeem was formerly associated with the customs group. Some income tax officers lodged petitions in courts and challenged Hakeem’s appointment. Meanwhile, Mr Hakeem appointed people of his own choice to key collectorates and regional tax offices during his tenure, that further aggravated the tussle between the two groups.

The 10-month long saga ended when the Islamabad High Court declared Mr Hakeem’s posting as the FBR chairman illegal. To add fuel to the fire, Ansar Javed, an IRS officer, was then appointed as his replacement in May 2013. Mr Javed also resorted to postings and transfers at a time when the fiscal year was about to close in a month or two.

Senior-level transfers, which are normally not made in the month of May, were challenged in the Supreme Court. The apex court finally annulled all the transfers. In the meantime, these actions caused a big dent in revenue collection for the fiscal year.

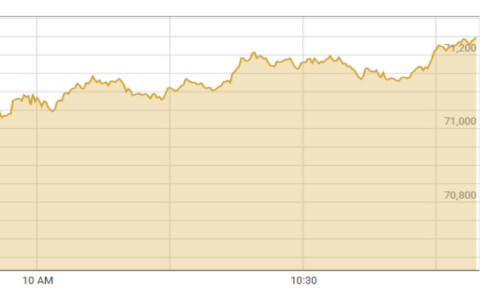

According to latest estimates, the tax body collected Rs1,941 billion in 2012-13, against the budgetary target of Rs2,381 billion. After multiple downward revisions during the course of the year, the revenue target had been finally reduced to Rs2,007 billion. This means that there was a shortfall of the revised target by Rs66 billion.

While the FBR expects total revenue for the year to reach close to Rs1,945 billion (after reconciliation of accounts in the next couple of weeks), it is still looking at a shortfall of Rs440 billion from the original budgetary target.

Meanwhile, the number of taxpayers filing returns fell to 800,000 in tax year 2012, from 1.3 million in 2011 or a decline of over 38 per cent.

Direct taxes collected during the outgoing fiscal year stood at Rs738 billion, against Rs739 billion in the previous year. The tax-to-GDP ratio has stagnated at around nine per cent over the past few years.

Sales tax collection in 2012-13 amounted to Rs846 billion, against Rs805 billion in the previous year, recording a marginal growth of five per cent. Taxpayers registered with the sales tax department numbered slightly over 100,000. But more than 80 per cent of the revenue is generated from 10 revenue spinners. As a result, the tax compliance level fell to 39.5 per cent in 2011-12, from 65 per cent in the previous year.

The federal excise collection fell by two per cent to Rs122.5 billion in 2012-13, against Rs120 billion in the previous year.

The only federal tax that surpassed its target for the year was customs collection, which reached Rs239.200 billion, against the target of Rs216 billion. This growth was achieved despite the fact that dutiable imports witnessed three per cent growth in the outgoing fiscal year, against the average of seven to eight per cent.

The FBR also collected more than Rs16 billion from amnesty schemes for smuggled vehicles during the year.

Factors directly contributing to revenue collection included oil price hike, tax amnesty schemes, recovery of arrears, rupee depreciation, rising imports bill, and collection of advance taxes.

The FBR’s performance during the just-ended fiscal year raises questions about its ability to meet the ambitious revenue target of Rs2,475 billion set by the new government in the 2013-14 budget. This is an increase of 23.3 per cent from the revised target of Rs2,007 billion for 2012-13.

The breakdown of the revenue target shows that the FBR has already taken Rs202 billion worth of revenue measures in the budget.

The finance ministry has projected that inflation will clock in at eight per cent in 2013-14, and the economy would grow by 4.4 per cent. Because of inflation and economic growth, Rs256.69 billion in revenues will be raised in 2013-14 without the involvement of tax officials.

The tax authority has established 19 regional tax offices (RTOs) with huge investment. Tax revenue collection by these RTOs is done through at-source deduction, which ranges between 95 to 97 per cent. Tax officials have no role in these collections. But currently, the cost of running these offices is more than the revenue generated by them.

This collection will go up because of the introduction of seven new withholding taxes in the budget 2013-14, which will come to the government exchequer without the involvement of tax officials. The government should review the performance of tax officials on the basis of the demand creation for taxes, and not consider withholding tax collection as part of that assessment.

Dear visitor, the comments section is undergoing an overhaul and will return soon.