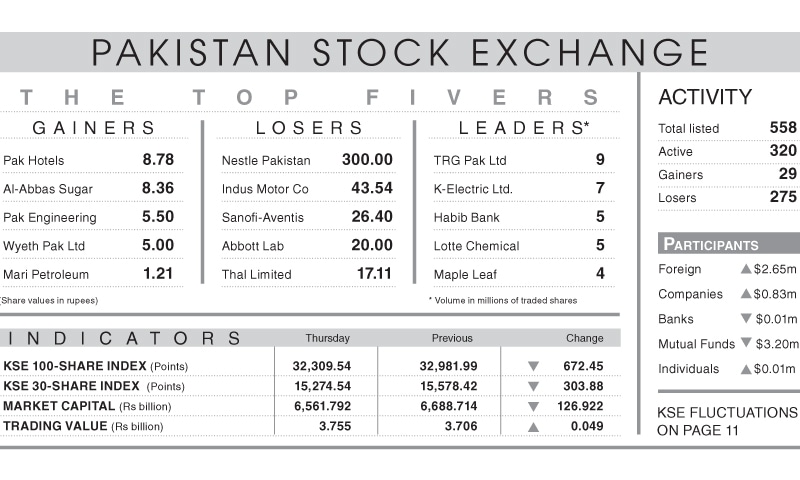

KARACHI: The stock market suffered another bout of intense selling pressure on Thursday with the KSE-100 index going into a tail spin to tank by 672.45 points (2.04 per cent) and close at 32,309.54.

The ghosts of investors’ suspicion on the end to State Bank of Pakistan monetary tightening; International Monetary Fund conditions for the bailout and economic worries came to haunt them as they decided to quit the market for safer investment avenues. To all of that was added the mounting political risk after the National Accountability Bureau picked up key opposition leader over corruption charges.

Market stayed positive in early trade with the index making intraday high by 32 points, but soon succumbed to selling pressure that pulled it down to intraday low by 758 points. Selling was observed across the board, but most market observers said that it was triggered by significant volume in Habib Bank.

According to figures released by the National Clearing Company of Pakistan, foreigners continued to take advantage of attractive valuations and bought stocks worth $2.65 million while mutual funds sold stocks valued at $3.20m, possibly to meet redemptions.

The volume declined 22pc to 86m shares, from 112m whereas traded value edged up by 0.9pc to reach $23.4m as against $23.2m. Cement sector came under the hammer as hike in interest rate and power tariffs would put further cost pressure. DG Khan; Maple Leaf; Cherat; Pioneer and Fauji hit their lower circuits.

Sector-wise, other big losses were noted in oil marketing companies, banks, exploration and production companies and fertiliser sector.

Major drag to the index came from Engro Corporation, lower by 3.92pc, Pakistan Petroleum 3.87pc, Habib Bank 2.69pc, Oil and Gas Development Company 2.14pc, Hub Power 1.50pc, Sui Northern Gas Pipelines 4.99pc and Pakistan State Oil 3.29pc. On the flip side, Mari Petroleum, Pakistan Oilfields, Shifa International, HBL Growth Fund and Atlas Honda Ltd made minor gains.

Published in Dawn, July 19th, 2019