PAKISTAN’S national airline lost Rs33 billion last year. This is more than what a fully loaded Boeing 777 would cost.

Few who know the airline business would have expected PIA to make a profit last year. Since the start of the financial crisis in 2008 the global airline industry has been hit by a double whammy.

It has seen a cut in business travel and a drop in leisure travel. On the other hand, high crude oil prices have squeezed yields.

That said; one cannot let PIA off the hook. This is for two reasons. First it has not adequately taken advantage of market opportunities available to it and second, it has let its costs creep well beyond global industry benchmarks.

On the market opportunities front, we have a significant Pakistani diaspora in North America and in Europe. This represents an alluring, captive market that would be the envy of any legacy national carrier. Western airlines typically do not fly to Pakistan.

All PIA has to do is operate direct flights from North American and European cities into major Pakistani cities offering the proposition “fastest way to get you there”. The two main ingredients of this proposition would be affordable fares and on-time performance.

Sadly though, PIA has conceded two thirds of this market to other (mostly Gulf-based) carriers. Financially, this corresponds to Rs60bn in annual revenue that PIA’s competitors have taken away.

Even if half of this can be won back over three years then the airline is looking at a 9pc annual growth rate at a time when most other airlines are stagnant. And this is just on the back of business regained in one segment: the Western hemisphere.

Now to be fair to PIA, the Gulf airlines (and airports) are driven by more than commercial considerations. They are in fact strategic play pieces, part of a larger vision to position these countries as world destinations and to build their image and global profile. This is not unlike the motivation for which countries host the Olympic Games.

It can be argued therefore that PIA is often up against competition of a variety that goes beyond the commercial and profit motive. Still it must cherry pick, then focus on and build its star routes, anchored in the proposition “fastest way to get you there”.

In these markets, traditional marketing has given way to search engine marketing, using which customers search flights, obtain fares and compare routings and timings.

Digital media has opened up new customer touch points which include price comparison websites and social media. It is not uncommon, for example, for customers to be engaging with the airline on Twitter — in real time — discussing meal options on a specific flight.

In addition most airlines have launched their own mobile apps allowing their customers to book tickets, to check-in and to manage their frequent flier accounts from their mobile phones.

Similarly, the domestic market from which PIA derives half its revenue is clearly underserved. The domestic travellers seek convenient flight times and on-time performance. Then there is a segment seeking budget fares.

Service propositions can be developed around these needs and have existed in the past. And while the global airline industry may be facing overcapacity, for PIA there is latent demand in the domestic sector offering several years of growth opportunity. The other main segments are outbound travel from Pakistan for business and for leisure. Here the in-flight experience and holiday airfares are important ingredients of the customer proposition. Then there is the religious travel segment and finally the expatriate Pakistanis in the Gulf region who are time poor and baggage heavy.

It doesn’t make sense to increase market share when each flight is losing you money.

This brings us to the second issue: costs creeping beyond industry benchmarks.

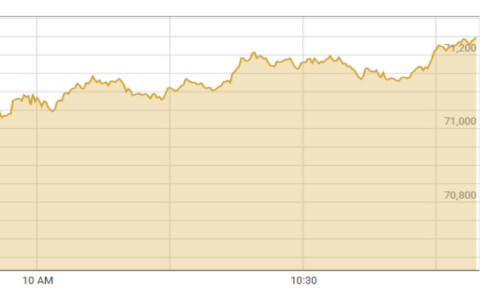

While much is made of overstaffing, in fact PIA’s cost inefficiencies are in its fleet, that last year guzzled Rs61bn worth of fuel. This represents 55pc of total revenue. In terms of the global airline industry, fuel makes up 35pc of total costs.

Meanwhile Australia’s Qantas — perhaps because of carbon tax considerations — keeps it as low as 28pc. PIA’s 55pc is therefore hard to accept.

In addition PIA’s load factor at 70pc is below par. Lastly, the fleet downtime is high with aircraft kept on the ground for want of spares or payment for fuel.

From the perspective of a strategic operating plan, an airline’s business analysis does not begin with aircraft but with the market forecast. However, once the traffic estimates are ascertained, then the most optimal aircraft solutions are found.

If it turns out that the aircraft available from within the airline’s fleet are a poor fit with requirements then a fleet restructuring may become necessary. Alternately it may become necessary for reasons of fuel efficiency or aircraft obsolescence.

If this turns out to be the case then the management and the airline board would need to be given a free hand to take the necessary decisions without outside meddling or interference.

They must also be allowed to choose between buying and leasing the aircraft and to evaluate and decide on the most viable financing plan. Needless to say, a onetime bailout may be extended against a sound business plan so that the airline is recapitalised and these ratios can be fixed.

The other 45pc of the expenses are non-fuel expenses. Whilst drastic reductions in manpower expenses may be unrealistic, airlines around the world have taken fiscal cost control measures which have included contract renegotiations, process improvements and restructuring agent commissions. But if over half of my expense is fuel, then half the time of my management looking for cost savings should be spent here.

The writer is a business strategist and entrepreneur.

moazzamhusain.com