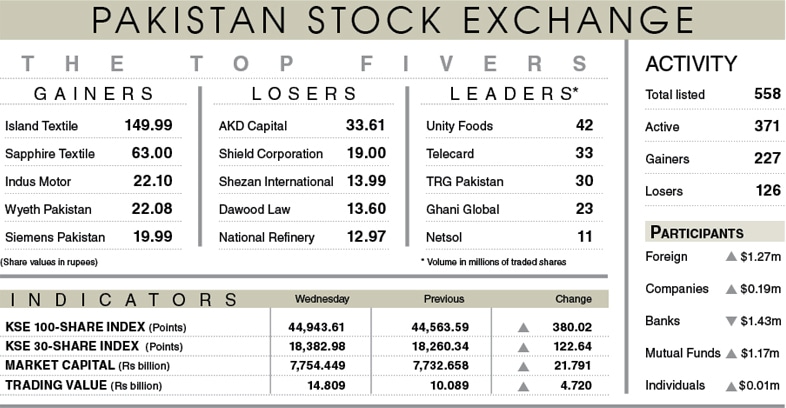

KARACHI: The stock market made strong recovery for a second consecutive day with the KSE-100 index accumulating another 380.02 points, or 0.85 per cent, to close at 44,943.61.

The index made an intraday high of 610 points.

The bullishness in the market was underpinned by investors’ interest in the independent power producers, including Hub Power and Kot Addu, on reports of partial release of funds by the government to settle IPPs’ outstanding dues.

Other positives were the decrease in positivity ratio of Covid-19 which was a relief to shareholders as they looked forward to no disruption in business and industrial activity.

The traders were also looking forward to a market-friendly budget as Finance Minister Shaukat Tarin — who held the post of chairman of the board of exchange in 2000 and 2006 — was aware of the market issues and needs. Sales of cement showed double-digit growth in April compared to same period last year pointing towards speedy construction work on housing and infrastructure.

Foreign investors took fresh positions in equities worth $1.27m to which was added the purchases by mutual funds in the sum of $1.17m.

Banks and brokers proprietary trading reduced exposures considering that Thursday would be the last trading day before the prolonged closure of market for Jumatul Wida and Eid holidays.

Sector-wise major performers were power, banks, E&Ps & O&GMCs. The scrips that added most points to the index included Hub Power, PSO, POL, Lucky Cement and PPL.

Stocks that took off points from the index include TRG, SCBPL, National Refinery, Highnoon and Engro Fertilisers.

The trading volume increased 17pc over the previous day to 259.9mn shares while the traded value also increased by 47pc to reach $96.6m.

Stocks that contributed significantly to the volumes included Unity Foods, Telecard, TRG, Ghani Global and Netsol, which contributed 54pc of the total turnover.

Published in Dawn, May 6th, 2021

Dear visitor, the comments section is undergoing an overhaul and will return soon.