The ultimate guide to investing in mutual funds

Most of us salaried individuals have limited personal wealth, but unlimited wants.

We all want the latest smartphones, the fanciest designer handbags, or the flashiest new car — but we don't always have enough disposable wealth to buy them.

That shouldn't mean we can't ever have these things however. By saving smartly and strategically investing those savings, you can maximise the rewards you reap.

Why should you invest your savings?

When an average salaried person decides to save, the first thing they need to keep in mind is the fact that a 100 rupees saved today sadly will not have the same purchasing power tomorrow.

This is due to the economic phenomenon known as 'inflation'.

You will have experienced inflation from the changes in prices of the daily goods we buy, the tuition fee we pay for our children, and the medical bills we pay for ourselves and our loved ones. What was worth Rs65 a year ago, may today be worth Rs100.

This means that simply saving money will do you more harm than good.

To counter the impact of inflation, your savings will need to grow at a rate that is either equal to or higher than the general increase in prices in the economy.

What exactly is a mutual fund?

We may understand the benefits of investing in a mutual fund as compared to investing on our own by looking at this simple example.

Consider driving yourself every day to work and coming back in your own private car. Commuting in your own car gives you the flexibility to decide when to travel, what stops to make and what route to take.

However, on the downside you would have to constantly think about taking the shortest and best route, wrestle through the traffic, endure stress, pay the extra amount for fuel consumption, and forego the work you could do if you were not driving.

On the other hand, if you were to travel in a public bus, you would just have to buy a ticket and board the bus. Once you are in the bus, the experienced driver, in our case the fund manager, would do all the hard work for you, and while commuting on the bus you could work on other tasks and save on the extra costs when travelling solo in your own car.

A mutual fund offers the same ease as the public bus has over the private car. You may invest and see your investments grow over the years.

It is a collective investment scheme in that a lot of people contribute their savings to a central fund. A professional and experienced fund manager, such as Al Meezan Investments can assess the situation and invest your money in a variety of investment options.

Why is now a good time to invest in mutual funds?

The financial markets have remained extremely volatile since the news broke out on offshore companies of politicians and businessmen. The ouster of former Prime Minister, Mian Nawaz Sharif, added fuel to the fire.

Political uncertainty has remained a major headwind for Pakistani financial markets this year, and with the upcoming elections, uncertainty and volatility may increase further.

Read more: Is 2018 a good year to invest in mutual funds?

Historically, we can see that the run up to the elections usually creates a volatile market with thin volumes. However, after the results, the markets stabilise and usually there is a strong rebound in financial markets’ performance.

Staying invested and positioning oneself to hedge against the volatility in an election year is critical to preserve the value of a salaried person’s savings and prime it up for the bull market once the volatility due to elections subsides. At the moment, we are seeing an increase in uncertainty in market due to multiple reasons.

Elections itself are the main cause for uncertainty among investors and they are afraid of investing directly into equities.

Investors are unsure about the fund flows that will result due to the latest amnesty scheme announced by the government. Larger than expected fund flows will push the market higher, whereas fund flows below expectations under the amnesty scheme would lead to a lackluster performance in the financial markets.

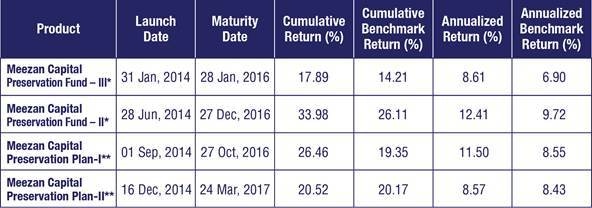

A salaried person, during such a time, can invest in a type of mutual fund known as a Capital Preservation Fund, such as the Meezan Capital Preservation Plan (V) to ride the volatility of the market safely and prudently and simultaneously protect their capital.

To learn more about mutual fund basics, click here.

Benefits of investing in mutual funds

Mainstream options for the average person are either to place their savings with a bank, or to invest them in the stock market.

However, most salaried people usually do not have the time or the expertise to make complicated investment decisions that will also be good for them — especially when it comes to investing in the stock market, which may be up today but down tomorrow.

A major benefit of investing in a mutual fund is that it relieves you of the daily hassle of managing your investments, as you give over that responsibility to a professional.

The second benefit of investing in a mutual fund is the tax credit it offers.

In Pakistan, these credits can go up to 20pc if the investor commits their money to the fund for 24 months (two years) or more. In addition, you can get up to 30% additional savings through Voluntary Pension Funds (VPS) such as Meezan Tahaffuz Pension Fund (MTPF)

Wondering how much tax you can save with mutual funds? You can calculate your tax savings by checking out Al Meezan's tax savings calculator.

This added tax benefit greatly amplifies the investor's return from the mutual fund.

How can I invest in mutual funds?

In Pakistan, investing in mutual funds is relatively easy. To begin with, you need to get an account made with an Asset Management Company such as Al Meezan. The sales associates will manage all your required documents and Al Meezan’s advisers will even collect the documents from your door steps.

The ease in paperwork provided by Al Meezan Investments made it a top preference for salaried individuals. Al Meezan has the largest investor base in Pakistan with over 75,000 investors.

How do I select an investment plan?

Your plan must be based on investment objectives and risk appetite.

For example, if an investor wants to save for a car (or place their savings in a fund that is easily accessible at any given point in time), they should invest in a cash fund. An example of this is the 'Meezan Cash Fund'.

However, if the person is looking to invest for their child’s college education or are looking for long-term savings, a balanced fund (where investments are balanced between stocks and other assets e.g. bonds) such as the 'Meezan Balanced Fund', or an equity fund (stock market focused), such as the 'Meezan Islamic Fund' or the 'KSE Meezan Index Fund', would be ideal.

Capital preservation funds on the other hand provide the best of both these worlds. They allow you to access your investment when required.

With capital preservation plans, Al Meezan aims to keep your capital secure, while aiming to achieve capital growth as an additional benefit.

Other ways to analyse mutual funds

1. Performance

Another thing you want to look at is the 'Performance Ranking' of a fund among its peers.

Rather than looking at a fund’s performance in isolation, it should be compared with similar funds on a monthly, quarterly, and annual basis.

A fund that is consistently in the top quartile or decile should be preferred over others.

The past performance of funds managed by an asset management company is a good indicator to see if your savings are in good hands.

2. Ratio analysis

A 'Ratio Analysis' of the fund helps in analysing its risk and return. Ratios such as standard deviation, Sharpe ratio, and measurement of Alpha helps in comparing your fund of choice with the other funds on offer.

The Alpha of a fund should be of particular interest, as it will tell you how much a fund manager has been able to outperform or underperform a benchmark.

The Alpha of any given fund, along with the other ratios, is available in the monthly Fund Manager Report (FMR) published by the asset management company.

The 'Total Expense Ratio' tells you about the total fund management and distribution related expenses. A higher expense ratio will adversely affect the fund’s returns and is generally not desirable.

Take a look at real examples of fund manager reports here.

3. Tenure and experience

The tenure of your fund's manager and his experience and expertise are also important things to look at when selecting a fund.

The fund manager is the final decision maker regarding any investment decision related to the funds. Their expertise and investing style will greatly impact the performance of a fund, and you should always try to find more out about them.

Al Meezan successfully fulfills this criteria, as it is the oldest AMC in Pakistan with 23 years of Asset Management experience.

4. Size of the fund

The size of a mutual fund is another important factor in the selection of a fund.

Funds with small Assets Under Management (AUM) are exposed to concentration risk. When a large investor exits or redeems their investment from a fund with a small AUM, the fund may be impacted adversely and the remaining small investors may have to suffer.

Common myths about mutual funds

1. Most people think that mutual funds only invest in equities and therefore come with all the risks equity markets are exposed to.

In reality, mutual funds offer investors a wide spectrum of investment options. There are even some that have no investment in equities at all.

2. It is believed that mutual fund investments are only for long-term investors.

Actually, a number of money market funds are now available for short-term investors. These funds offer high liquidity for investors looking to park excess cash in assets that will yield good returns.

3. There is a common perception out there that investments in mutual funds are locked and cannot be cashed out.

'Open-end funds' can be easily redeemed at the prevailing net asset value by contacting the asset management company. Likewise, 'closed-end funds' can be sold on a secondary market with the help of a broker.

Furthermore, when investing with e.g. Al Meezan Investments, an investor can even redeem their investment through their Meezan Bank ATM card, or instantly transfer their funds through Al Meezan’s Connect mobile application.

4. Another myth that goes around is that all returns from mutual funds are taxable.

Only returns on funds that are held for less than 24 months are taxable. Not only that, funds held for 24 months or more can even give investors significant tax credits.

5. You might have heard that mutual fund investments are not Shariah compliant and may lead to the erosion of capital.

Today, a number of Shariah-compliant capital preservation funds are offered by a number of Asset Management Companies.

Al Meezan Investments is the largest AMC by AUMs in Shariah-compliant funds. Currently, they are offering the 'Meezan Capital Preservation Plan (V)', which aims to preserve the investor’s initial capital and provide good returns.

Types of Mutual Funds

Mutual funds can be broadly categorised into two distinct branches: a) according to their structure and b) according to their investment objectives.

By structure, a mutual fund can either be an “Open End Mutual Fund” or a “Closed End Mutual Fund”.

The other broad classification of mutual funds looks at their objectives.

The funds under this head are categorised according to their investment objective, risk profile, and underlying investments.

Which funds should you invest in?

Mutual funds are all very different: their profile varies according to what financial instruments the fund manager has invested them into. They offer varying returns and risks, accordingly.

Today, it is easy for investors to find a mutual fund that suits their 'risk appetite'. To understand risk appetite, you need to understand a rule of thumb: the higher the risk of an investment is, the higher returns it will offer. Likewise, 'safer' investments will usually offer modest returns.

Once investors understand how much they're willing to risk, they can then comfortably invest in a mutual fund that matches their risk appetite.

Investing in mutual funds offers one of the best investment solutions available to salaried individuals. Through mutual fund plans such as the Meezan Capital Preservation Plan V, a salaried individual can be sure that his principal investment would remain secure and by the time of maturity may even yield capital gains.

Once a salaried individual is aware of their needs and requirements, liquidity preferences, and savings targets and goals, they may easily select a mutual fund. Once the fund is selected, they can sit back, relax and see they savings grow into something substantial that will help them achieve their dreams and goals.

Common terms used in fund manager reports

Net Asset Value (NAV): This is the price per unit of an open-end mutual fund. The NAV is the difference between the current market value of all assets of the fund less its liabilities, divided by the total number of outstanding units of the fund.

Sharpe Ratio: This metric is the average return earned over and above the risk free rate per unit of volatility.

Cum-dividend NAV: The NAV at the time of announcement of the dividend

Ex-dividend NAV: The NAV after the dividend is subtracted from the fund

Factor: Cum-dividend NAV divided by Ex-dividend NAV

Adjusted Starting NAV: Starting NAV divided by Factor

Absolute Return: The difference of Ending NAV and Adjusted Starting NAV divided by the Adjusted Starting NAV

Simple Annualised Return: Absolute Return multiplied by 365 days divided by the number of days

AGM: Annual General Meeting

CGT: Capital Gains Tax

FY: Financial/Fiscal Year

GDP: Gross Domestic Product

PSX: Pakistan Stock Exchange

VPS: Voluntary Pension Scheme

YTD: Year to Date return

This content has been produced in paid partnership with Al Meezan

All investments in mutual funds are subject to market risks. Past performance is not indicative of future results. Please read the offering documents to understand the investment policies, risks and tax implication involved.

Performance has been calculated NAV to NAV with dividend reinvested. Performance data does not include the cost incurred directly by an investor in the form of sales load etc.

Investors are advised in their own interest to carefully read the contents of offering document of MCPP-V, in particular of the investment policies mentioned in clause 4, risk factors mentioned in clause 14 and warning in clause 15, before making any investment decisions.

This is for general information purposes only. In view of individual nature of tax consequences, each investor is advised to consult with his/her tax advisor with respect to specific tax consequences of investing in the fund.