State of play: Is videogame development on the rise in Pakistan?

Videogames stand as one of the most influential and largest consumed mediums present — with an approximate target market of over 2.3 billion gamers worldwide. It accounted for a global revenue of over $137.9 billion in 2018, up by 13.3% from the previous year.

According to unpublished IGDA Pakistan (International Game Developers Association) estimates, upto $25 million in revenue is earned locally across the industry each year; with more than 8,000 professionals associated with videogame development.

Yet, videogames, and in particular videogame development in the country, has always flown under the radar. But somewhere within these numbers lies Pakistan's modest gaming industry. This story is about that.

Coming of age: From consumers to developers

The journey of videogame development in Pakistan started sometime around the 2000s — when teenagers who had played and experienced games from what is formally known as the 3rd and 4th generation of videogame development internationally, started to become young adults.

This generation, that had grown up on early PCs, NES, Sega, Atari and Commodores, soon found that it wasn't satisfied with being a mere consumer. It was clear to many of them that a new medium was rising, one where pixels and gameplay were telling a story, replacing the simple and unadorned use of moving images or words.

Initially, the concept of videogame development started off with 'modding' existing games.

Games like Counter-Strike and Unreal Tournament were being actively played in LAN (local area network) cafes, with easily accessible 'world editors' that one could use to modify and tinker levels and features. So it didn’t take long for the pioneering generation to get its hands on some of these modifying features, resulting in the occasional use of custom game maps based on familiar localities on old LANs, which were built by internet service provides or by private individuals.

The first few studios that popped up around the same time were Trango Interactive and Fork Particle in Islamabad, along with Wireframe Interactive in Lahore, that solely focused on small mobile games and indie PC titles.

The early bird catches the worm

Since the target market segmentation for indie gaming was not mature and crystalised enough — and videogame development studios located internationally were creating content of a much higher production value than the local development scene —the early birds found life tough.

To sustain themselves, they had to diversify their revenue streams and enter the world of the outsourcing servicing business model.

This led to some of the big AAA/AA publishers and mobile developers, such as Sega, THQ, Zynga, Pocket Gems, Disney Interactive, Eidos Interactive, etc. to send their outsourced projects, asset and content work to some of these studios; providing finances that allowed Pakistani studios to work on their own projects on the side as well.

Read: Gaming industry breaks cultural barriers

Tomb Raider: Legend, Zynga Poker, Death Jr.2: Root of Evil and Afterburner: Black Falcon, all have hints of a Pakistani soul running through them.

Moreover, it was during this time that Mindstorm studios were able to sign a contract with Codemasters, an internationally acclaimed game publisher and developer, that kickstarted development on Cricket Revolution, the first-ever videogame developed by Pakistan to land on Steam, an infrastructure for distributing and managing the installation and use of games.

With the rise of smartphones and social media platforms, suddenly new opportunities within videogame development emerged; a vast, ever-increasing target market of smartphone users led to large consumer niches and sub-niches, that could be monetised relatively painlessly as digital distribution of services put everyone on an even playing field.

This led to the emergence of many mobile and browser studios; distinctively we'R'play, TinTash, PlayDom and Caramel Tech.

Unfortunately, this small golden window of growth that started in the early 2000s clamped down fast — and resistance in the shape of international competition, especially from China and India in outsourcing, geopolitical climate, scarce talent pool and limited government support meant that Pakistani companies simply couldn’t keep up with the pace of international demands.

Computer science graduates started to look into a more stable career path in software development, graphic artists turned towards digital art and animation in private channels and whatever small number of investors were interested in videogame development, started to look for greener pastures.

The tide is turning

However, the tide seems to be slowly turning; as part of IGDA in collaboration with PakGamers, a recent survey with a sample size of over 200 people was conducted to ascertain the size of the industry.

According to initial estimations, Pakistan employs around 8,500 game developers in three major sectors of game products, middleware and services.

61.9% of people who responded were from Punjab, 15.7% from Sindh, 3.3% from Khyber Pakhtunkhwa, 10.5% from Federal Capital, 1% from Balochistan and 1% from Gilgit, other outside Pakistan.

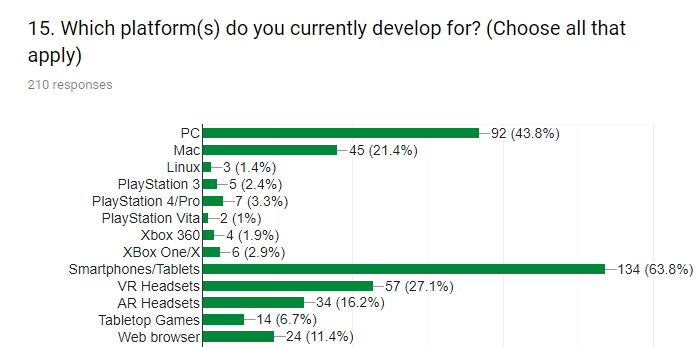

Listed below are some of the platforms Pakistani developers were developing for. The numbers can possibly be more, as a lot of studios develop and deploy games on multi-platforms.

Here are some videogame genres respondents to the survey developed for.

The IGDA Pakistan chapter has been ruffling all the right feathers in trying to bring companies, institutions, developers and students on board. This effort is much needed if we are to compete internationally – as distributed knowledge will give us half-cooked products in the short term, and only hinder us from hitting the quality expectation and innovation in future game projects.

Another large factor for some cautious optimism is the size of the local Pakistani mobile phone market. In September 2018, PTA announced Pakistan had crossed 150 million total mobile subscribers, with an estimated 72 million using smartphones, accompanied by a recent resurgence and reception of localised apps.

Related: Pakistani girls take on male-dominated gaming industry

It feels like the critical mass needed to keep the bank balance afloat has been reached; and with enough people using a smartphone for casual gaming, now even a good localised game can potentially make a significant sum back, or turn a profit.

Moreover, millennials seem to make up a vast percentage of videogame developers in the current climate and are increasingly aware of the untapped potential in the market.

Way forward

With the burgeoning size of the industry along with an immense growth year on year in almost all genres of videogames, previous niche markets such as AR, VR, higher fidelity Indies, Double AA and free-to-play multiplayer have opened up sizeable newer segments.

Notable players in the space include Caramel Tech Studios, TinTash, Mega Particle, Gameview, Kwick Games, We’R’play, Folio3, Quixel, Fork Particle, WRLD3D, Frag Gaming, Optera Digital and Mindstorm – who are all determined to go forward with their respective experiments.

With successes like Whacksy Taxi, Dream Chaser, Jetpack Joyride, Groopic and Stick Sports under the belt, there is enough data to build reliable business models on; be it free-to-play (free to download and play), freemium (a combination between free and premium), pay to play, direct/indirect monetisation, Paynium (initial purchase then free play) or even something else.

Recently, Rematch Studios in Karachi produced an excellent AA quality VR title called 'Area of Darkness', which has been positively received. Developed in Karachi to be played on PCs, the game is a psychological thriller/Adventure VR experience.

In addition, WonderTree, an indie studio in Karachi are developing medically research-based AR games, changing how education and therapy is provided to people with special needs. They engage with children and people with special needs through augmented reality based games, gather and analyse their performance data to determine health effects – which has already had a positive effect.

Mega Particle has also hinted at something “special” which they have been developing secretly and is close to completion.

Alongside this, a number of smaller development teams working on mobile titles and smaller Indies have popped up as well. To support this growing trend Arena Multimedia Pakistan, Institute for Arts and Culture, PixelArt Game Academy, The Millennium Universal College, FAST, UIT and Habib University have all started programs and courses that complement and facilitate this growing industry.

The quality of education being offered and its long-term impact is definitely a variable factor, but the hope lies in industry veterans and expat Pakistanis, who will possibly be able to contribute to organizing the knowledge base, intensive information and data sharing, along with breeding a culture of openness within the industry and its institutions.

Videogame development is such a lucrative market, that with proper government and institutional support, it can not only make gaming a stable career path for Pakistani youth but will also contribute significantly to our software industry.

A number of nations from Iran, Turkey, India to the Scandinavian region have invested heavily in their respective gaming sectors, in addition to creating an atmosphere for growth that companies can tap into and take advantage of.

It is high time that we take a similar approach in this "Naya Pakistan”.