KARACHI, May 28: Amid a bloodbath on the Karachi Stock Exchange, which saw the KSE-100 index bleed by 567 points or 4.42 per cent on Wednesday, market participants were frantically praying for the end to ‘uncertainties’ that loom large on almost all fronts -- from economics to politics.

“This thick layer of uncertainty is worst than bad news,” said a stockbroker, who said he would rather not discuss the obvious. The punters as well as long-term investors were jittery over a long list of questions that begin and end with: “What comes next?”

Most major players were keeping quiet or were lost for words. But conversation with some of the market players brought forth a forest of question markets. Starting from the issue of Capital Gains Tax (CGT) (whether it would be extended or levied from July 1); the CVT (would it be reduced if CGT is imposed?); what is this talk about wealth tax; how high would international oil prices go (Is FM Naveed Qamar sure the public can take the brunt of the blow, if all of full-blown oil price rise is passed on to consumers); where are the inflation; trade; current account; budget deficit numbers heading. What does the upcoming budget hold for the country and the market?

On the political front, the issue of judges restoration; the talk of impeachment of the President and therefore a dreaded confrontation between the government and the Presidency; the fear of falling apart of the loose coalition and generally a feeling of lack of governance, marred the stock market, as it did the country.

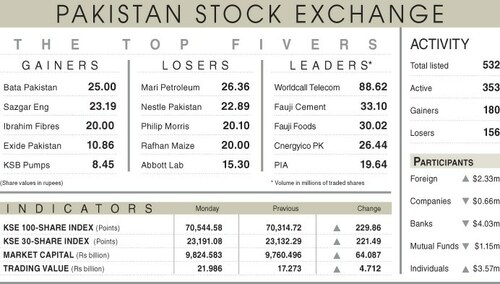

Starting on April 18, the KSE-100 index has dipped by 22 per cent or 3,505 points in just 26 trading sessions. On Wednesday evening, the KSE released a reassuring note: “Karachi Stock Exchange is pleased to inform all concerned that all dues payable by the members of the Exchange on account of their exposure margins and mark to market losses till to date have been fully collected by the exchange”.

Independent enquiries revealed that at least two stock brokerage houses were in dire straits and facing string of margin calls, but there were perhaps no defaults. How long can the market hold on was the question on everybody’s mind. Eyebrows were being raised on the deafening silence from the government end.

Many participants thought that the market downturn could be arrested if the government were to come upfront on issues that boggle the investors’ mind, mainly the CGT.

There were reports that towards evening, major stockbrokers and other well-known participants were locked in discussions over the dilemma facing the stock market. Would they be able to come up with ideas to stop the hemorrhage? Only time would tell, for those in the meeting were avoiding phone calls.

Dear visitor, the comments section is undergoing an overhaul and will return soon.