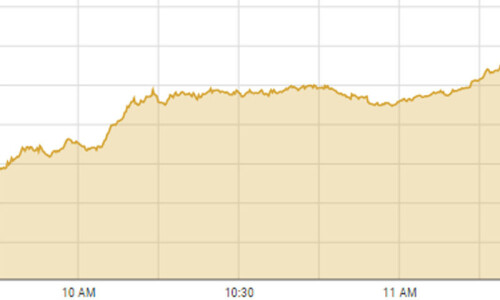

KARACHI: Share prices rose on Tuesday as investors reacted to the positive triggers of Saudi financial support package and flood-related assistance from Asian Development Bank.

JS Global said investors carried out buying in selected stocks, which lifted the overall market sentiments.

The news about the finalisation of the draft for upgrading the local refineries helped stocks in the refinery sector register modest gains.

Even though cement stocks also made some initial upticks, a lack of volumes eroded the intraday gains and most companies closed the day in the red. It expects the benchmark index of the stock market to trade in a narrow range, with most of the activity confined in a few selected stocks.

As a result, the KSE-100 index settled at 41,714.30 points, up 173.75 points or 0.42 per cent from the preceding session.

The overall trading volume increased 8.5pc to 144.8 million shares. The traded value went up 16.2pc to $16.7m on a day-on-day basis.

Stocks contributing significantly to the traded

volume included Pakistan Telecommunication Company Ltd (15.3m shares),

Dewan Farooque Motors Ltd (9.6m shares), WorldCall Telecom Ltd (8.6m shares), Fauji Cement Company Ltd (5m shares) and TPL Properties Ltd (4.7m shares).

Sectors that contributed to the index performance were fertiliser (84 points), commercial banking (64 points), miscellaneous (43.9 points), technology and communication (24.1 points) and tobacco (17.3 points).

Companies registering the biggest increase in their share prices in absolute terms were Pakistan Services Ltd (Rs84.53), Sapphire Fibres Ltd (Rs78.75), Sapphire Textile Mills Ltd (Rs73.19), Bhanero Textile Mills Ltd (Rs68.80) and Mehmood Textile Mills Ltd (Rs58).

Companies that recorded the biggest declines in their share prices in absolute terms were Bata Pakistan Ltd (Rs49.92), the Premium Sugar Mills Ltd (Rs19.17), Al-Abbas Sugar Mills Ltd (Rs16.99), Sanofi-Aventis Pakistan Ltd (Rs10.90) and Gillette Pakistan Ltd (Rs9.38).

Foreign investors were net buyers as they purchased shares worth $0.6m.

Published in Dawn, December 14th, 2022

Dear visitor, the comments section is undergoing an overhaul and will return soon.