THE board of directors of the Pakistan Gum and Chemicals Limited resolved, last Wednesday, to seek voluntary de-listing from the Pakistan Stock Exchange.

In order to achieve this objective, the sponsors propose to buy-back shares held by minority shareholders, which according to the company, amounts to 0.442m. The minority stake would be repurchased by the sponsors at a price of Rs183.20 per share of the par value of Rs10, or ‘as may be determined by the Pakistan Stock Exchange (PSX) or the Securities and Exchange Commission of Pakistan (SECP)’.’

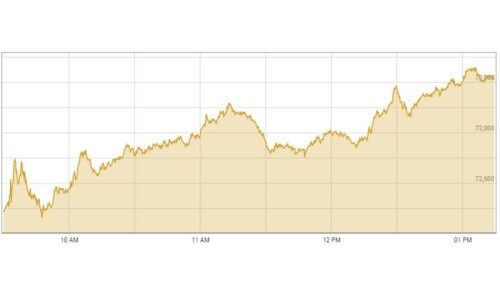

The news of a buy-back was greeted warmly by investors at the stock market where the price of the Pak Gum share rose by Rs6.28 on Wednesday to close at Rs131.96 on account of the sizeable premium of the buy-back price over the market value. Due to a relatively small paid-up capital that translates into tiny free float, analysts covering the ‘chemical sector’ scarcely follow the scrip for it is not of much interest for foreign investors, who prefer to trade in large-cap stocks.

According to the statement provided by the company to the PSX on July 13, the free-float of shares stood at only 0.365m shares, which worked out to a mere 8.6pc of the total outstanding shares in Pak Gum. The associated company and the sponsors held the remaining stock in large frozen blocks.

Pak Gum is the only public limited company in the guar industry that is listed on the PSX. The company boasts of being the ‘largest producer of guar gum in the country’.

Pak Gum is the only public limited company in the guar industry that is listed on the PSX

Guar gum is an essential ingredient of a host of food products which require a natural thickening, emulsifying and stabilising additive. It is used in bakery products, beverages, canned food, confectionery, cheese, dairy products, gravies and soups, ice creams, ketchup, noodles and pharmaceuticals.

The by-product, guar meal is used as a nutritional supplement for animals, poultry and cattle. Pak Gum is an export-based company with customers all over the world; in the Gulf, Europe and the US.

Its associated company, East West Group Holdings Inc. is the majority shareholder in Pak Gum with 60pc stake in aggregate paid-up shares. Mr Shuaib Ahmed vice-chairman of the company holds another 10.66pc of the stock.

Total assets of Pak Gum at the last released accounts for March 31, 2016 stood at Rs498m. In the face of a small paid up capital of Rs42.5m, the company has piled up huge reserves of Rs382m, taking the shareholders’ equity to Rs424m. By that reckoning the break-up value of a share works out at Rs99.76.

The company has seen its fortunes sink in recent times. In the first quarter ended March 31, 2016 it reported a net loss of Rs10.7m, against a net profit of Rs0.545m in the same quarter last year. Local sales shrank to Rs17m from Rs72m while exports plunged to Rs78m from Rs178m. Export sales form as much as 82pc of the aggregate turnover and is therefore the determining factor in the company’s financial results.

Mohammad Moonis, chairman of Pak Gum explains: “The dip in sales volume and price reflects a substantial drop in demand even at the reduced selling price.” But he pointed out that the depressed results for the first quarter had been foreseen, due to a declining trend in the price of guar products and the company’s margins. “This is mainly because of a poor demand from overseas buyers, particularly from the oil drilling and gas sector”.

He sounded worried over the fact that the guar market had changed drastically during the past two years. “Buyers seem to be waiting in hopes of a further price decline, although the price has already taken a steep drop from the peak of 2012”, the company chairman says. He adds: “On the other hand, there is no stability in seed prices, which are largely influenced by prices in India. The seed market remains totally uncontrolled and unpredictable”.

In order to salvage the situation, the company dispatched its sales team to the Far East. “We have gained some ground and are getting fresh enquiries. The results of these efforts should become visible in the coming months”, chairman Mohammad Moonis hoped.

In the announcement on Wednesday, the directors did not say why the company wished to go private. In the financial year 2015, the company had suffered a net loss of Rs75m, which was the first in five years. The Board also had to skip a dividend that year, though the company had paid cash to shareholders at 50pc for the preceding two years and at 100pc in 2012. There have been no bonus payouts for as far back as one can see with the board preferring to retain cash in reserves.

While the PSX has hardly seen new listings during the current year to-date, it would be pity to see a company with a record of good payout calling quits to the stock market.

Published in Dawn, Business & Finance weekly, August 29th, 2016